Previously only those with less than 20% down were tested, but now all borrowers will be.

Previously only those with less than 20% down were tested, but now all borrowers will be.

Canada's top banking regulator has published the final version of its new mortgage rules, which include a requirement to "stress test" borrowers with uninsured loans to ensure they could withstand higher interest rates.

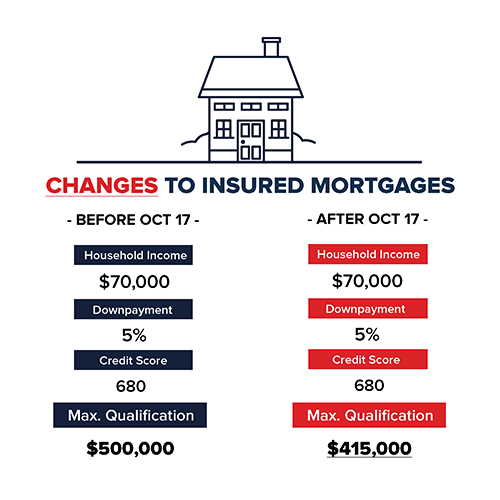

The Office of the Superintendent of Financial Institutions (OSFI) released new guidelines for the mortgage industry on Tuesday. The regulator floated a similar version of these rules earlier this summer in draft form, but Tuesday's release makes them official as of Jan. 1. Among the major new rules is a requirement to stress test uninsured borrowers. Previously, only insured borrowers had to undergo such a test.

By law, borrowers with a down

…

Whatever your reasons for re-financing, the condition of your property is always important if it needs an appraisal.

Whatever your reasons for re-financing, the condition of your property is always important if it needs an appraisal.

In our changing mortgage market where traditional lenders shy away from risk, some buyers may have to consider the alternative

In our changing mortgage market where traditional lenders shy away from risk, some buyers may have to consider the alternative

As the summer approaches, Canadians from coast to coast are getting ready to indulge in the ultimate homeowner’s pleasure: renovations. And what better way to finance that marble countertop than a home equity line of credit (HELOC)?

As the summer approaches, Canadians from coast to coast are getting ready to indulge in the ultimate homeowner’s pleasure: renovations. And what better way to finance that marble countertop than a home equity line of credit (HELOC)?

Canadians just aren’t interested in buying homes the way they used to be.

Canadians just aren’t interested in buying homes the way they used to be.

Canadian Airbnb hosts and the Canada Revenue Agency

Canadian Airbnb hosts and the Canada Revenue Agency

Canadian homeowners carried an average of $190,000 in mortgage debt in 2015

Canadian homeowners carried an average of $190,000 in mortgage debt in 2015

Have the recent government changes effected your home buying choices?

Have the recent government changes effected your home buying choices?

Here's what you should – and shouldn’t – buy

Here's what you should – and shouldn’t – buy

accounts to cover automatic payments, mortgages,

accounts to cover automatic payments, mortgages,