The dollar figure on your provincial property assessment notice should not be taken as your home’s market value

The dollar figure on your provincial property assessment notice should not be taken as your home’s market value

In early January, homeowners across British Columbia received their 2020 assessed property values, released by BC Assessment. For the most part, the province remains relatively stable. However, there are significant changes to note, including a dramatic decrease in values in the lower mainland by as much as 15 per cent and increases of 41 per cent in smaller areas such as Kitimat. Regardless of the situation, it can be a confusing landscape to navigate as a homeowner, seller, or buyer. Here is a look at some of the need-to-know points that demystify the real versus the perceived impact of the newly released property assessments.

But hold

…

Finding the perfect home doesn't happen in one day. It takes careful planning and lots of work. Fortunately, there are a number of things you can do to simplify the process.

Finding the perfect home doesn't happen in one day. It takes careful planning and lots of work. Fortunately, there are a number of things you can do to simplify the process. When it comes to investing your money, land has always been a valuable commodity to consider.

When it comes to investing your money, land has always been a valuable commodity to consider.

At some point in your journey as a real estate investor, you may develop the desire to quit your current job to pursue real estate investing full-time.

At some point in your journey as a real estate investor, you may develop the desire to quit your current job to pursue real estate investing full-time.

So you’re moving to a new home, what do you need to get done?

So you’re moving to a new home, what do you need to get done?

The single family home has, unfortunately, become unaffordable for many people.

The single family home has, unfortunately, become unaffordable for many people.

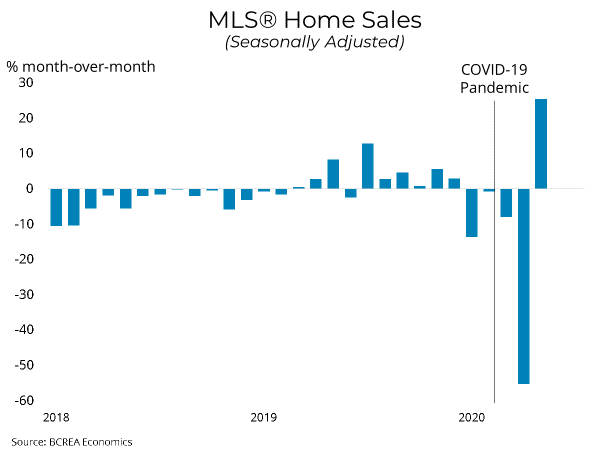

National home sales shot up in June, with prices also climbing steadily, according to June data released by the Canadian Real Estate Association (CREA).

National home sales shot up in June, with prices also climbing steadily, according to June data released by the Canadian Real Estate Association (CREA).

Buying a New Home Subject to the Sale of your Old Home

Buying a New Home Subject to the Sale of your Old Home

The latest homeowner's conundrum: buy first or sell first?

The latest homeowner's conundrum: buy first or sell first?

The British Columbia Real Estate Association (BCREA) reports that a total of 4,518 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May 2020, a decline of 45.2 per cent from May 2019.

The British Columbia Real Estate Association (BCREA) reports that a total of 4,518 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May 2020, a decline of 45.2 per cent from May 2019.

Buying and selling manufactured homes

Buying and selling manufactured homes