Don't fall for the staging: Real estate expert on how to avoid rookie buyer mistakes

Posted by Steve Harmer on Tuesday, March 20th, 2018 at 9:40am.

Being a first-time home buyer without guidance from qualified professionals is like using the internet to diagnose a serious illness -- it’s not going to end well. That’s the advice Toronto real estate agent and industry expert Karyn Filiatrault gives to millennials looking to enter the housing market.

Being a first-time home buyer without guidance from qualified professionals is like using the internet to diagnose a serious illness -- it’s not going to end well. That’s the advice Toronto real estate agent and industry expert Karyn Filiatrault gives to millennials looking to enter the housing market.

She joined CTV’s Your Morning on Tuesday to warn against some of the biggest mistakes she sees real estate rookies make, even when they are getting help from the pros.

Not getting pre-approved by an experienced mortgage broker

Online calculators can help buyers get a rough idea of how much housing debt they can handle, but Filiatrault recommends using a mortgage broker to find the rate and terms that are best for you.

She adds that younger buyers often make the mistake of getting too cozy with their first financial institution, the bank where they first opened an account as a child, and fail to shop around.

“I’m not dissing the banks, but don’t walk into the bank and talk to the first teller you see and get a pre-approval that way,” she said. “Get a pre-approval from a qualified mortgage broker.”

Going to a home viewing with ‘blinders’ on

Some sellers pull out all the stops when it comes to making their home look like it was torn from the pages of a magazine. Filiatrault said it’s important to filter out the “staging,” and look carefully at the property you are actually buying.

“Everybody falls in love with the staging, the furry throws, the beautiful little baby room,” she said. “It’s always pristine and perfect, and they walk away and say, ‘Oh, I love this so much.’”

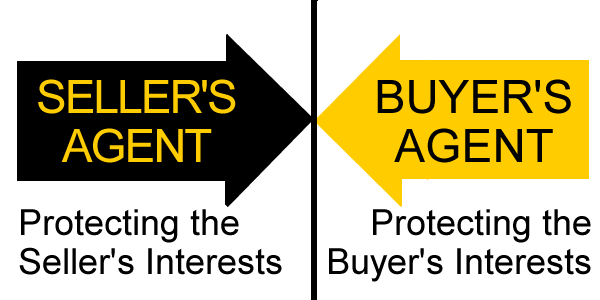

Using the seller’s realtor

A seller’s agent can double their commission by representing the buyer. They may make using them sound convenient, but buyers should know that the commission for the agent representing them comes out of the sale price at closing. It’s common for seller’s broker to share the commission with the buyer’s broker. The buyer is not out of pocket for an additional fee.

“Using your seller’s agent to help you buy a property is like using your ex spouse’s divorce attorney to help you litigate the divorce settlement,” Filiatrault said.

Not listening to your agent

Not listening to your agent

Schooling up on the ins-and-outs of how real estate deals work is perfectly fine, but don’t rely on your amateur online training when you have a pro in your corner.

“There is so much information online. Use it and talk to your agent. Trust them. If they say the home needs a home inspection, trust them. If they say this home is outside of your price point . . . they are not saying that just so you can spend more,” Filiatrault said.

Messing up your credit score before a deal closes

Perhaps unsurprisingly, it’s important to keep your credit situation as pristine as possible when a real estate deal is in the works. That means you shouldn’t apply for a new credit card, go on a plastic-fueled spending spree, or co-sign a loan for a friend. It sounds obvious, but Filiatrault said these missteps happen more than you’d think.

“I have a client. He literally bought a beautiful Mercedes right before closing,” she said. “I got the call from the mortgage broker. He was like, ‘What just happened?’ The deal didn’t fall through, miraculously. But it wasn’t a good choice.”

© https://www.ctvnews.ca/business/don-t-fall-for-the-staging-real-estate-expert-on-how-to-avoid-rookie-buyer-mistakes-1.3811231