Fact or fiction in BC Real Estate.

Fact or fiction in BC Real Estate.

The industry has been booming for well a while now. Low inventory has created bidding wars and fixer-uppers in some major cities are hitting seven figures. So how do you keep your head amid the frenzy? How can you wade through all the clutter and the chatter to suss out the info you need to make wise decisions?

How to interview your Realtor CLICK HERE

Well, you always have us in your back pocket. In the meantime lets look at some of the common misconceptions that we have all heard in real estate transactions.

#1: Question: Real estate contracts are standardized so just sign the paperwork and work out the details later.

#1: Question: Real estate contracts are standardized so just sign the paperwork and work out the details later.

Answer. Not on your life,. Each real estate contract is as unique as the pink and black tiled bathroom being sold. You really do need to read the fine print and understand exactly what is being included in each agreement of purchase and sale. Never make assumptions about the appliances, the fixtures or even the possession date. This actually works in your favour, since every little point offers the possibility for discussion.

Same goes for the contract you sign with your real estate rep - they’re not all the same and terms, like how long you’re committed to each other, are up for discussion. Don’t sign until you understand everything and are happy with the terms.

#2: Question: When you sign on with a salesperson, they are personally committed to being on-call for you.

Answer: Representation agreements are between you and the brokerage firm where your salesperson works. If you are working with a large team of agents in an office sometimes the salesperson you thought you had retained will get reassigned and someone else on his or her team will be assigned to work with you. If there is a certain someone you really want working for you on a daily basis, you can ask to put in writing who your primary contact will be during the transaction process. Speak up and be clear about everyone’s level of involvement before you get started. With Danielle if you sign with me I am your girl through the complete transaction guaranteed.

Answer: Representation agreements are between you and the brokerage firm where your salesperson works. If you are working with a large team of agents in an office sometimes the salesperson you thought you had retained will get reassigned and someone else on his or her team will be assigned to work with you. If there is a certain someone you really want working for you on a daily basis, you can ask to put in writing who your primary contact will be during the transaction process. Speak up and be clear about everyone’s level of involvement before you get started. With Danielle if you sign with me I am your girl through the complete transaction guaranteed.

#3: Question: A brokerage can represent both the buyer and the seller, no questions asked.

Answer: Before June of 2018 in British Columbia this was true and used to be called Limited Dual Agency. Dual agency used to be a common practice in real estate transactions, occurring when a realtor represents more than one party, such as the buyer and the seller, in the transaction. The practice of limited dual agency raised a number of concerns for consumers, including that:

- a licensee may not be able to be completely loyal and impartial to two clients with competing interests

- a licensee may not be able to properly advise those clients without improperly disclosing their confidential information to each other

- a licensee acting as a dual agent might prioritize his or her own interest in earning the whole commission, rather than acting in the best interest of his or her clients.

As of June 15, 2018 this is no longer an option. However, an exception to that rule will apply to extremely remote locations poorly served by realtors. According to the Real Estate Council of B.C., the new rule changes will better protect buyers and sellers.

#4: Question: When a bidding war breaks out, the seller must accept the highest offer.

#4: Question: When a bidding war breaks out, the seller must accept the highest offer.

Answer: The seller can choose to accept or reject any offer he or she wishes, regardless of the price. It often surprises buyers to know that price is not always the deciding factor for a seller. For example, a seller may accept a lower value offer if it comes with an earlier closing date or has no conditions, which could potentially delay the transaction. A bird in the hand, as they say…

#5: Question: Open houses are perfectly safe and you don’t need to worry about a thing.

Answer: Stuff happens. Open houses can be an awesome way to show off your home, but showing off all your cool stuff can also lead to the possibility of theft or damage. Remove your valuables, financial information and personal items, and store them in a secure place. Insist on a sign-in sheet and ask your salesperson to escort visitors through the home rather than waving them through to explore on their own. It is still your home, so you get to set the rules about visitors.

#6: Question: Home inspections are overkill and a waste of money.

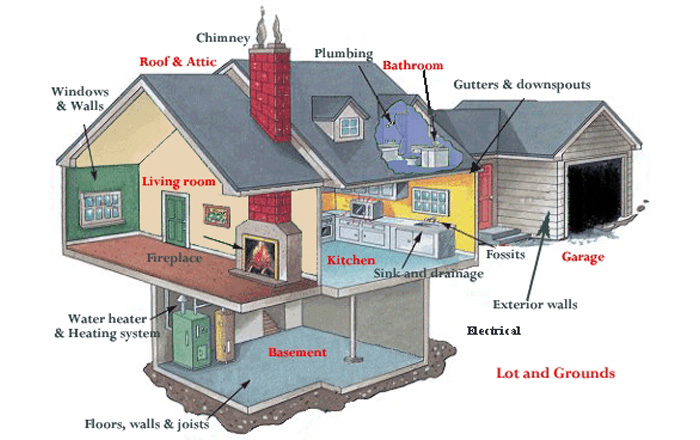

Answer: Your heart may tell you “this is the one”, but your head needs a few more facts to determine what you should be shelling out of your wallet. An experienced home inspector examines what is actually going on behind those walls, including the condition of the electrical, roofing, plumbing, heating, air quality, foundation and septic systems. If there is repair work or upgrading needed, this should be reflected in the home’s price. Skip the inspection and you run the risk of your dream home turning into a very expensive nightmare. READ MORE HERE

Answer: Your heart may tell you “this is the one”, but your head needs a few more facts to determine what you should be shelling out of your wallet. An experienced home inspector examines what is actually going on behind those walls, including the condition of the electrical, roofing, plumbing, heating, air quality, foundation and septic systems. If there is repair work or upgrading needed, this should be reflected in the home’s price. Skip the inspection and you run the risk of your dream home turning into a very expensive nightmare. READ MORE HERE

#7: Question: You will automatically get your deposit back if your offer doesn’t pan out.

Answer: When you make an offer subject to certain conditions and it is accepted, you pay a deposit, which is held in a brokerage trust account. If the conditions are not met or not waived by you, the deal falls through. But don’t assume you automatically get your money back. At this point, both the buyer and seller must agree to a release of the deposit money. If the seller does not agree, you will have to obtain a court order to recoup your funds. Again an experienced Realtor will help you with advice so as everything works out smoothly.

#8: Question: Anyone can buy or sell a home and there is no advantage to getting the help of a registered real estate professional.

Answer: Real estate professionals must abide by industry regulations and a Code of Ethics. In Ontario, they are registered with RECO, which has the authority of the provincial government to protect home buyers and sellers. When you work with a regulated real estate professional who knows your neighbourhood, you get the advantage of experience when it comes to prices and buyer behaviour, plus access to an insurance program that protects consumer deposits. As you enter into one of the biggest financial transactions of your life, having an experienced and trustworthy professional to guide you through the steps (and steer you away from the pitfalls!) can be a huge comfort.

#7: Question: You should wait to list your home until the spring.

Answer: Yes and no, real estate is seasonal. In some cities this is more apparent than others, especially places with harsh winter weather. When real estate company Redfin crunched the numbers over the past five years, we found that 51 per cent of homes listed in the winter sold above asking price, compared with 50 per cent in the spring.

Answer: Yes and no, real estate is seasonal. In some cities this is more apparent than others, especially places with harsh winter weather. When real estate company Redfin crunched the numbers over the past five years, we found that 51 per cent of homes listed in the winter sold above asking price, compared with 50 per cent in the spring.

If you want the best shot at selling your home quickly and for the most money, list in the first half of the year. The percentage of homes that sold over asking price dropped to 44 per cent and 43 per cent in the summer and fall respectively in our region. Ultimately, the difference between selling in the winter and spring is negligible. Pricing and marketing strategy is the most likely to sell.

#8: Question: Look for a deal during the holidays.

Answer: I've seen many buyers who were convinced they could score a great deal on a home by looking around the holidays. There is a nugget of truth to this concept. Fewer buyers are looking during this time period. Sellers who list during the holidays might be selling due to necessity, like a job relocation, and therefore be more motivated to sell quickly.

Sale price is ultimately a function of market dynamics and less a function of the season. The key is to be patient. I also suggest buyers look at homes that have been on the market for a bit of time. These might be good opportunities for negotiating a sale  under asking price.

under asking price.

#9: Question: You don't need an inspection for a new build or recent renovation.

Answer: Some buyers are under the impression that they can forgo the inspection for a property that is new or recently renovated. From an improperly installed dryer vent to faulty wiring, new developments can have minor and major problems that aren't apparent until you get a professional to do a review.

While there might be competitive reasons to waive the inspection contingency in the contract, the decision to do so should not be taken lightly and should be made with full knowledge of the risks.

#10: Question: Your home is updated and in a good neighbourhood so you don't need to stage it to sell.

Answer: Even the most beautiful, highend homes should be staged and photographed by a professional photographer. Listing photos are a critical factor in the selling price of your home, how quickly it sells, and whether it sells at all. Most agents found that homes with professional listings photos sold faster and for more money, as much as several thousand dollars more.

A professional stager can provide objective advice on how to get your home photo-ready. They see a lot of homes so they can speak to design trends and features that are common in homes for sale in your area.

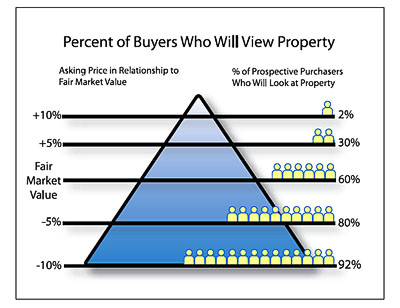

#11: Question: Price your home above the amount you want to get, so you have room to negotiate.

Answer: Determining what your list price should be is an art and a science. Before you list your home, ask your real estate agent for a comparative market analysis, which will help you determine a reasonable price based on sales of similar homes in your area. A Redfin study showed that the first week a listing goes on the market it receives nearly four times more visits online than it does a month later. Even if you drop the price later, it won't get the same attention. When in doubt, start with a lower asking price.

Answer: Determining what your list price should be is an art and a science. Before you list your home, ask your real estate agent for a comparative market analysis, which will help you determine a reasonable price based on sales of similar homes in your area. A Redfin study showed that the first week a listing goes on the market it receives nearly four times more visits online than it does a month later. Even if you drop the price later, it won't get the same attention. When in doubt, start with a lower asking price.

#11: Question: A home is a great investment

Answer: A home is often touted as a great investment, one that will appreciate steadily over the years and help you build your net worth. Over the very long term, that's generally been true. But there are a few problems with looking at your house as an investment. The first is pretty simple: you need somewhere to live. This means that unlike other investments - such as stocks, bonds or even investment real estate - you can't just sell your house when the market's hot. And even if you did sell, you'd probably have to plough that money right back into a new home — one that has likely appreciated at a similar rate as the one you're selling. Furthermore, the real estate market is like many other markets in that it is not entirely predictable; it may not be at a peak when the time is right for you sell.

This isn't to say a home isn't worth buying. Many of the biggest benefits of homeownership are more personal than financial — and you can't put a price on that. Just remember that the real, underlying reason you have a home is to keep you out of the rain. And that makes it unlike any other investment you'll ever own.

#12: Question: A mortgage is a debt

Answer: This one will surprise a lot of people, but a mortgage technically isn't a debt; it's a security interest in a property, held by a lender as collateral for a debt. What that means is that a mortgage is an asset exchange; the buyer gives the bank an interest in the home in exchange for the money to finance its purchase. It is this transaction that makes real estate different from most other things we might buy on credit. Unlike a takeout lunch or a night out at a concert, real estate is not consumable; it's a hard asset like money, and often an appreciating one at that. So, while homebuyers should aim to pay off their mortgage as quickly as possible to save on interest costs, don't get too dragged down by the notion of being in debt. Living expenses are a fact of life, and once your mortgage is paid off, you'll have a piece of land of your very own. That's a lot more tangible — and valuable — than anything you've ever bought with a credit card.

#13: Question: You get more for your money in the suburbs

Answer: Canadians love the suburbs. Although we're increasingly becoming more urban, according to figures released by Statistics Canada in April, areas beyond major cities' cores have been growing their populations about 40 percent faster than urban centers. This growing legion of suburbanites is often dominated by families with young children. And who can blame them? Houses in the suburbs are often bigger, newer and cheaper than anything you'd find deep within a city's boundaries.

But suburban life has hidden costs. According a U.S. think tank called The Center for Neighborhood Technology, the cost of living far from services can be as much as $3,800 per year, much of which is taken up by transportation costs. Sure, you get a brand-new house, but it won't be long before it too has chipped paint and dated decor. The only difference is, you'll still have to commute for ages to get to work and back.

#14: Question: A mortgage's term and amortization are the same thing

Answer: If there's one thing that confuses people about mortgages, it's the difference between a mortgage's term and its amortization. Well, it's time to blow up this myth because if there's anything that's financially irresponsible, it's paying into a financial instrument you don't understand.

Answer: If there's one thing that confuses people about mortgages, it's the difference between a mortgage's term and its amortization. Well, it's time to blow up this myth because if there's anything that's financially irresponsible, it's paying into a financial instrument you don't understand.

So here it goes...amortization is the rate at which a mortgage is paid off. If you have a 25-year amortization on your mortgage, it will take 25 years to be mortgage-free if you continue making the same payments. This is the calculation used to spread the price of the home out over a period that will make it affordable for the buyer.

SEE OUR BLOG ARTICLE ON MORTGAGE TERMINOLOGY

A mortgage term, on the other hand, is just the length of the contract you have with the bank or lender, which determines your payment, interest rate and other factors. It is generally anywhere from six months to 5 years, regardless of whether your amortization is 10 years or 25. Once the mortgage term is up, you have to renew your mortgage, which may mean a new interest rate, a new payment amount or even a switch to a different type of mortgage altogether. Why can't you just be locked in for the full  amortization period? Well, the term is designed to protect both the lender and the borrower by allowing them to renegotiate the loan agreement at a set point in time rather than sticking with the same product and interest rate for decades. In Canada, the end of the term also gives the homeowner the opportunity to pay off the mortgage balance without penalty.

amortization period? Well, the term is designed to protect both the lender and the borrower by allowing them to renegotiate the loan agreement at a set point in time rather than sticking with the same product and interest rate for decades. In Canada, the end of the term also gives the homeowner the opportunity to pay off the mortgage balance without penalty.

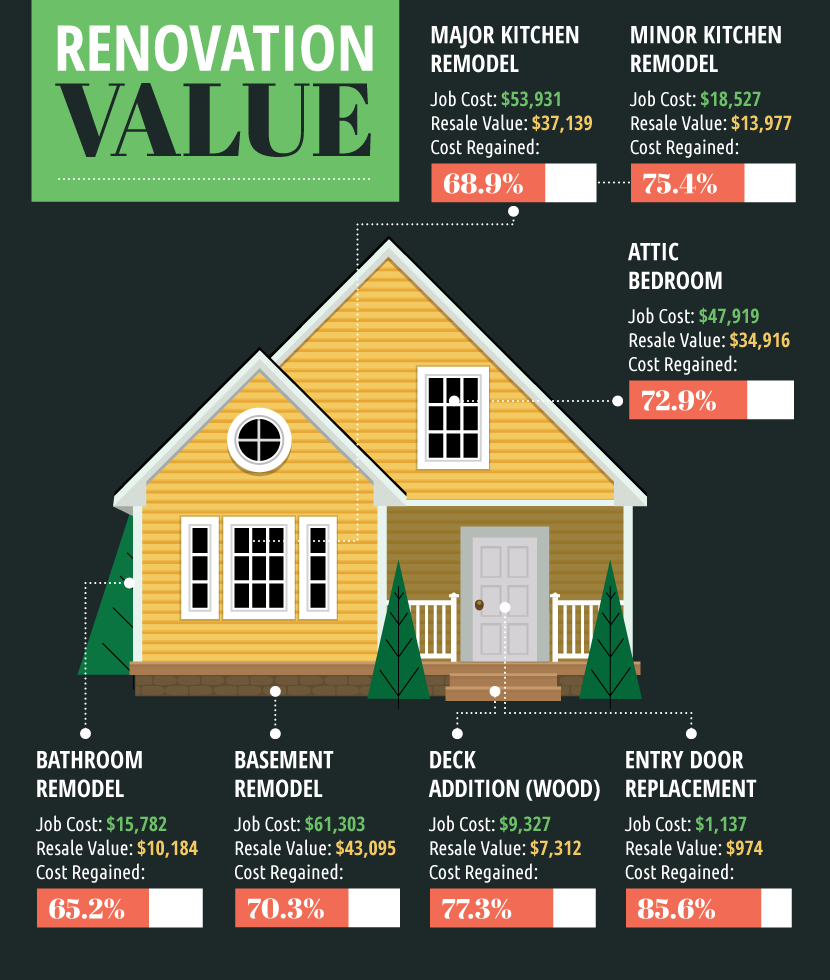

#15: Question: Renovations are a great investment

Answer: Go ahead and remodel if you want to. Just don't tell yourself it's an investment. In fact, you'll be lucky to recoup your costs, much less make money. Don't believe us? Remodeling Magazine's 2011 Cost vs. Value Report looked at a number of common household renovations and found that rates of return peaked out at about 75 percent of the cost of the remodel. That said, when the real estate market is really hot and you pick the right kind of renovation, such as adding a bathroom, that number can go above 100 percent — but it isn't by much, and that isn't the norm. The bottom line: if you renovate, do it for you, not a future buyer.

Learn the truth

When it comes to buying a home, don't fall prey to neighbourhood talk and common fiction; learn the truth. Go in with your eyes wide open and a keen sense of what to really expect. You can't afford not to.

Interview a great Realtor and get your questions answered.

© http://www.hgtv.ca/blog/8-real-estate-myths/