In a nationwide survey of over 9,000 prospective homebuyers carried out on its platform, Point2 Homes found that 66% of the Millennials interested in purchasing a home would like to do so within one year.

In a nationwide survey of over 9,000 prospective homebuyers carried out on its platform, Point2 Homes found that 66% of the Millennials interested in purchasing a home would like to do so within one year.

However, almost half (49%) of the survey-takers aged between 25 and 38 years old have savings significantly under the national average down payment amount, which is $25,000. Moreover, some of the Millennials in the survey state that they haven’t managed to set aside anything at all, meaning that the desire to buy a home might be in conflict with Gen Y’s budgetary realities.

Most Millennials Set Aside Less Than 10% of their Monthly Income

35% of Millennials state that they set aside less than 10% of their income each month and 30% of respondents only save between 10% and 20%; a small minority (5%) are very thrifty and manage to survive on a small budget, saving over half their income.

It might be that sometimes, the sacrifices Millennials could make in order to save faster are considered too big. Skipping vacations for a year, getting a second job, and lowering general expenses is not that easy when opportunities for consumption and entertainment abound. But even if they are thinking about starter homes and condos, certain financial restrictions are still necessary if they want to meet their goal.

And when it comes to actual amounts, the majority of young people who wish to eventually own a home do not yet meet the minimum requirements.

Given that the down payment is the first hurdle on the road to home ownership, saving enough money is the natural first step. However, 40% of Millennials had saved less than $10,000 at the time they took the survey, which is not even half the national average down payment amount.

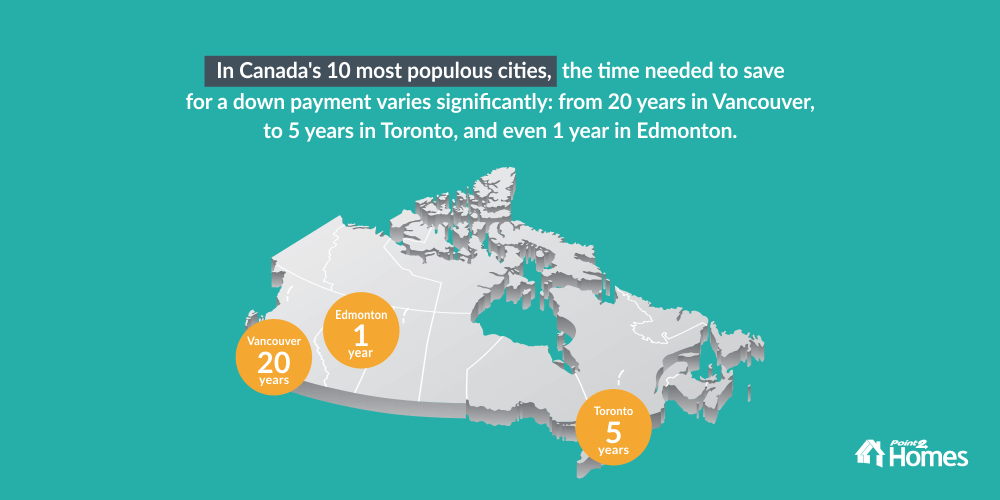

And if we zoom in to city level, it becomes apparent that home ownership can go all the way from being an achievable goal to looking like a dream deferred indefinitely.

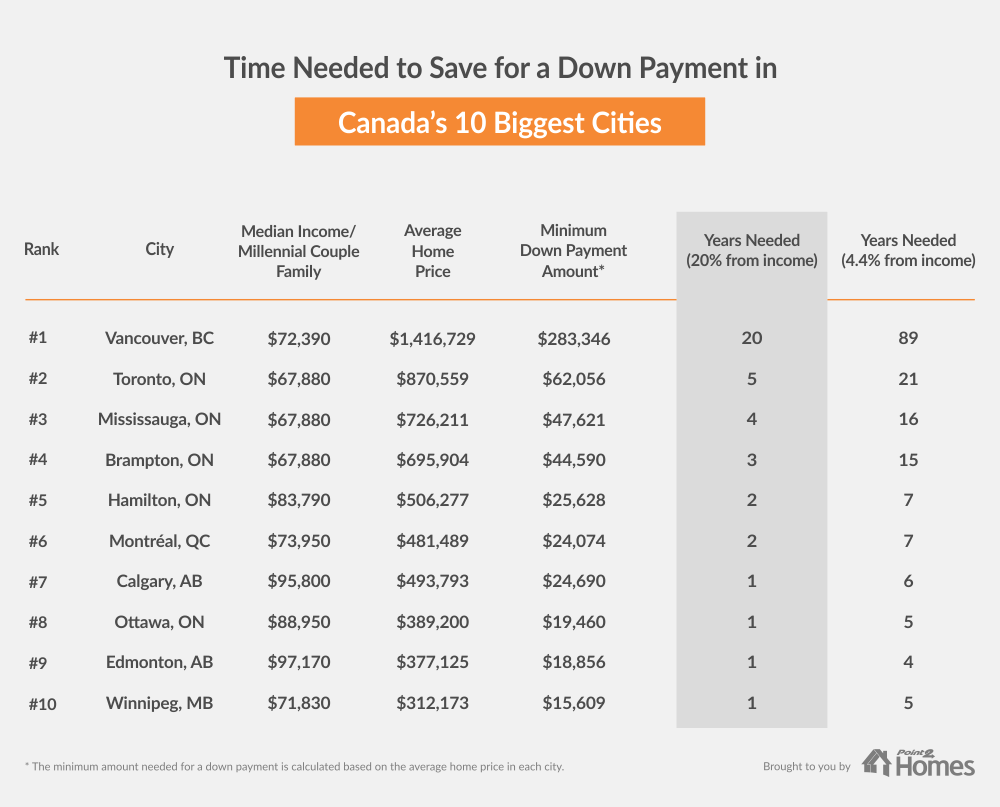

Saving for a Down Payment in Canada’s 10 Biggest Cities

- Millennials hoping to purchase property in Vancouver, Toronto, Mississauga, and Calgary tend to grossly underestimate the down payment amount they will need.

- Given the current median income of a Millennial couple and the local average home price, Vancouver is out of reach for young people.

- Toronto, Mississauga and Brampton are much more attainable for Millennials trying to save for a down payment, while Edmonton, Ottawa, and Winnipeg have the lowest saving time of all the big cities.

The contrast between how much money Millennials think they will need and the actual down payment amount is striking in several cities. In some of the most popular and most expensive business hubs in the nation, most Millennials are in for a big surprise.

Although the minimum down payment is close to $300,000 in Vancouver, 80% of the Millennial respondents believe they will need under $100,000. There is also a large gap between expectations and reality in Toronto: here, the average down payment is a little over $62,000, but 70% of Millennials estimate they will need under $50,000.

In other urban hubs, there are smaller discrepancies between how much money Millennials think they need, the amount they actually need, and how much they have in savings. However, even in cities like Calgary, Edmonton or Mississauga, a significant percentage of young home seekers are expecting significantly lower down payments.

This means one of two possibilities might be true: either Millennials are counting on their parents for help when they take the step towards home ownership, or their unrealistic expectations will set them up for a rude awakening when reality hits.

This means one of two possibilities might be true: either Millennials are counting on their parents for help when they take the step towards home ownership, or their unrealistic expectations will set them up for a rude awakening when reality hits.

To get an idea about how long it would take Millennials to gather the money needed to start the home buying process, the Point2 Homes analysts started from the premise that Gen Y-ers would set aside a fixed 20% of their income every month, per the well-known 50-30-20 financial rule. However, knowing that Canadians save, on average, only 4.4% of their income, we included estimates based on that percentage as well. The projections in Canada’s largest cities in each of the two scenarios are as follows:

The down payment requirements in the nation’s biggest cities vary considerably. This means buying property in some of these real estate markets is somewhat attainable, while other markets are highly unattainable for Millennials. Vancouver, the eighth-most populous city in the country, is the harshest on its aspiring home owners: young people who want to settle down here are looking at almost 20 years’ worth of savings, assuming they can set aside 20% of their income after paying the rent and covering other necessities in this expensive Pacific metropolis.

The other big urban centres don’t come even close to this overwhelming time span.

Toronto might also discourage a fair share of Millennials attempting to find their dream home in this city, but it is more than accessible by comparison: in Canada’s largest business centre, it would take four and a half years to save for a down payment. Mississauga and Brampton, ON, follow suit, with a more encouraging three-and-a-half years. Edmonton, AB (12 months), Winnipeg, MB (13 months) and Ottawa, ON (13 months), close this ranking with an even more positive outlook for prospective young homebuyers.

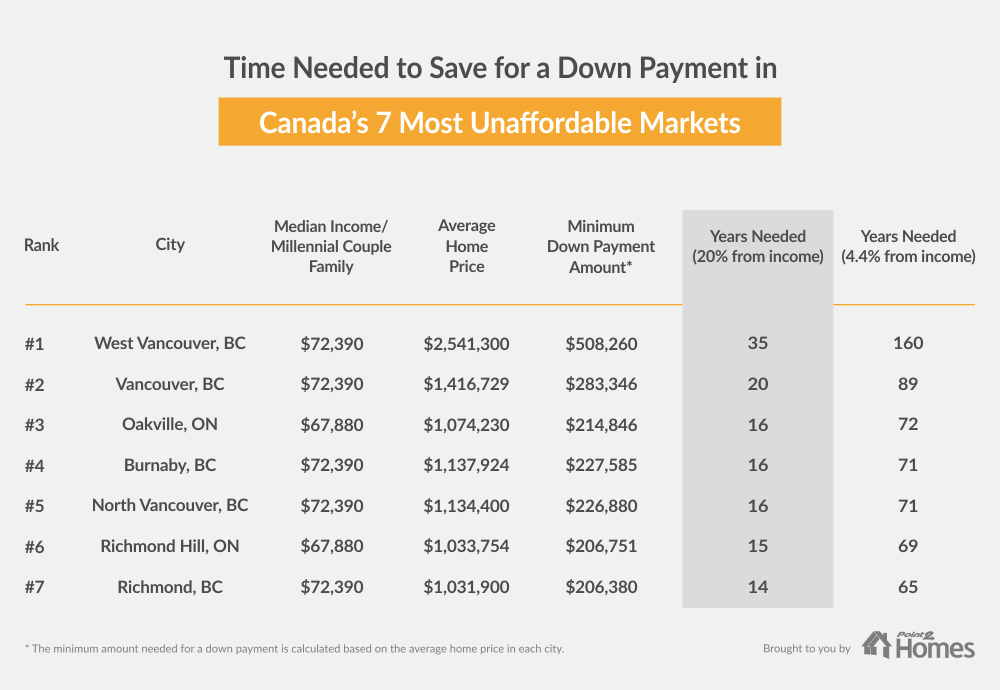

Seven Canadian Markets Are Completely Out of Reach for Millennials

- Millennials would need between 14 and 35 years to save for a down payment in these seven markets: West Vancouver, BC, Vancouver, BC, North Vancouver, BC, Burnaby, BC, Oakville, OK, Richmond Hill, ON, and Richmond, BC.

- West Vancouver boasts the most outrageous average home price of all the urban centres we analyzed, but these seven highly-unattainable real estate markets all crossed the $1 million mark.

- Oakville and Richmond Hill, ON have two of the lowest incomes per Millennial household in all of Canada.

Many Millennials would like to one day own a home in the city they love. But if that city happens to be Vancouver, they probably already know their homeownership dream is more like a fairy tale: enjoyable to think and talk about but ultimately unrealistic. Vancouver, however, is not the only urban hub that is totally out of reach for people in their mid-twenties to mid-thirties: according to our analysis, there are seven markets where it is virtually impossible for a Millennial couple to save for a down payment.

Taking into consideration the average home prices and the average household income of Millennials living and working in Canada’s most expensive urban centres, it would take young people in these places a depressingly long time to save for a down payment. And even this would only be possible if Millennials religiously set aside 20% of their income each month.

Moreover, given the recently introduced mortgage stress test, along with other measures aimed at cooling the Canadian real estate market, Millennials might not meet the credit standards and debt-to-income requirements necessary to qualify for a mortgage, even if they do have the money for the down payment.

Moreover, given the recently introduced mortgage stress test, along with other measures aimed at cooling the Canadian real estate market, Millennials might not meet the credit standards and debt-to-income requirements necessary to qualify for a mortgage, even if they do have the money for the down payment.

High home prices are the first part of the problem

West Vancouver, one of Canada’s wealthiest municipalities, boasts average home prices well over $2.5 million. This amount puts West Vancouver in a league of its own, since the down payment alone could actually buy you a home in 64 of Canada’s biggest urban centres.

The second most expensive market in Canada, Vancouver, saw its average home price settle at a little under $1.5 million in June. The other five real estate markets, three of them in BC (North Vancouver, Burnaby, and Richmond) and two in Ontario (Oakville and Richmond Hill) all have prices that hover around the $1 million mark.

But things could be worse. Considering that Canadians only manage to save, on average, 4.4% of their income per month, the numbers look simply comical (or tragic, depending on your perspective and sense of humour). Under these conditions, it would take people in Richmond, BC (the least expensive of the seven) 65 years to save for a down payment, and no less than 160 years if they chose to settle down in West Vancouver. These absurd numbers suggest that something has to give in the Greater Vancouver property markets.

Low incomes make the problem worse

Although a lower income is to be expected considering the age and professional experience of this demographic, people still want to become financially independent, move out of their parents’ house and buy their own when they’re in their 20s or early 30s.

This feat seems to be the most challenging in Oakville and Richmond Hill, ON, where the average income per household is $67,880. This means two of the seven urban centres with the highest home prices are also among the top three places where Millennials have the lowest salaries in all of Canada (Cornwall, ON, is at the bottom of the list, with an average income of $65,250 for people aged between 25 and 38 years old).

In fact, many of the cities surrounding the Ontario capital, Toronto included, have a similar median income ($67,880), but it’s the diverse home prices that make the difference: while both Oakville and Richmond Hill have crossed the $1 million threshold, meaning a Millennial would need over 15 years to save for a down payment, in Mississauga it is possible to save for your entire down payment in three and a half years, provided of course 20% of your income is set aside.

40 Cities Give Real Cause for Hope

- Timmins, ON, is the most Millennial-friendly city of all the urban centres included in our analysis when it comes to homeownership opportunities. Here, a Millennial couple could afford their down payment in just five months.

- Trois-Rivières, QC, and Cape Breton, NS, follow suit, with only six months needed to save for a down payment.

- Edmonton, AB, and Québec City, QC, are two of the most populous and most affordable cities for Millennials, with saving time frames of 12 and 10 months respectively.

Although Millennials definitely drew the short straw when it comes to homeownership, there is a silver lining. In 40 Canadian cities, it is possible for Millennials to save for a down payment in 12 months or less. And it looks like the news is slowly reaching young Canadians, since in one of our previous studies, Québec City took the number one spot as Canada’s most attractive city for Millennials.

With the third lowest unemployment rate in the country and above average yearly income, it is no wonder this city is such a Millennial magnet.

Aside from Québec City, Edmonton, and Halifax, which are the biggest cities among the 40 most Millennial-friendly real estate markets, Gatineau, QC, Saskatoon, SK, and Regina, SK, are also some of the largest Canadian cities that offer younger homebuyers the opportunity to settle down in a home of their own in less than a year.

The provinces that are best represented in this category are Québec, with 13 cities where it could take a Millennial under a year to save for their down payment, followed by Ontario with nine cities, and Alberta with seven. British Columbia markets are at the other end of the spectrum, which means only one of the cities included in our analysis appears among the 40 markets where home ownership is affordable for most Millenials: in Prince George it would take Millennials only 11 months to get started on their way to buying a home.

Expert Insights

To find out what an expert thinks about the current market conditions for the younger generations, we talked to Avis Devine, Associate Professor of Real Estate with the new Brookfield Centre for Real Estate and Infrastructure in the Schulich School of Business at York University. Read her interview below to discover some of the reasons she believes Millennials struggle with homeownership and her opinion on how younger generations will feel towards homeownership.

What do you think are the main reasons for the Millennials’ difficulties in attaining homeownership?

As your findings suggest, the greatest hurdle to homeownership – for Millennials as well as all generations – is affordability. In many urban cases, this is rooted in limited supply in desirable locations, leading to price increases.

How do you think future generations will perceive homeownership and how might their attitude affect the real estate market?

As has been well documented, the younger generations are delaying family creation, both in terms of choosing a partner or spouse and in terms of adding children to a household. Homeownership is often spurred on by family creation events. Therefore, we are seeing delayed interest in homeownership.

Additionally, many Millennials are valuing their time and experiences over amassing physical assets (contrary to prior generations). People that follow this approach may prefer to spend their time (and money) on, for example, traveling rather than on home maintenance. Additionally, for those valuing their time over possessions, decreased commute time is key, making urban (often more expensive) locations more desirable. All of this leads to a large number of households that prefer to rent rather than purchase.

Renting allows flexibility in location (which can be key in taking advantage of possible career opportunities – an important factor for the Millennial generation as they advance through their careers) and unit size & quality, which they can adjust to match their changing income and lifestyle. On the contrary, homeownership involves significant transaction costs, decreasing the flexibility of future housing decisions.

As more young people seek out the flexibility provided by renting, and as the rental stock increases in variety, quality, and location, it is likely that we will see more people elect to rent, particularly during the more flexible times in their lives