Still trying to figure out this RRSP thing? You’re not alone.

Still trying to figure out this RRSP thing? You’re not alone.

It's that time of year again - time to make the most of your RRSP contributions before the clock strikes twelve on March 2, 2020

The Registered Retirement Savings Plan, known simply as the RRSP to most, is a great tool for saving money. RRSP contributions are tax-deductible, which allows you to delay paying taxes on that income until you retire, when you’ll likely be in a lower tax bracket. If you don’t know a lot about RRSPs, it’s time to educate yourself. Unfortunately, our high cost of living and competing financial demands can make it challenging putting money aside. But hopefully that won’t deter you from figuring out how to make the most of what you have.

There are times when

…

Finding the perfect home doesn't happen in one day. It takes careful planning and lots of work. Fortunately, there are a number of things you can do to simplify the process.

Finding the perfect home doesn't happen in one day. It takes careful planning and lots of work. Fortunately, there are a number of things you can do to simplify the process. Find out how much the median single-family home in your municipality went up (or down) in value last year

Find out how much the median single-family home in your municipality went up (or down) in value last year

Rent-to-own is an alternative route to home ownership for those who can’t obtain financing due to poor credit or because they don’t have enough money for a down payment (or both).

Rent-to-own is an alternative route to home ownership for those who can’t obtain financing due to poor credit or because they don’t have enough money for a down payment (or both).

The Province is proposing more residential flexibility for people living in the Agricultural Land Reserve (ALR) as outlined in a new policy intentions paper released Jan. 27, 2020, by the Ministry of Agriculture.

The Province is proposing more residential flexibility for people living in the Agricultural Land Reserve (ALR) as outlined in a new policy intentions paper released Jan. 27, 2020, by the Ministry of Agriculture.

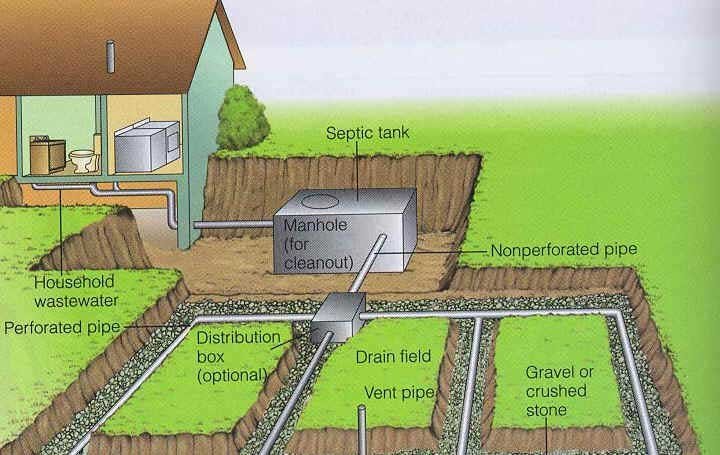

This article provides you with advice for people who are considering the purchase of a home with a private septic system, both in terms of testing and inspecting the system to make sure that it is functional and passes local standards of operation.

This article provides you with advice for people who are considering the purchase of a home with a private septic system, both in terms of testing and inspecting the system to make sure that it is functional and passes local standards of operation.

Buying your first house can feel overwhelming, but it’s oh-so-worth-it to leave the rental life behind.

Buying your first house can feel overwhelming, but it’s oh-so-worth-it to leave the rental life behind.

The cost of owning a house and starting a family just might be the lost opportunity to get a good head start on saving for retirement.

The cost of owning a house and starting a family just might be the lost opportunity to get a good head start on saving for retirement.

Canada Mortgage and Housing Corporation (CMHC) has defended mortgage stress test rules and warned federal policymakers to hold the line amid calls from industry associations to ease the rules.

Canada Mortgage and Housing Corporation (CMHC) has defended mortgage stress test rules and warned federal policymakers to hold the line amid calls from industry associations to ease the rules.