We are open 24/7 and safe to browse.

In this time of great change don't forget that the Kamloops Property For Sale Website is open 24hrs a day for all of your real estate questions and answers.

It's a safe way to get the info you need now and be ready to sell or list your Kamloops Real Estate when the time is right. If you register today you can save searches and get the information you need delivered to your email.

So how does everything effect the real estate market?

The B.C. government’s 2020-2021 budget envisioned about $1.6 billion in revenue from the property transfer tax, and the real estate sector, which employs tens of thousands of people, is worth more than $22 billion annually to the province’s GDP, according to the industry

…

Still trying to figure out this RRSP thing? You’re not alone.

Still trying to figure out this RRSP thing? You’re not alone.

Find out how much the median single-family home in your municipality went up (or down) in value last year

Find out how much the median single-family home in your municipality went up (or down) in value last year

The cost of owning a house and starting a family just might be the lost opportunity to get a good head start on saving for retirement.

The cost of owning a house and starting a family just might be the lost opportunity to get a good head start on saving for retirement.

Canada Mortgage and Housing Corporation (CMHC) has defended mortgage stress test rules and warned federal policymakers to hold the line amid calls from industry associations to ease the rules.

Canada Mortgage and Housing Corporation (CMHC) has defended mortgage stress test rules and warned federal policymakers to hold the line amid calls from industry associations to ease the rules.

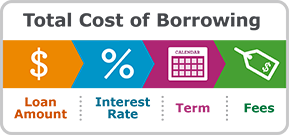

The cost of borrowing for a home is predicted to get a little cheaper this year.

The cost of borrowing for a home is predicted to get a little cheaper this year.

Vancouver, BC – March 12, 2019.

Vancouver, BC – March 12, 2019.

A special thank you to my past and present clients, friends and family for another great year.

A special thank you to my past and present clients, friends and family for another great year.

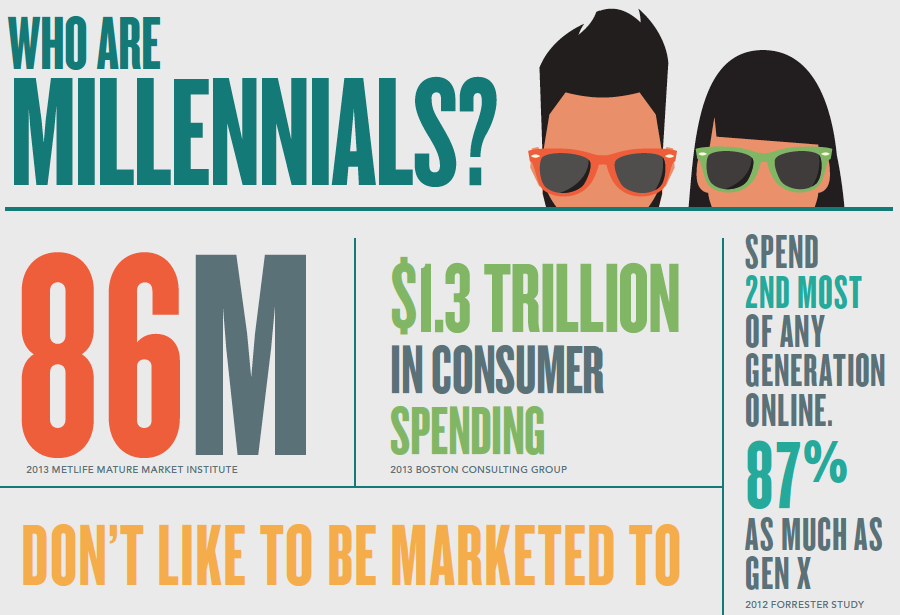

In a nationwide survey of over 9,000 prospective homebuyers carried out on its platform, Point2 Homes found that 66% of the Millennials interested in purchasing a home would like to do so within one year.

In a nationwide survey of over 9,000 prospective homebuyers carried out on its platform, Point2 Homes found that 66% of the Millennials interested in purchasing a home would like to do so within one year.

There are some parts of Canada where the prices of real estate have already shot up toward what is likely to be a peak for the time being.

There are some parts of Canada where the prices of real estate have already shot up toward what is likely to be a peak for the time being.