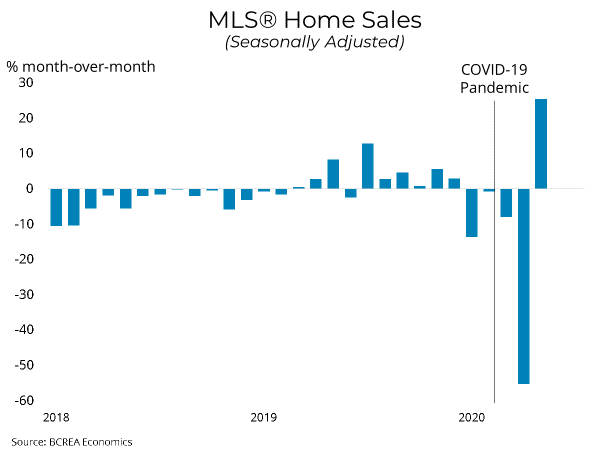

National home sales shot up in June, with prices also climbing steadily, according to June data released by the Canadian Real Estate Association (CREA).

National home sales shot up in June, with prices also climbing steadily, according to June data released by the Canadian Real Estate Association (CREA).

Transactions were up about 15.2%, while the average property price was up 6.5% from June 2019 to $539,000. Excluding the country’s most expensive markets, Toronto and Vancouver, the average price falls to $432,000.

“While June’s housing numbers were mostly back at normal levels, we are obviously not back to normal at this point,” said Shaun Cathcart, CREA’s senior economist. “I guess the bigger picture is one of cautious optimism. The market has recovered much faster than many would have thought, but what happens later this year remains a big question mark. That said, daily tracking suggests that

…

Buying a New Home Subject to the Sale of your Old Home

Buying a New Home Subject to the Sale of your Old Home

The latest homeowner's conundrum: buy first or sell first?

The latest homeowner's conundrum: buy first or sell first?

The British Columbia Real Estate Association (BCREA) reports that a total of 4,518 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May 2020, a decline of 45.2 per cent from May 2019.

The British Columbia Real Estate Association (BCREA) reports that a total of 4,518 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May 2020, a decline of 45.2 per cent from May 2019.

Buying and selling manufactured homes

Buying and selling manufactured homes

Hiring the right person to sell your home is critical to ensure that you encounter as few roadblocks as possible during the sale process and earn a good price for your house.

Hiring the right person to sell your home is critical to ensure that you encounter as few roadblocks as possible during the sale process and earn a good price for your house.

Ready to buy a home? Be prepared: With inventory tight and prices rising, this is a tricky time to be entering the market.

Ready to buy a home? Be prepared: With inventory tight and prices rising, this is a tricky time to be entering the market.

You may have heard of the incentive programs that the federal government has created to try to entice first time home buyers into the real estate market, but how much do you really understand? Is this something for you?

You may have heard of the incentive programs that the federal government has created to try to entice first time home buyers into the real estate market, but how much do you really understand? Is this something for you?

If you have questions about the coronavirus and how the current situation might impact your finances, you’re not alone.

If you have questions about the coronavirus and how the current situation might impact your finances, you’re not alone.

Your credit scores are an important aspect of your financial profile.

Your credit scores are an important aspect of your financial profile.