It's RRSP time. Here are some tips and tricks to think about.

Posted by Steve Harmer on Thursday, February 6th, 2020 at 3:22pm.

Still trying to figure out this RRSP thing? You’re not alone.

Still trying to figure out this RRSP thing? You’re not alone.

It's that time of year again - time to make the most of your RRSP contributions before the clock strikes twelve on March 2, 2020

The Registered Retirement Savings Plan, known simply as the RRSP to most, is a great tool for saving money. RRSP contributions are tax-deductible, which allows you to delay paying taxes on that income until you retire, when you’ll likely be in a lower tax bracket. If you don’t know a lot about RRSPs, it’s time to educate yourself. Unfortunately, our high cost of living and competing financial demands can make it challenging putting money aside. But hopefully that won’t deter you from figuring out how to make the most of what you have.

There are times when you may need to let retirement planning take a backseat to more urgent financial issues like dealing with debt, saving for a mortgage and planning for your family. But keep in mind that RRSPs aren’t just for retirement. The federal government allows you to make penalty-free withdrawals to buy your first home (with the Home Buyers’ Plan) or to finance your education (with the Lifelong Learning Plan), as long as you return the money to your account over a certain period of time.

Before you start, here's a quick checklist:

- To qualify as a 2019 deduction, contributions to your personal or spousal RRSP must be made on or before March 1, 2020.

- Determine your RRSP contribution limit for 2019 by referring to your previous year’s Notice of Assessment from the Canada Revenue Agency (CRA), or visit the CRA website at www.cra-arc.gc.ca.

- Determine how much, if any, you have already contributed to your RRSP for 2019.

- You can take advantage of any unused 2019 RRSP room up to your contribution limit. You will receive a 2019 tax deduction for this amount as long as the contribution is made by the RRSP deadline.

Some tips to get you up to speed.

1. To contribute or not to contribute

When deciding whether or not to contribute, consider the tax savings that will come from your RRSP contributions. Every dollar you contribute to an RRSP comes off your taxable income. So, for example, if you make $60,000 and contribute $5,000 of it to an RRSP, you’ll only be taxed on $55,000 – saving you $1,410 off your tax bill for 2019.

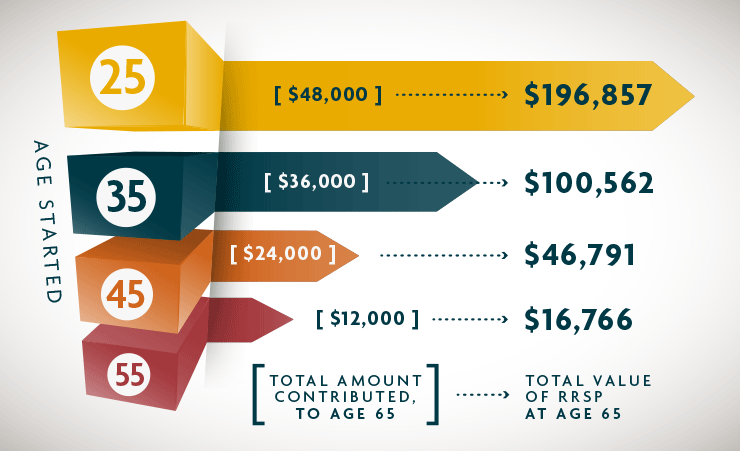

2. Start saving early

Saving money when you’re younger means you likely won’t need to save as much to reach your financial goals. If you start saving $100 a month when you’re 25, you’ll end up with almost $197,000 in 40 years (assuming a 6% annual rate of return), according to Sun Life Financial. But if you start saving later, you’ll need to save even more to have $197,000 by the time you turn 65.

3. Know how much you can contribute

In order to contribute to an RRSP, you need to have earned income (such as income from employment, a pension, or a rental property). Your limit is 18% of your earned income for the preceding year up to an annual maximum. You can find your limit on your latest notice of assessment or notice of reassessment, by logging into your Canada Revenue Agency (CRA) account online.

4. RRSP contribution = tax refund

Contributing to an RRSP will likely result in a tax refund. But that refund shouldn’t be used for a trip or a shopping spree. Instead, you should re-contribute that money into an RRSP or pay down debt. If you want to get a tax refund this year, you need to make an RRSP contribution by March 2, 2020.

Contributing to an RRSP will likely result in a tax refund. But that refund shouldn’t be used for a trip or a shopping spree. Instead, you should re-contribute that money into an RRSP or pay down debt. If you want to get a tax refund this year, you need to make an RRSP contribution by March 2, 2020.

5. Mortgage payments vs. saving for retirement

Should you focus on paying down your mortgage or contributing to an RRSP? Mathematically, you can calculate which alternative is better, given assumptions about mortgage rates and the rate of return in your RRSP. Most analysts conclude that it is better to pay off your mortgage first, assuming that the rate of return of the investment in your RRSP does not exceed your mortgage rate. There are many factors that you should also consider. Will you be able to catch up on your RRSP contributions once you’ve paid off your mortgage? Will you need the funds in your RRSP for emergencies? Do you want to diversify your investments rather than place all of your available cash in your home? Keep in mind that having the discipline to save money, either by paying down your mortgage or putting money in your RRSP, will mean that you will increase your net worth in the long run. Both paying off your mortgage and saving for retirement are important components of any good financial plan.

6. Think about a spousal RRSP

Marriage can function as a great tax shelter. The idea behind a spousal RRSP is to equalize family income, which can lead to big tax savings. As a couple, it’s a good idea to even out the amount in your RRSPs if there’s a big disparity. You don’t want one partner to have a much larger RRSP because they may get bumped up into a higher tax bracket when they start withdrawing, costing you more money in taxes.

But what about income splitting? Current income-splitting rules do allow money withdrawn from a RRIF (Registered Retirement Income Fund) to be split with a spouse if you are 65 or older. Using a spousal RRSP is still a prudent thing to do if you are married or have a common-law partner, you can contribute to a spousal RRSP for your partner and claim the tax deduction yourself. However, your total contributions to your own plan and your partner’s can’t exceed your allowable maximum contribution.

7. What size RRSP do I need to retire?

Determining how much you need to retire can be baffling. Where do you start? “Assess your financial situation and personal needs,” advises Chartered Accountant David Trahair, author of Enough Bull: How to Retire Well Without the Stock Market, Mutual Funds or Even an Investment Advisor. “The general rule is that you need 70 per cent of your pre-retirement income, but each situation is different. Figure out your expected retirement income and expenses. Do you own your own home, or will you have rental or mortgage payments? Do you have other outstanding debt or financial responsibilities, such as supporting an aging parent?

“Also consider your RRSP investments. Do you know what your annualized Personal Rate of Return (PRR) has been since you opened your RRSP? Many brokerage firms don’t provide this information on their monthly statements,” advises Trahair. “Get rid of any debt at a higher interest rate. For example, if your PRR has been two per cent a year on average since you started your RRSP and your mortgage is at six per cent, then simple analysis shows that paying off the mortgage leaves you further ahead.

“Remember that your RRSP is supplemented by the Canada Pension Plan (CPP) and Old Age Security (OAS). If your RRSP is projected to provide enough income during retirement, you may want to optimize its size so it doesn’t spit out too much income and cause a clawback of Old Age Security.

8. RRSP room carries forward

If you have $9,000 in RRSP contribution room but you only contribute $5,000, the remaining $4,000 in contribution room carries forward. So if you expect to have $6,000 in RRSP contribution room next year, you’ll be able to contribute up to $10,000 ($4,000 + $6,000) in the foloowing year. Your unused contribution room carries forward until you turn age 71.

If you have $9,000 in RRSP contribution room but you only contribute $5,000, the remaining $4,000 in contribution room carries forward. So if you expect to have $6,000 in RRSP contribution room next year, you’ll be able to contribute up to $10,000 ($4,000 + $6,000) in the foloowing year. Your unused contribution room carries forward until you turn age 71.

9. You can’t contribute to an RRSP forever

When you turn 71, you can no longer make contributions to an RRSP. You must convert your RRSP into a registered retirement income fund (RRIF) and begin making withdrawals or use the funds to buy an annuity. You can also do both. There’s also the option to withdraw everything from your RRSP but you’ll have to pay a withholding tax of up to 30%. When you’re close to retirement, it’s best to speak with a financial advisor to find out what the best option is for your situation.

10. RRSP vs. Tax Free Savings Account

It’s been three years since the Tax Free Savings Account was introduced to Canadians. Is it still a viable alternative to an RRSP? “It all depends on your income tax rate at the time when contributions are made, as compared to the rate during the withdrawal phase,” explains Chartered Accountant Ken Lancaster, Tax Partner with MacGillivray Hamilton. “If the two rates are identical, then the TFSA is a preferred option because it is more flexible and withdrawals do not affect income-tested benefits.

“Many individuals fall into the category where their income tax rates in the accumulation phase are higher. That’s because they are in their peak earning years and are paying high income tax rates. Presumably, when they retire, they will be paying much lower income taxes. Since their contribution income tax rate is much higher than the withdrawal income tax rate, an RRSP contribution is probably the preferred option for this category of individuals,” says Lancaster.

“For the few Canadians who pay a higher rate in their withdrawal years than in their contribution years, a TFSA is probably the better choice.”

11. Name a beneficiary

One of the advantages offered by RRSPs is your ability to name someone to receive your plan value after you’re gone. Naming a beneficiary may save your estate probate fees (i.e., the cost of the legal process to validate your last will and testament). And naming certain beneficiaries may even delay them or you paying tax on the plan, until withdrawals from it are made. Review your RRSP beneficiary regularly to make sure it matches your current wishes.

As always take professional advice from a financial expert before making big decisions.