How to Take Equity out of Your House to Buy Another

Posted by Steve Harmer on Wednesday, February 20th, 2019 at 9:32am.

There are some parts of Canada where the prices of real estate have already shot up toward what is likely to be a peak for the time being.

There are some parts of Canada where the prices of real estate have already shot up toward what is likely to be a peak for the time being.

In some other areas, though, the markets are just heating up, and interest rates are still relatively low. This makes this a terrific time to start investing in real estate. However, if your liquidity is on the low side, where do you get the funds?

Why borrow against home equity?

What is home equity? It’s the difference between the market value of your home, as determined by an appraisal, and what you owe on the mortgage. If you bought a house for $750,000, and you’ve paid down the balance on the mortgage to $250,000, but the value of the home has gone up to $900,000 in the years since you bought it, you have $650,000 in equity on the house. You can take out a home equity loan, home equity line of credit (HELOC) or cash-out refinance in order to get the money out so that you can buy another house, provided you meet prime lender credit and affordability requirements. You can take out a mortgage, or you can sell some of your other investment assets, such as bonds or stocks, or you can raid your RSP, or you can take out equity to buy a second home.

Your home equity goes up in two ways:

- as you pay down your mortgage

- if the value of your home increases

You may be able to borrow money that will be secured by your home equity. Interest rates on loans secured with home equity can be much lower than other types of loans. You must be approved before you can borrow from your home equity.

Be aware that you could lose your home if you’re unable to repay a home equity loan.

Not all financial institutions offer home equity financing options. Ask your financial institution which financing options they offer.

ALWAYS SEEK PROFESSIONAL ADVICE WHEN MAKING LARGE FINANCIAL DECISIONS

If you want to take equity out of your house to buy another, there are some real benefits. You may get a better interest rate and lending term from the bank, because you have more at stake – two properties with collateral.

If you take out a second mortgage to buy that second home, you represent a higher risk than someone who refinanced their primary residence to make that purchase. If you run into financial difficulties, you’re more likely to let a second home go into foreclosure if that loan doesn’t jeopardize the place where you live. You can save on this loan, because you won’t have to pay fees for title searches or many of the other costs that go with taking out a new mortgage, because you’re accessing the equity in a home you already own instead of asking for financing to purchase a separate one.

If you take out a second mortgage to buy that second home, you represent a higher risk than someone who refinanced their primary residence to make that purchase. If you run into financial difficulties, you’re more likely to let a second home go into foreclosure if that loan doesn’t jeopardize the place where you live. You can save on this loan, because you won’t have to pay fees for title searches or many of the other costs that go with taking out a new mortgage, because you’re accessing the equity in a home you already own instead of asking for financing to purchase a separate one.

There are some drawbacks to this too, of course. You will now face a higher mortgage payment each month when you take equity out of your house to buy another property. If you plan to rent out the second property, that income can counteract the higher payment. However, if you run into financial trouble and can’t make the payments, your primary residence is the collateral – and it is what the bank will come after if you go into default.

If you are planning on investing in a second home to “flip” it – or make some improvements and then sell it at a profit, then you won’t have that larger mortgage payment for long, because you can take the profits and use it to pay down that larger mortgage or save some of the money and then reinvest the profits elsewhere. If you are planning for this second home to be a vacation home, you could consider renting it out on the weeks when you don’t plan to use it. That secondary income can help you with that larger mortgage that you have now as well. There are many property management companies that can help you administer a rental property either in your own city or in a place on the other side of Canada.

Planning to use it as a rental property with a full-time tenant? You’ll still have money rolling in once the lease gets signed, which should help you with those mortgage payments. Once again, though, you don’t want to take on a mortgage payment that you can’t handle – even if you have zero income coming from the rental property. Don’t let your primary residence end up be the one facing foreclosure because you gambled the place where you and your family live – and you lost.

Refinancing your home

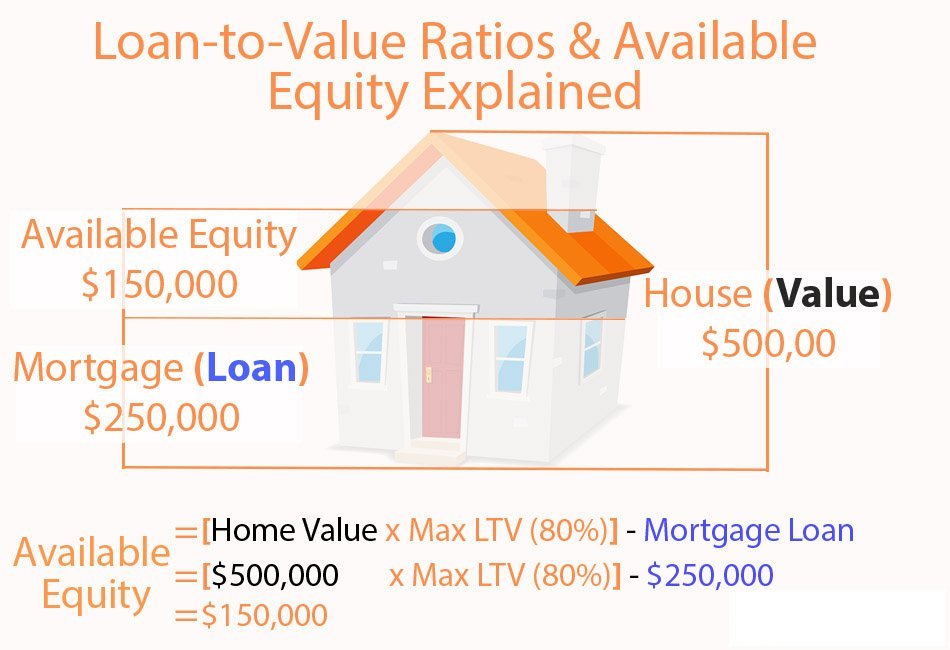

You can borrow up to 80% of the appraised value of your home, minus what you have left to pay on your mortgage, home equity line of credit or any other loans that are secured against your home.

You can borrow up to 80% of the appraised value of your home, minus what you have left to pay on your mortgage, home equity line of credit or any other loans that are secured against your home.

Your lender may agree to refinance your home with the following options:

- a second mortgage

- a home equity line of credit

- a loan or line of credit secured with your home

The money you borrow may be deposited in your bank account all at once.

Example: Refinancing your home

Suppose you want to refinance your home to pay for renovations. Your house is currently worth $500,000 on the real estate market. You still owe $250,000 on your mortgage.

If your lender agrees to refinance your home to the $150,000 limit, you'd owe a total of $400,000 on your mortgage.

| Appraised value of your home | $500,000 |

|---|---|

| Maximum loan you may get | x 80% |

| Loan amount based on appraised value of your home | = $400,000 |

| Less balance you owe on your mortgage | – $250,000 |

| Refinancing credit limit | $150,000 |

Interest rates and fees if you refinance your home

The interest rate on the refinanced part of your mortgage may be different from the interest rate on your original mortgage. You may also have to pay a new mortgage loan insurance premium if your existing mortgage amount is modified. You may have to pay administrative fees which include:

- appraisal fees

- title search

- title insurance

- legal fees

You may have to change the terms of your original mortgage agreement.

You may have to change the terms of your original mortgage agreement.

Borrowing on amounts you prepaid

You may be able to re-borrow money that you prepaid. If you've made lump-sum payments on your mortgage, your lender may allow you to re-borrow that money. You can borrow total amount of all the prepayments you made. Any money you re-borrow will be added to the total of your mortgage. The money you borrow may be deposited in your bank account all at once.

Example: Borrow on amounts you prepaid

Suppose you want to borrow money to pay for home renovations that will cost $15,000.

Assume the following:

- you’ve held your mortgage for three years

- you have $250,000 left to pay on your mortgage

- over the past 3 years, you’ve prepaid an extra $20,000 against your mortgage

If your financial institution allows you to borrow $15,000 from the amount you prepaid, you’ll owe $265,000 ($250,000 + $15,000) on your mortgage.

Interest rates and fees if you borrow on amounts you prepaid

You'll pay either a blended interest rate or the same interest rate as your mortgage on the amount you borrow. A blended interest rate combines your current interest and the rate currently available for a new term. Fees vary between lenders. Make sure to ask your lender what fees you’ll need to pay. You may not have to make any changes to your mortgage term.

Getting a home equity line of credit

A home equity line of credit (HELOC) works much like a regular line of credit. You can borrow money whenever you want, up to the credit limit. You can take out money from a home equity line of credit when you need to by using your regular banking methods. You pay it back and borrow again. This line of credit is secured by your home.

Getting a second mortgage

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage.

The loan is secured with your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage. If you can’t make your payments and your loan goes into default, you may lose your home. Your home will be sold to pay off both your first and second mortgage. Your first mortgage lender would be paid first.

Your lender may deposit all the money in your bank account all at once.

Example: Getting a second mortgage

Suppose you need money to pay for your child’s post-secondary education. Consider how much you may be able to borrow with a second mortgage.

Assume the following:

- your home is worth $250,000, according to an appraisal

- you owe $150,000 on your mortgage

| Appraised value of your home | $250,000 |

|---|---|

| Maximum loan allowed | x 80% |

| Loan amount based on appraised value | = $200,000 |

| Less balance you owe on your mortgage | – $150,000 |

| Second mortgage credit limit | $50,000 |

Interest rates and fees on second mortgages

Interest rates on second mortgages are usually higher than on first mortgages because they are riskier for lenders. You may have to pay administrative fees such as:

- an appraisal fees

- title search fees

- title insurance fees

- legal fees

Getting a reverse mortgage

Getting a reverse mortgage

A reverse mortgage allows you to borrow up to 55% of the current value of your home.

You must be a homeowner and at least 55 years old to qualify for a reverse mortgage. If you have a spouse, both of you must be at least 55 years old to qualify.

Qualifying interest rates for mortgages

To qualify for a refinanced mortgage loan or a second mortgage at a bank, you will need to pass a “stress test”. You will need to prove you can afford payments at a qualifying interest rate which is typically higher than the actual rate in your mortgage contract. Credit unions and other lenders that are not federally regulated may choose to use this mortgage stress test when you apply for a refinance or a second mortgage. They are not required to do so. The qualifying interest rate your bank will use for the stress test depends on whether or not you have mortgage loan insurance.

If you have mortgage loan insurance, the bank must use the higher interest rate of either:

- the Bank of Canada’s conventional five-year mortgage rate

- the interest rate you negotiate with your lender

If you don’t have mortgage loan insurance, the bank must use the higher interest rate of either:

- the Bank of Canada’s conventional five-year mortgage rate

- the interest rate you negotiate with your lender plus 2%