Coronavirus and your finances - Tips to help

Posted by Steve Harmer on Thursday, May 28th, 2020 at 10:37am.

If you have questions about the coronavirus and how the current situation might impact your finances, you’re not alone.

If you have questions about the coronavirus and how the current situation might impact your finances, you’re not alone.

We’ve all heard the words “unprecedented times” more than ever over the last month. While we deal with so much uncertainty around us, it’s important to recognize that there are still actions we can take to help protect ourselves.

With financial markets crashing and the loss of a number of jobs, Canadians are questioning their financial future. It is yet to be determined the real economic impact of the coronavirus as data is changing quickly with limited time to analyze. There are indications that joblessness will increase in the short term, which can be scary; however, the government and lenders are stepping up to aid households in the pandemic.

In just a matter of weeks, the impact of the COVID-19 pandemic on the finances of Canadians has been swift and unprecedented. Over a million individuals have already filed for Employment Insurance (EI) benefits, and the government is expecting up to four million applicants for its new Canada Emergency Response Benefit (CERB). If you are one of the millions affected by COVID-19, it may not all be doom and gloom. Although you cannot control this pandemic, you can control how you will financially weather this storm. Government and amenities providers are stepping up to aid the financial disruption that coronavirus has induced.

Here are some steps to consider taking that may help you feel more confident and stay on top of your credit while so much else is going on. The spread of COVID-19 and its repercussions could affect a number of areas in people’s financial lives. We’ve broken down our advice and resources into a few key areas to help Canadians better deal with this crisis.

As always with financial matters speak to a qualified financial advisor before making any life changing decisions.

1. Manage your cash flow

Pausing or minimizing certain bill payments if you can — and determining which expenses are essential — can help you manage your cash flow. For example, paying less rent for a month or two and making it up later in the year could help you shuffle around your finances now to help you make ends meet.

Contact Your Providers

If you are in a cash flow crisis due to COVID-19, make a list of all your amenity providers such as:

- Mortgage / Rent

- Power

- Water

- Cable

- Car Loan

- Student Loan

Contact each provider and ask what flexibility is available due to the coronavirus outbreak. Explain your circumstance and provide proof of your job loss or situation. Keeping in communication with your providers will enable you to keep your credit score intact for future lending.

Think of everything you’re paying for on a monthly basis. You may be able to temporarily stop making payments toward student loans, auto loans and insurance. Asking for a break from payments may help you find some breathing space. But it’s important to remember that although you won’t be making payments, interest may still apply during any breaks you arrange. And you’ll need to make arrangements to resume paying at some agreed point in the future.

Make a note of the different payment breaks you’ve agreed to with your lenders. And during each break, prepare to start paying again, because missing payments after any payment break ends can hurt your credit score.

You could even set up a direct debit to start the month after your payment break ends, to make certain you immediately get back on track with your payments.

If possible, make sure you’re making your minimum payments on accounts where you can’t get deferrals. While it’s normally a best practice to pay off your credit card bill in full each month, during times of stretched income, try to pay the minimum payment to help you avoid late fees or hits to your credit score.

2. Use credit wisely

If you know you’ll need to spend more than you currently have on necessary expenses, pay attention to the interest rate on your credit cards and take stock of your options.

Your interest rate might be found on letters or emails you received when you were approved. You should also be able to find that information by logging into your online account through the lender’s website or app, or by giving them a call.

The goal here should be to think about how you might be able to move more expensive debt with higher interest rates to more-affordable options that offer lower interest rates. Avoid emergency credit card use and astronomical interest payments by setting up a personal finance strategy now.

Paying a lower interest rate on debt with other credit cards or personal loans with lower rates could save you a significant amount of money over time. But remember, you always need to check whether your current lender allows you to transfer your balance to a different lender and whether any fees apply from the existing lender or the new one.

3. Know your options

Arm yourself with knowledge. Use both public and private resources and talk to your lender to determine the best option for your situation.

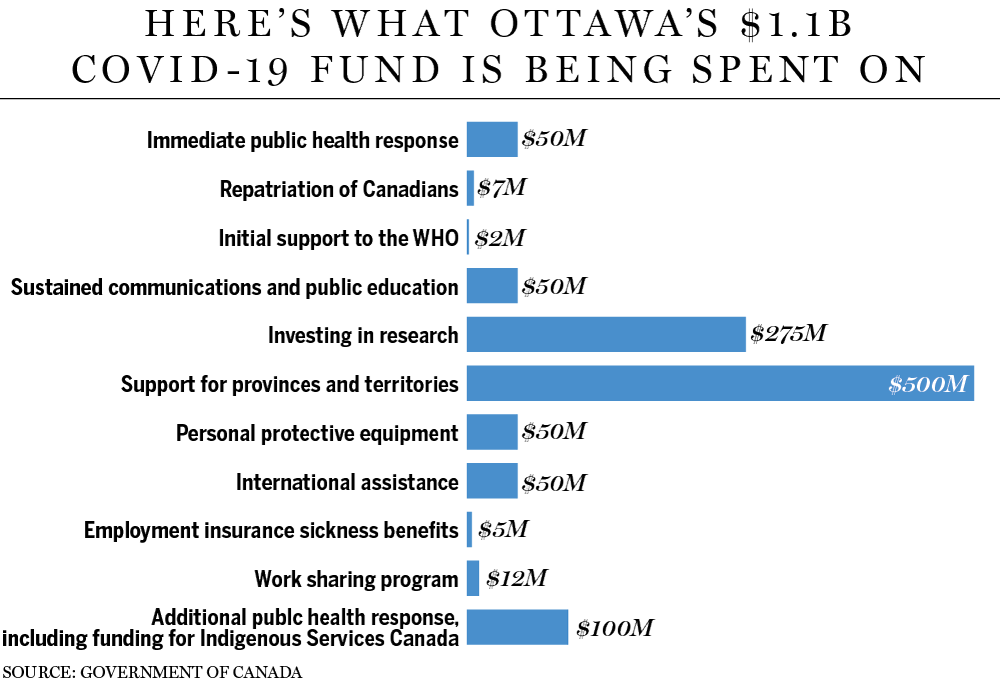

The government of Canada and provincial governments are taking action to help Canadians deal with the financial hardships of the ongoing pandemic, including income support, tax filing flexibility, expanded employment insurance and other programs. Additionally, Canada’s six largest banks and other financial institutions have announced that they’ll be offering Canadians financial support on various loans and credit products.

4. Help improve your credit score

When we come out on the other side of this outbreak — and we will — you’ll want your credit score to be in the best place it can be. Part of the battle is protecting your score through this difficult period, doing all you can to ensure you don’t miss payments or apply for too many new products in a short space of time.