The single family home has, unfortunately, become unaffordable for many people.

The single family home has, unfortunately, become unaffordable for many people.

With roller coaster housing prices and more people finding that renting is better idea than buying, there will be more people turning to renting.

So you’ve made the fortuitous decision to invest in real estate and now you want the revenue stream to begin raining down on you. But are you ready? Below we provide a list of items to help prepare you to be an effective and fair first-time landlord!

NB- We are assuming your building allows rentals so you are not breaking any strata laws in listing your place.

Know your Tenants Rights and the Law

Learn about landlord and tenant laws in your province to ensure you’re prepared in case things go wrong—and they will. The three most common types of disputes from a landlord’s perspective are non-payment of rent, persistent late payments, and unruly behaviour or damages. Each has a separate form that has to be filed to the Landlord and Tenant Board to get your case heard. “I tell all landlords to be consistent and not to get emotionally involved,” says Toronto paralegal Cathy Corsetti. “Those are the messiest cases. When they go sour, they really go sour.”

By far the biggest reason landlords go to Landlord and Tenant Court is for arrears of rent. “Tenants can be pretty savvy when it comes to excuses for why they haven’t paid the rent,” says Corsetti. “They’ve had their wallet stolen, a cheque is late.” Corsetti advises landlords to stick to the rules and not be swayed by emotional pleas for exceptions.

You can minimize problems by doing a check on all potential tenants. That means calling their employer as well as two of their previous landlords. Be careful though, because some tenants will put down the names of friends and family as references, hoping you won’t dig deeper. Others may even give photocopies of fraudulent credit scores and bank statements in the hope of hiding their bad tenancy record. “There are professional renters out there,” says Mattina. “Once they’re in, they don’t pay the rent. Then it’s up to you to evict them and get the rent money. That can be a challenge because these renters know the law and will do everything they can to stay without paying.”

As soon as one of your tenants doesn’t pay the rent, serve them notice in writing. If rent is to be paid on the first of the month, in most provinces you can legally file notice on the second. (Although many landlord and tenant laws are the same across Canada, check with your own province’s Tenancies Act or Landlord and Tenant Board for the specifics.) Usually the tenant then gets 14 days to pay the full amount owing. If they don’t pay, the landlord can file an application for a hearing three weeks later. “Always, always serve notice on the first day you can,” says Mattina. “Once you apply, the clock starts ticking. You can change your mind if they come through with the rent, but serve the notice. The longer you take to file it, the longer it will take to get your money.”

As soon as one of your tenants doesn’t pay the rent, serve them notice in writing. If rent is to be paid on the first of the month, in most provinces you can legally file notice on the second. (Although many landlord and tenant laws are the same across Canada, check with your own province’s Tenancies Act or Landlord and Tenant Board for the specifics.) Usually the tenant then gets 14 days to pay the full amount owing. If they don’t pay, the landlord can file an application for a hearing three weeks later. “Always, always serve notice on the first day you can,” says Mattina. “Once you apply, the clock starts ticking. You can change your mind if they come through with the rent, but serve the notice. The longer you take to file it, the longer it will take to get your money.”

Whitney Wihidal, a chiropractor and landlord in Orillia, Ont., is pragmatic about rent arrears and evictions. He owned a 14-unit apartment building with his brother-in-law for several years before selling it in 2009 for about the same price he’d paid for it. “There were always a couple of tenants I had to chase down for the rent, and one or two in the process of being evicted every month,” says Wihidal. “Cut your losses by knowing the law.” But even if everything goes in your favour, it can still take anywhere from three months to a year to get a tenant evicted. That’s many months of lost rental income that you may never recoup. That’s why these days, Wihidal sticks closer to home, renting out his basement. It’s allowed him to easily keep an eye on things. “I always advertise at the local college for student tenants,” says Wihidal. “If the parents come along to look at the place and write the monthly cheques, I’m pretty sure I’ll get my money. They solidify it for me.”

In order to know how to work with your tenants (in case you get a tenant from hell) you need to know what they can or cannot do, demand from you, or not do. You need to know their rights. Here are some of the documents or websites that tenants across Canada from West to East (minus the territories):

British Columbia

Tenant Resource and Advocacy Centre– has a phone line your tenants can call in addition to a handy Tenant Resource and Advocacy Centre Survival Guide. If you live in B.C. I highly recommend you download this guide. It’s one of the most downloaded publications from the government of British Columbia (who knew?). I downloaded this guide recently and found it very helpful.

Alberta

In Alberta, the Landlords and Tenants webpage has a myriad of links including how to file a dispute, tipsheets on the rights and responsibilities of landlords and tenants, and Alberta also has a guide for download.

Sasketchewan

In Sasketchewan, the Landlords and Tenants website has information on starting a tenancy, ending a tenancy, and what to do after a tenancy is over (like how tenants get their security deposit back)

Manitoba

In Manitoba, you can read the Residential Tenancy Act and also contact the Residential Tenancy Branch. They offer presentations on landlord and tenant issues to schools and other community groups. They also help mediate disputes between landlords and tenants.

Ontario

Ontario’s residential tenancy branch probably has one of the most comprehensive websites. Not only do they have a guide (and multiple brochures you can download), they have a chart where you can find your issue and find out what you can do about it.

Quebec

Quebec

Quebec has a website through the CMHC as well. Apparently in Quebec, collecting deposits is not allowed? (oh geez!)

New Brunswick

The website is through CMHC in addition to information for tenants through the office of the Rentalsman

Nova Scotia

In Nova Scotia, has a tenant guide with the first part of the guide named “Tenant Empowerment: How to Use this Guide.” So you know that they mean business.

Newfoundland and Labrador

Last but certainly not least, the Service NL website for landlords and tenants is chock full of good information (written in a no nonsense and easy to find way) for both the tenants and the landlord.

Pick a path to prosperity

There are several ways to become a landlord. You can rent out a part of your own home, such as a basement suite, or you can purchase a second place, in which case you’ll need to decide if you want to deal with your tenants directly, or use a property management company. All the financial rewards are yours to keep if you deal with the tenants yourself, but you’ll probably find yourself devoting a lot of time and energy to maintaining the property.

Find the perfect property

Start your rental property search by looking at cities with good job and population growth so there’s a large pool of tenants to pick from. Also build a team of professionals to help you, including a good real estate lawyer, tax accountant and mortgage broker. Read books on how to buy rental property and ask friends and family to share their own landlording experiences with you.

Ultimately, the best property for you might be your own home.

Figure out what you can afford

Based on the down payment you have available, what can you afford to buy? Keep in mind that in Canada small rental properties of one to four units require a minimum down payment of 20% to qualify for a Canada Mortgage and Housing Corp. (CMHC) insured loan. How would affordability change if you increased your down payment? Don’t forget to factor in real estate closing costs and other financial commitments that you have in life—things like a new car, medical bills or daycare costs.

Of course, some investors are so keen to get in the game that they’ll put just 5% down on a property, or they’ll use credit card cash advances to scrape together a down payment. Don’t do it. “Lenders want you to have some skin in the game,” says Marc Lamontagne, a fee-only adviser with Ryan Lamontagne Inc. in Ottawa. “So down payments under 20% for investment properties are rare. Lenders don’t want to be left on the hook if cash flow turns negative.”

Run the numbers

Before buying anything, ask yourself whether you can still make money, given that prices in many parts of Canada are high. “There’s more than one way to assess a property, but ensuring that it’s cash-flow positive from day one is the ideal,” says Lamontagne. “Don’t count on appreciation in price for your investment return. That’s just speculation.”

Once you know your down payment, it’s time to look at what rents and expenses will be like for the properties you are considering. That means looking at total annual rental income less all expenses (typically mortgage interest, property taxes, insurance and utilities). Put all of this information into a cash flow statement, and the number you get when you subtract expenses from income will show either a positive cash flow (meaning you’re making money) or negative cash flow (you’re losing money).

Some investors will argue that it’s fine to lose a bit of money each month because the tenants are paying your mortgage. But this line of thinking is a slippery slope to losses, because there will be items you can’t control—like rising mortgage rates, major repairs and unpaid rents—that can cost you thousands. You have to think of it as you would any small business, If a small business is in the red, that’s not a good thing, and neither is it for a rental property—whether tenants are paying your mortgage or not.

The one thing that often trips up landlords is unforeseen expenses. To minimize that risk, budget 2% of the purchase price of your property for maintenance and repair costs. So if the property you bought costs $300,000, you should add $6,000 a year for repairs to your annual expense budget to get a more accurate cash flow projection. Otherwise, losses can mount quickly.

Also make sure you beef up your rainy-day fund. “The biggest mistake I see people make is failing to recognize that you need reserves,” says Ross McCallister, a property manager in Arizona. “They stretch their finances too far and then, when a tenant doesn’t pay for a month or two or three, it becomes emotional and pinches the family’s lifestyle.”

Get Thicker Skin

If you tend to be the “aim to please” type, as a landlord it can be difficult to not to try and be your tenants friends. It’s a good idea to keep the relationship professional and cordial otherwise they may try and take advantage of your kindness. You will learn that as a landlord, you need to grow a pair or else people may decide they can walk all over you.

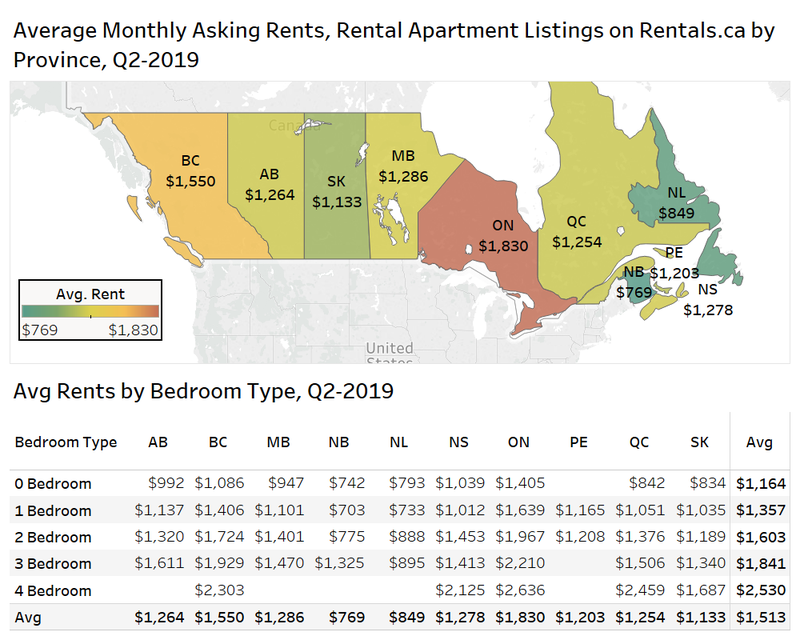

Know How Much Rents Go For

Know How Much Rents Go For

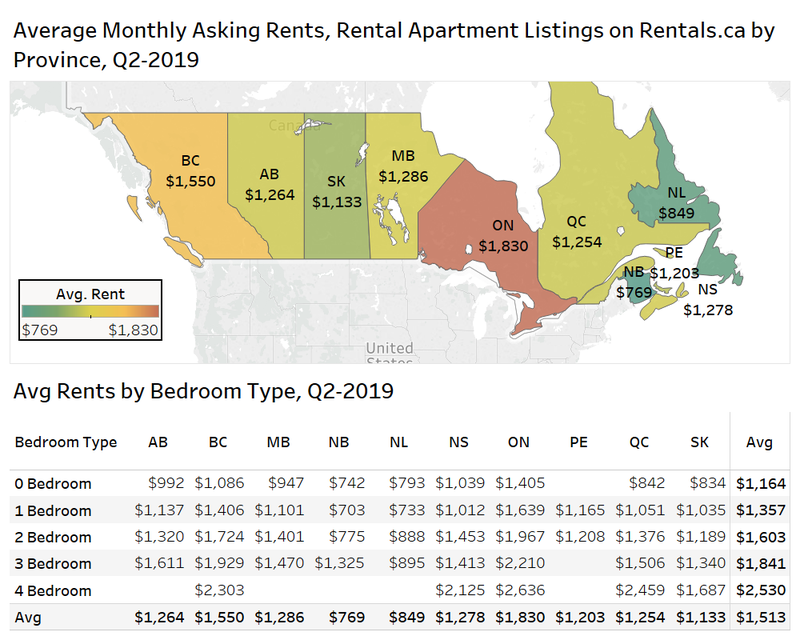

Knowing how much rents go for in the area is extremely important. You want to set your rental rates within market value for the area. You don’t want to go so low that you low ball everyone else in the neighbourhood, and you don’t want it too high as the demand will likely be lower.

Each province should have information on how much you can legally raise the rent and this varies from province to province. This raise accounts for the inflation due to rising utility prices, rising property taxes, and the like.

Don’t Stop Until You Get the Security Deposit and Lease Signed

Finally, another important piece of advice is to keep the rental unit on the market until you get the security deposit and the lease signed. There are, unfortunately, some very flakey people out there. To the point that they say yes, they meet you, say yes again. Then they try and make you reword the lease agreement so that they could leave and break the contract without penalty (e.g. instead of a 12 month lease they want to leave at 6 months).

There are obviously many other things to consider and research before jumping into the deep end of becoming a landlord, and this is just a fraction of what you would need to know.

Learn the tax rules

To use the tax laws to your full benefit, be aware of what can and can’t be claimed on your taxes. For instance, expenses that may be fully deducted against your rental income typically include the cost of advertising, repairs and maintenance of the rental space, and legal expenses incurred to collect unpaid rent. If the rental apartment is part of your home, you can deduct certain expenses based on the portion of space the rental suite takes up in the house, typically insurance premiums, the interest component of mortgage payments, property taxes, utilities and landscaping.

In general, you have a loss if your rental expenses are more than your gross rental income. You can deduct this loss against your other sources of income. So, for instance, if you made $10,000 in rent, and expenses were $4,000, then $6,000 will be added to your taxable income for the year. At the 40% tax bracket, you would pay $2,400 in taxes on that rental income. If, instead, your expenses exceeded your rental income by $6,000, this amount is subtracted from your other sources of taxable income, like your salary. So if you paid taxes on all your other income throughout the year, you would get a refund of $2,400.

Some expenses may not be fully deductible in the year they’re incurred: they may have to be amortized over several years at prescribed rates. These are called capital expenses, and the method of deducting them over time is referred to as depreciation, or capital cost allowance (CCA). The distinguishing feature of a capital expense is that it has an enduring value that benefits the current as well as future years, such as renovations and major appliances.

If you incur expenses to bring a property back to its original condition—for example, painting and grouting—the expenses should be fully deductible in the year incurred. If, on the other hand, you enhance the original condition of the property—say, by renovating a bathroom or installing a new roof—that may be considered a capital expense and should be depreciated over three to five years. Your accountant can help determine this for you.

Finally, don’t overlook important details that could cost you thousands in future gains, such as the tax consequences of renting out a portion of your principal residence. “If you have a self-contained unit in your home that you are renting out, such as a basement apartment or entire second floor, you effectively have two properties and will be taxed on a portion of your capital gains—according to space and percentage of time rented—when you sell,” says John Mott, a chartered accountant in Toronto.

Also be diligent about claiming all rental income on your annual tax return. If you don’t, the taxman will eventually find out about it, ask for back taxes and give you stiff penalties for dodging your tax obligations. “Tenants have to put down their landlord’s name and the annual rent paid on their own tax forms to receive certain provincial tax credits and benefits,” says Mott. “All of this info can easily be cross-referenced by the Canada Revenue Agency and cost you thousands when they find out about it.”

What skills and qualities does one have to have to be a successful landlord?

Being a landlord is not just about managing bricks and mortar. It is managing relationships and you have to be an effective problem solver when there is a repair to be made, a noise complaint or late rent.

Unless you plan to have your property managed by a professional, you need to have time.Your best financial position is to be able to do some things yourself and that takes time. If there are tenants that dont do stuff or then you may be faced with mowing a lawn or shovel the walkway on an icy day.

Do you need to be handy? Yes and no. You will save a great deal of money if you can handle small jobs such as painting and yard work. If you are not up to the bigger jobs, watch more television. Seriously. Many programs and even youtube can be informative about larger home repairs and, although you may not tackle those jobs yourself, you will be better informed and less likely to be taken advantage of when you hire trades people.

Financial literacy is important. When you are making renovation decision, it is important to know what is a “write off” again your rental income for your current year’s taxes and what are “capital gains” improvements that you can use to your advantage when you sell your property. Even if you hire an accountant, you need to keep track of all of your income and expenses and have an organized system for bills and receipts. You also need to be organized to check references and the credit of potential tenants.

Flexibility is needed when remembering that your tenants are not you. They will not do things the way you would and as long as they are respectful and paying their rent, you may need to let some things go. This is especially important if you live in the building with your tenants. The ability to stay calm is essential. You may be tempted to shed some tears when the first time you run the tub and the water pours through the ceiling of the unit below, but you need to stay composed and call a plumber.

To be a successful landlord one needs to be prepared and educated. Although it’s a great deal of work to manage a multiple family dwelling, the financial payoff can be rewarding. It’s a great way to build equity while paying down the mortgage with the rental income with a goal toward owning that single family you have so intently set your sights on.

Decide on an exit strategy

Knowing when to sell your rental property is easy if you have a long-term financial goal. Do you want to hold on to your property for a source of income in retirement? If not, then one exit strategy may involve selling sometime in your 60s. “If you’re close to retirement, take advantage of good market conditions,” says Thomas Venner, a financial planner in Hamilton, Ont. “Take your profit and stuff it in annuities for your later years.”

Or you may have a more immediate goal for your rental gains. Gord Radman and his wife Rossana certainly do. Eight years ago, the Burlington, Ont., couple purchased a 1,300-sq-ft townhouse that they’ve rented out. The property has been cash flow positive since day one. With three kids aged 15, 13 and 11, the Radmans plan to sell and tap into what will be close to $200,000 of equity in the townhouse in five years. The goal? To pay for their children’s post-secondary education.

The single family home has, unfortunately, become unaffordable for many people.

The single family home has, unfortunately, become unaffordable for many people. As soon as one of your tenants doesn’t pay the rent, serve them notice in writing. If rent is to be paid on the first of the month, in most provinces you can legally file notice on the second. (Although many landlord and tenant laws are the same across Canada, check with your own province’s Tenancies Act or Landlord and Tenant Board for the specifics.) Usually the tenant then gets 14 days to pay the full amount owing. If they don’t pay, the landlord can file an application for a hearing three weeks later. “Always, always serve notice on the first day you can,” says Mattina. “Once you apply, the clock starts ticking. You can change your mind if they come through with the rent, but serve the notice. The longer you take to file it, the longer it will take to get your money.”

As soon as one of your tenants doesn’t pay the rent, serve them notice in writing. If rent is to be paid on the first of the month, in most provinces you can legally file notice on the second. (Although many landlord and tenant laws are the same across Canada, check with your own province’s Tenancies Act or Landlord and Tenant Board for the specifics.) Usually the tenant then gets 14 days to pay the full amount owing. If they don’t pay, the landlord can file an application for a hearing three weeks later. “Always, always serve notice on the first day you can,” says Mattina. “Once you apply, the clock starts ticking. You can change your mind if they come through with the rent, but serve the notice. The longer you take to file it, the longer it will take to get your money.” Quebec

Quebec

Know How Much Rents Go For

Know How Much Rents Go For