B eing around public transportation wasn’t always a good choice when it came to real estate. After World War II, downtown living was frowned upon and people flocked towards the suburbs in order to find larger and greener land. As a result, real estate prices rose outside the city.

eing around public transportation wasn’t always a good choice when it came to real estate. After World War II, downtown living was frowned upon and people flocked towards the suburbs in order to find larger and greener land. As a result, real estate prices rose outside the city.

Fast forward to today and we’re seeing the opposite effect. People want to live in the downtown core and public transportation is at the forefront of political debate.

Billions of dollars are being spent on new subways and streetcars in cities like Toronto and Vancouver. Calgary and Ottawa are also beefing up its public transit service in response to a higher demand from residents.

In fact, every major city across Canada has plans to focus on public transportation. It’s a

Buying a home

Finding the perfect home doesn't happen in one day. It takes careful planning and lots of work. Fortunately, there are a number of things you can do to simplify the process.

Finding the perfect home doesn't happen in one day. It takes careful planning and lots of work. Fortunately, there are a number of things you can do to simplify the process.

Let these articles give you the information you need to make the right decision on buying real estate in Kamloops.

We have a page dedicated to buying real estate in Kamloops

Found 401 blog entries about Buying a home.

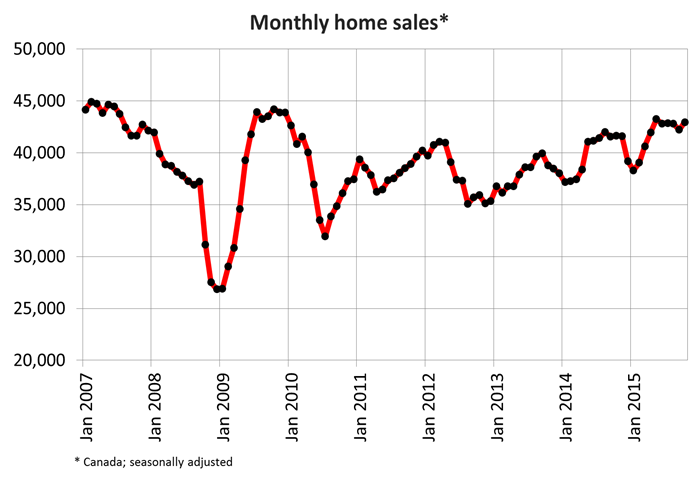

Canadian home sales rebound in October

Ottawa, ON, November 16, 2015 - According to statistics released today by The Canadian Real Estate Association (CREA), national home sales increased in October 2015 from the previous month.

Highlights:

- National home sales rose by 1.8% from September to October.

- Actual (not seasonally adjusted) activity was little changed (+0.1%) compared to October 2014.

- The number of newly listed homes was up 0.9% from September to October.

- The Canadian housing market remains balanced overall.

- The MLS® Home Price Index (HPI) rose 6.7% year-over-year in October.

- The national average sale price rose 8.3% on a year-over-year basis in October; excluding Greater Vancouver and Greater Toronto, it increased by 2.5%.

The number of homes trading

The number of homes trading

Thompson-Nicola Rental Housing Situation Poor, But Better Than Most

Kamloops and the Thompson-Nicola region is facing a rental housing shortage, but compared to the rest of the country the area is not fairing too poorly.

According to the Canadian Rental Housing Index, in the region there are 53,375 renter households and of those 10,995 people are renting accommodations. That represents 21 per cent of the population as renters, with a median household income of $37,384. The average rent in the area is $835 including utilities. Of those renting, more than 48 per cent of people spend 30 per cent or more of their income for housing. Another 2,425 people spend more than 50 per cent of their income on housing needs, representing 22 per cent of all renters.

According to the Canadian Rental Housing Index, in the region there are 53,375 renter households and of those 10,995 people are renting accommodations. That represents 21 per cent of the population as renters, with a median household income of $37,384. The average rent in the area is $835 including utilities. Of those renting, more than 48 per cent of people spend 30 per cent or more of their income for housing. Another 2,425 people spend more than 50 per cent of their income on housing needs, representing 22 per cent of all renters.

The number of renters living in overcrowded conditions represents

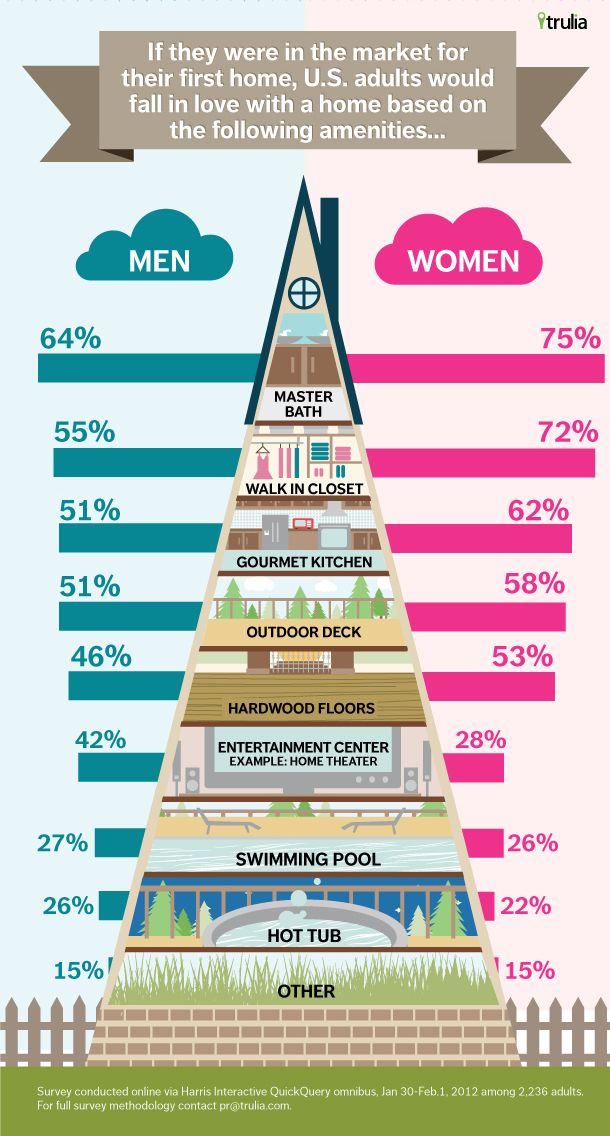

…What do men like in a house and more importantly what do women like!

So what are the features that attract men and women in a house. A survey in 2012 in the US suggested that master bathroom was the biggest single amenity to a house from both of the sexes. See the graphic below for a full breakdown. Does it match your ideas?

© http://pro.truliablog.com

Private mortgage loans - Private Lenders

With a credit score under 600, it is likely that you will be turned down by a bad credit or prime lender and you may have to turn to a private lender. Private lenders provide an option to clients with bruised credit. Since it is a fast financing option with a higher risk to the lender, interest rates are almost always higher.

With a credit score under 600, it is likely that you will be turned down by a bad credit or prime lender and you may have to turn to a private lender. Private lenders provide an option to clients with bruised credit. Since it is a fast financing option with a higher risk to the lender, interest rates are almost always higher.

Most borrowers – real estate investors included – think of private lenders as a last-resort option if they can’t secure financing anywhere else. But private funds are gaining traction as a financing option due to the new mortgage rules set by the federal government and the continued post-crisis caution being exercised by institutional lenders. Private lenders have realized that conservative lending guidelines used by banks and

…Costs of buying your first home in Kamloops

“There are costs that just don’t exist anywhere else,” says Phil Soper president and CEO of Royal LePage Real Estate Services, Toronto. There are often costs involved in buying a home that many first time home buyers have never heard of, particularly if they didn’t do their homework or seek good advice during the transaction.

That’s where a realtor can come in handy, says Elton Ash, regional vice-president of Re/Max Western Canada, Vancouver.

“You’re paying a realtor for a service,” says Soper. “That service goes well beyond simply sales service. The realtor should be willing to take the novice purchaser through the entire process, including a summary of all the costs and steps necessary to…

“There are costs that just don’t exist anywhere else,” says Phil Soper president and CEO of Royal LePage Real Estate Services, Toronto. There are often costs involved in buying a home that many first time home buyers have never heard of, particularly if they didn’t do their homework or seek good advice during the transaction.

That’s where a realtor can come in handy, says Elton Ash, regional vice-president of Re/Max Western Canada, Vancouver.

“You’re paying a realtor for a service,” says Soper. “That service goes well beyond simply sales service. The realtor should be willing to take the novice purchaser through the entire process, including a summary of all the costs and steps necessary to…

Renters: Are You Ready to Buy a Home?

While you save up your down payment, take these 5 steps to get you closer to closing.

For renters planning to buy a home, preliminary steps like creating a budget and saving for a down payment are obvious. Here are five more advanced steps toward moving out of your rental and into a dream home of your own.

Understand the full cost of home ownership

As a renter, a single rental fee covers your monthly housing payment. But as a homeowner, four main factors go into your monthly housing payment: principal, interest, taxes and insurance (P.I.T.I.). Understanding these costs will help you determine how much house you can afford.

As a renter, a single rental fee covers your monthly housing payment. But as a homeowner, four main factors go into your monthly housing payment: principal, interest, taxes and insurance (P.I.T.I.). Understanding these costs will help you determine how much house you can afford.

Together, principal and interest comprise your monthly mortgage payment, with the principal paying down your loan balance

…Mortgage's explained - Part 2 - Fixed versus variable

The gap between variable rate mortgage and fixed rate mortgage products has narrowed in recent years. And while fixed rate mortgages are starting to rise they offer certainty in a monthly payment. On the flip-side, variable rate mortgages remain low, but are the riskier of the two choices – so how do you choose?

Your income, lifestyle and risk tolerance will weigh heavily on your decision and will inevitably determine which product suits your circumstance.

Risk versus reward

The appeal of variable rate mortgages (also called adjustable rate mortgages) is that the interest rate is typically lower than that of fixed rate mortgage products. However, the main drawback is the risk involved. Without warning, interest rates could increase…

The gap between variable rate mortgage and fixed rate mortgage products has narrowed in recent years. And while fixed rate mortgages are starting to rise they offer certainty in a monthly payment. On the flip-side, variable rate mortgages remain low, but are the riskier of the two choices – so how do you choose?

Your income, lifestyle and risk tolerance will weigh heavily on your decision and will inevitably determine which product suits your circumstance.

Risk versus reward

The appeal of variable rate mortgages (also called adjustable rate mortgages) is that the interest rate is typically lower than that of fixed rate mortgage products. However, the main drawback is the risk involved. Without warning, interest rates could increase…

Mortgage's explained - Part 1 - The Basics

Sometimes concepts in the finance world can be tricky. We get so caught up in trying to understand what all the offerings are that we forget to understand the simple things. When is the last time that someone said what a mortgage really is? Or explained why I can only buy a home for $350,000.00. We all have questions in the back of our minds that we don't articulate because we are just too embarrassed. Here are the top five things you are afraid to ask.

Sometimes concepts in the finance world can be tricky. We get so caught up in trying to understand what all the offerings are that we forget to understand the simple things. When is the last time that someone said what a mortgage really is? Or explained why I can only buy a home for $350,000.00. We all have questions in the back of our minds that we don't articulate because we are just too embarrassed. Here are the top five things you are afraid to ask.

1. What is a mortgage?

A simple enough question but not one that people seem ready to admit to . A mortgage is a loan secured by real property, commonly referred to as real estate. In essence it is a contract that includes rights and obligations of both parties. The term actually comes from a

…Time to test home for radon gas?

Radon gas is the second-leading cause of lung cancer after smoking.

What is Radon?

Radon is a radioactive gas that occurs naturally when the uranium in soil and rock breaks down. It is invisible, odourless and tasteless. When radon is released from the ground into the outdoor air, it is diluted and is not a concern. However, in enclosed spaces, like homes, it can sometimes accumulate to high levels, which can be a risk to the health of you and your family.

Most homes in contact with the ground will contain some amount of radon gas. Radon becomes more of a concern when it reaches high levels, with levels varying across the country. According to Health Canada, about seven per cent of Canadian homes have radon levels that may be putting

…