Creating good spending habits is a very valuable skill for anyone.

Creating good spending habits is a very valuable skill for anyone.

Did you have good habits before you left home? If not, what kind of difference would it have made in your life? In the current world economic environment it is more important than ever to get your kids to understand the true value of money. With interest rates for saving low it is critical that as your kids look to move out of the family home and into their new life they can manage their financial obligations and be able to afford the essential items for life. When still young it's a great time to start showing them the costs of things and getting them to manage money early in life. Here are a few powerful concepts that can make a huge difference in the way your teens manage their

…

One of the beauties of real estate investing is the numerous options to make money which the industry gives you.

One of the beauties of real estate investing is the numerous options to make money which the industry gives you.

If you’re embarking on a home improvement project to simply make your home more comfortable and enjoyable to live in, then when you’re looking at the cost it’s a matter of what you can afford, and what you’re prepared to pay for the benefits the improvements will bring.

If you’re embarking on a home improvement project to simply make your home more comfortable and enjoyable to live in, then when you’re looking at the cost it’s a matter of what you can afford, and what you’re prepared to pay for the benefits the improvements will bring.

In most property transactions the word appraisal comes up sometimes more than once.

In most property transactions the word appraisal comes up sometimes more than once.

Industry group Mortgage Professionals Canada (MPC) have raised some issues regarding the stress test, specifically its capacity to deter many Canadians from the home market. For this reason, the association is asking the government to reassess such policies.

Industry group Mortgage Professionals Canada (MPC) have raised some issues regarding the stress test, specifically its capacity to deter many Canadians from the home market. For this reason, the association is asking the government to reassess such policies.

Are you thinking about a separation from your spouse? How does that effect real estate?

Are you thinking about a separation from your spouse? How does that effect real estate?

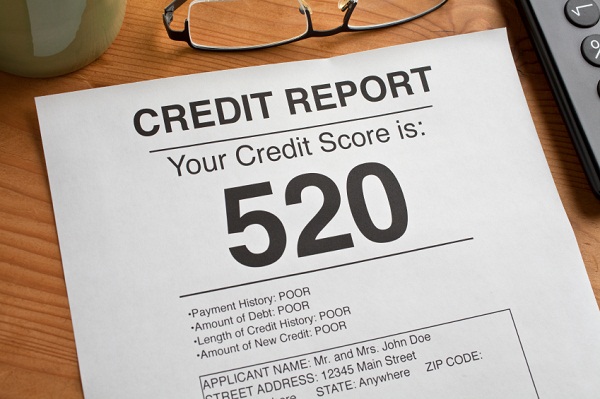

When most people think about the process of applying for a mortgage, they think about going to a bank or other lending institution depending on where they live. Private Mortgage loans are short in term, ranging from six months to three years. They are based on assets or a hard money real estate loan. What determines whether or not you get the loan depends on the value and equity of the property that serves as the collateral, rather than the credit of the party taking out the loan. Many professional real estate investors who want to purchase, renovate and “flip” a property, or liquidate the equity from property that produces income use Bad Credit Mortgage Lenders.

When most people think about the process of applying for a mortgage, they think about going to a bank or other lending institution depending on where they live. Private Mortgage loans are short in term, ranging from six months to three years. They are based on assets or a hard money real estate loan. What determines whether or not you get the loan depends on the value and equity of the property that serves as the collateral, rather than the credit of the party taking out the loan. Many professional real estate investors who want to purchase, renovate and “flip” a property, or liquidate the equity from property that produces income use Bad Credit Mortgage Lenders. Guest article written by Karen Weeks from www.elderwellness.net

Guest article written by Karen Weeks from www.elderwellness.net

We have collected information from both of the consumer reporting agencies (credit bureaus), as well as our own research to provide a full picture on credit files and credit scores, including those little known “insider” secrets.

We have collected information from both of the consumer reporting agencies (credit bureaus), as well as our own research to provide a full picture on credit files and credit scores, including those little known “insider” secrets.

Fear of rising interest rates is causing more Canadians to opt for fixed-rate mortgages over variable-rate alternatives that could save them thousands of dollars in payments, according to a leading expert.

Fear of rising interest rates is causing more Canadians to opt for fixed-rate mortgages over variable-rate alternatives that could save them thousands of dollars in payments, according to a leading expert.