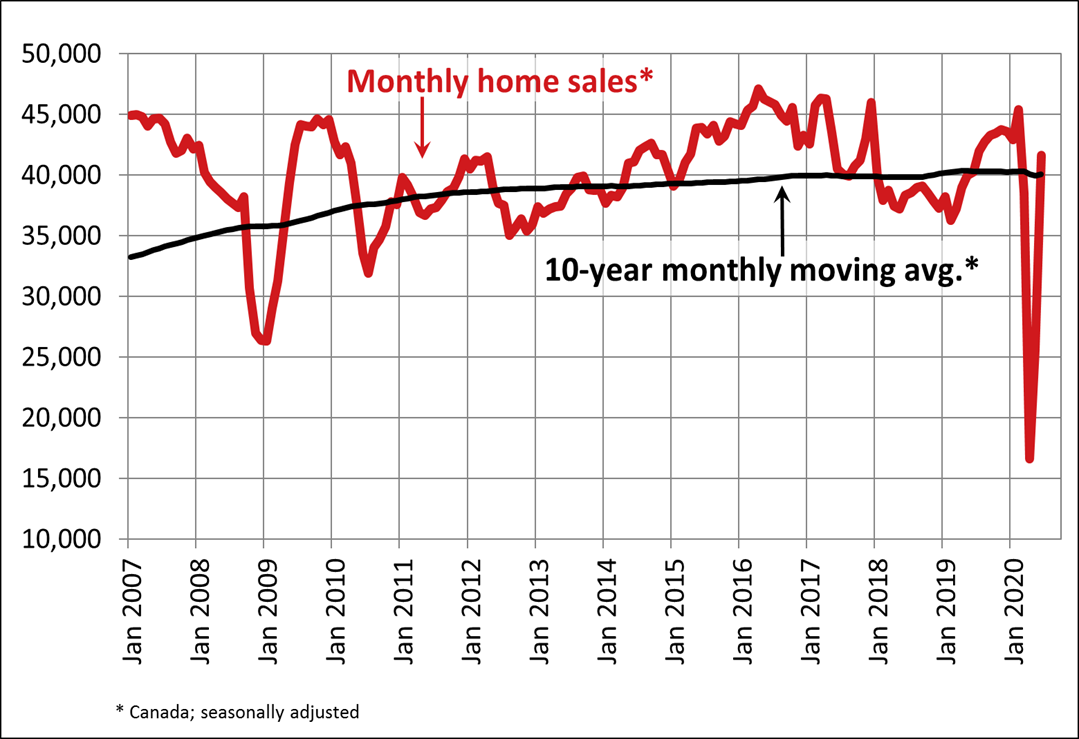

National home sales shot up in June, with prices also climbing steadily, according to June data released by the Canadian Real Estate Association (CREA).

National home sales shot up in June, with prices also climbing steadily, according to June data released by the Canadian Real Estate Association (CREA).

Transactions were up about 15.2%, while the average property price was up 6.5% from June 2019 to $539,000. Excluding the country’s most expensive markets, Toronto and Vancouver, the average price falls to $432,000.

“While June’s housing numbers were mostly back at normal levels, we are obviously not back to normal at this point,” said Shaun Cathcart, CREA’s senior economist. “I guess the bigger picture is one of cautious optimism. The market has recovered much faster than many would have thought, but what happens later this year remains a big question mark. That said, daily tracking suggests that July, at least, will be even stronger.”

But it’s the month-over-month data that is truly staggering: property sales are not only 150% above where they were in April, but sales rose 83.8% in the Greater Toronto Area , 75.1% in Montreal and 60.3% in Greater Vancouver.

“Pent-up demand (supported by the fact that would-be house hunters have likely suffered lesser job declines) fuelled a surge in home sales during June. The gain brought sales levels nearly back to where they were in February,” noted TD economist Rishi Sondhi. He added that average prices have almost entirely erased pandemic-related losses, with prices down only 0.5% compared to February.

“Pent-up demand (supported by the fact that would-be house hunters have likely suffered lesser job declines) fuelled a surge in home sales during June. The gain brought sales levels nearly back to where they were in February,” noted TD economist Rishi Sondhi. He added that average prices have almost entirely erased pandemic-related losses, with prices down only 0.5% compared to February.

And with such a frenzy of homebuying activity, it’s no wonder that national inventory levels are at a 16-year low with just 3.6 months of housing supply left, should sales continue at the current rate. With such limited housing stock, buyers are forced to compete fiercely for properties.

Another metric that shows sellers with the upper hand in most markets is the sales-to-new listing ratio, which is at 63.7%. A balanced ratio is between 40-60% and anything below 40% is considered a buyers’ market.

Homebuyers Growing More Confident

As the demand for homeownership is clearly still strong, with or without COVID, prices are likely to continue moving upward for the time being barring something drastic that would force homeowners to start listing their properties en masse. Some speculate the forthcoming end of the government’s income-assistance programs and mortgage payment deferrals that were offered by most lenders may be that “drastic” something.

“While third-quarter sales growth is likely to be very strong, what takes place in the few quarters thereafter is a major risk point, as mortgage deferral programs and the CERB are set to conclude in the fourth quarter,” Sondhi noted. “In our view, as long as unemployment is elevated, population growth slows, and CMHC measures remain in place, growth in home sales and prices is likely to be subdued after this initial burst.

On the other hand, homebuyers may be assured by the prospect of lower interest rates for potentially years to come, as was confirmed today by Bank of Canada Governor Tiff Macklem.

“The message to Canadians is that interest rates are very low and they’re going to be there for a long time,” Macklem said during a press conference following the Bank’s interest rate decision, in which it left the overnight lending rate at 0.25%. “We recognize that Canadians and Canadian businesses are facing an unusual amount of uncertainty, so we have been unusually clear about the future path for interest rates.”

Kamloops home sales bounce back in June, prices up sharply

Kamloops home sales bounce back in June, prices up sharply

The Kamloops real estate sector bucked the trend of slower sales last month, but prices were up markedly. In a news release, the Kamloops and District Real Estate Association (KADREA) says 291 residential units changed hands in the region last month. That’s up 8.2 per cent from June of 2019. The average sales price in the area was more than $456,000, a jump of almost 10 per cent from the same month last year. The COVID-19 pandemic has dealt a huge blow to real estate sales so far in 2020, but KADREA President Wendy Runge says agents have adapted their business practices and that has made a big difference.

“The sales in June signify that if we keep doing what we are doing, the impact of the pandemic on the real estate markets could be softened through the rest of the year,” said Runge in a news release. Runge cautions, because sales numbers were slow in April and May, the improvement in June could just be the release of some pent-up activity from earlier months. “I would call this a ‘muted recovery’ in the market,” said Runge. “But this also means that things are improving, and better days are ahead.”

It seems small town real estate is doing well, and two of the attractions are more space and less COVID-19.

Jennifer Handley is a real estate agent in Nanton, a town about an hour drive south of Calgary. She is also the town’s mayor. According to her, the Nanton housing market is hot right now.

“We haven’t been able to catch our breath that’s for sure, for about three of four weeks,” Handley said. Handley said when COVID-19 hit Alberta back in March, sales were halted, not unlike any other real estate market. But since the middle of May, she has sold about 15 houses — a pretty big number when you consider the size of the rural market in a global pandemic. A big chunk of the buyers are coming to the town, which has a population of 2,300, from Calgary. They’re telling Hanley they want out of the big city.

“We haven’t been able to catch our breath that’s for sure, for about three of four weeks,” Handley said. Handley said when COVID-19 hit Alberta back in March, sales were halted, not unlike any other real estate market. But since the middle of May, she has sold about 15 houses — a pretty big number when you consider the size of the rural market in a global pandemic. A big chunk of the buyers are coming to the town, which has a population of 2,300, from Calgary. They’re telling Hanley they want out of the big city.

“They felt, especially if they were living in a condo apartment and they wanted to sell their place there, come here and not be as close to people — and we’ve heard that story time and time again,” Handley said. While Calgary is still considered the hot spot for COVID-19 cases in Alberta, Handley said there have been no cases reported in Nanton. There were just 14 cases in the entire municipal district where the town is located, as of Sunday.

“I think there is that appeal that we are a little bit isolated from what’s going on in the city,” Handley said. Anne-Marie Lurie is with the Alberta Real Estate Association, which tracks data in rural areas. Lurie said she’s not surprised by Handley’s experience. “The trend has been the same in areas like Airdrie as well, where their numbers improved much more in June than what we saw in the city.” According to the Calgary Real Estate Board, Airdrie’s sales rose above last year’s levels this June, following declines from the previous three months. Inventories were also below last year’s levels as well.

Other small municipalities in the Calgary region also saw sales improve slightly (Cochrane) or remain stable (Okotoks), despite the economic conditions. Lurie said something to keep an eye on is a shift in consumer demand preferences . “If people aren’t having to come into the office as much what does that mean?” she said. “Do we see people considering living in different, more further out places? So I’m really curious to see if there are any fundamental shifts that will come with you know, essentially COVID-19.” For now, small town realtors like Handley are happy to ride the rural real estate wave for as long as it sticks around.