In a hot sellers market, you may feel pressure to make some concessions to win over a seller.

In a hot sellers market, you may feel pressure to make some concessions to win over a seller.

When you make an offer on a home, it's standard to throw in some subjects—telling the seller that if the home isn't up to snuff for a variety of reasons, you have the right to walk away from the deal—with all of your cash in hand.

That's all hunky-dory in a buyer's market but as the housing market has moved towards a sellers one buyers are getting competitive—more and more are waiving those subjects, or protections, in order to sweeten their offer and speed the deal through to closing.

You want the house, and the seller doesn't want any hiccups. So getting those pesky contingencies out of the way is a win-win, right?

Of course not!

It's riskier to

…

Did you know that two out of three Canadian families own a house? That is one of the highest rates of home ownership in the world. And for good reason . Real estate is a great investment.

Did you know that two out of three Canadian families own a house? That is one of the highest rates of home ownership in the world. And for good reason . Real estate is a great investment. What Are the Three New Mortgage Rules That Arrived In January 2018?

What Are the Three New Mortgage Rules That Arrived In January 2018?

Previously only those with less than 20% down were tested, but now all borrowers will be.

Previously only those with less than 20% down were tested, but now all borrowers will be.

Owning real estate is a privilege, and in doing so, you are committing not only to serving your own personal interest, but potentially that of your family for years to come. A success story is increasingly possible, and for many of us real estate is our single most important asset when it comes to retaining value. When managed well, the rights in land associated with the building on it, not only maintain their value while factoring in inflation, but increase in value. The key to retaining your home’s value while ensuring comfort is good maintenance and a few simple upgrades.

Owning real estate is a privilege, and in doing so, you are committing not only to serving your own personal interest, but potentially that of your family for years to come. A success story is increasingly possible, and for many of us real estate is our single most important asset when it comes to retaining value. When managed well, the rights in land associated with the building on it, not only maintain their value while factoring in inflation, but increase in value. The key to retaining your home’s value while ensuring comfort is good maintenance and a few simple upgrades.

In our changing mortgage market where traditional lenders shy away from risk, some buyers may have to consider the alternative

In our changing mortgage market where traditional lenders shy away from risk, some buyers may have to consider the alternative

Shopping for a home is exciting, exhausting and a little bit scary. In the end, your aim is to end up with a home you love at a price you can afford. Sounds simple enough, right? Unfortunately, many people make mistakes that prevent them from achieving this simple dream. Arm yourself with these tips to get the most out of your purchase and avoid making 10 of the most costly mistakes that could put a hold on that sold sign. (Don't know even where to get started when purchasing a home?

Shopping for a home is exciting, exhausting and a little bit scary. In the end, your aim is to end up with a home you love at a price you can afford. Sounds simple enough, right? Unfortunately, many people make mistakes that prevent them from achieving this simple dream. Arm yourself with these tips to get the most out of your purchase and avoid making 10 of the most costly mistakes that could put a hold on that sold sign. (Don't know even where to get started when purchasing a home?

Canadians just aren’t interested in buying homes the way they used to be.

Canadians just aren’t interested in buying homes the way they used to be.

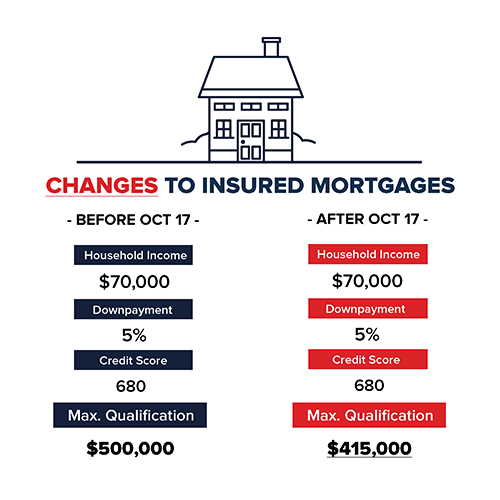

Have the recent government changes effected your home buying choices?

Have the recent government changes effected your home buying choices?