Market news and stats

Kamloops Property For Sale gives you all the news and updates. See what selling in Kamloops and the surrounding communities.

Kamloops Property For Sale gives you all the news and updates. See what selling in Kamloops and the surrounding communities.

Keep up to date with the latest stats on Kamloops real estate. If your buying or selling a house in in Kamloops or its neighbourhood's keep your eye on the market and read all the updates from Kamloops Property for sale.

Found 364 blog entries about Market news and stats.

New CMHC rules make it easier for some homebuyers to include rental income in mortgage application

Change aimed at boosting affordability will likely affect suburbs most.

Changes to mortgage rules mean that some home buyers in Metro Vancouver's hot housing market may soon get a break when it comes to their loan application.

Changes to mortgage rules mean that some home buyers in Metro Vancouver's hot housing market may soon get a break when it comes to their loan application.

Currently, home buyers with a deposit of less than 20 per cent are required to have their mortgage loan application approved and insured by Canada Mortgage and Housing Corporation (CMHC).

Starting this fall, CMHC plans to change the rules for those buyers to allow them to include projected income from secondary suites when they apply for a loan.

"CMHC will consider up to 100 per cent of gross rental income from a two-unit owner-occupied property that is the subject of a loan application submitted for insurance," the new

…Liberal win: Good for first-time home buyers, investors

But prepare for an “uptick” in interest rates

The Canadian 2015 election. “It was a very clear verdict that Canadians were seeking real change,” said Pramod Udiaver, CEO of online advisor service, Invisor. “The Liberals campaigned and won with a focus on the middle-class,” says Udiaver, “with many of their promises attempting to make a meaningful difference for middle-income families.”

While most Canadians still struggle with paying too much in taxes, trying to maximize savings while making sound financial decisions, the new Liberal majority government will have real impact on the nation’s real estate market.

Continued interest by foreign investors

“From a fiscal point of view, the Liberal government will be moving Canada from a modestly

…Is it time to sell your rental property? Or time to buy another?

According to Statistics Canada, 69 per cent of Canadians own homes, so most of us have reason to worry about the fate of the housing market. Landlords, in particular, make a conscious choice to invest in real estate that goes beyond just a place for their families to live. As a result, landlords should be paying close attention to the conflicting views and data on Canadian real estate.

One in 20 Canadians own rental real estate according to the Financial Industry Research Monitor. An Altus Group study shows that for households earning more than $100,000 per year, rental real estate ownership is twice that of the general population – about 10 per cent.

So the question is: buy or sell?

Buy

Donald Trump may very well be the next

…Interested in Buying a Foreclosure? These Tips Will Help!

Many home buyers are attracted to foreclosed properties because they can offer great opportunity. But don’t get too excited yet, though foreclosed homes really offer great deals, they also come with challenges. Knowing what you will deal when you decide to buy a foreclosure can prepare you in the process.

Many home buyers are attracted to foreclosed properties because they can offer great opportunity. But don’t get too excited yet, though foreclosed homes really offer great deals, they also come with challenges. Knowing what you will deal when you decide to buy a foreclosure can prepare you in the process.

There are no disclosures

With a traditional sale, you’ll get disclosures from the sellers. With foreclosures, there’s none. It’s like not knowing what you’re getting into because you will not have any knowledge if the house will need some serious fixing. The bank will not give you the history of the home nor the problems you might encounter when you move in so you have to be prepared.

You can work with your agent on this. Search as much as

…Home Staging Tips: How to Have a Successful Yard Sale

Decluttering is the first step in staging a home for sale, but what to do with all those unwanted items? Tina Parker has a great solution and how to execute it.

We all know that when you’re selling up, decluttering is a key part of staging your home for sale. But after you have decluttered and come up with storage solutions, you will need to get rid of everything you have decided to part with. A good way to use this to your advantage is to have a yard sale.

In order to have a successful yard sale, you will need to apply the four Ps of marketing: product, price, place, and promotion. So you must know your products, set appropriate prices, find a place that will showcase your items, and promote your sale properly.

Product

Be organized and make

…Dinner in Kamloops: Turn off the highway to discover B.C.’s newest food and wine region

You probably think of Kamloops as a refuelling stop, a place to pause for a tank of gas and a Tim’s before hitting the Coquihalla Highway. But it’s so much more than that.

Seemingly overnight, Kamloops has become B.C.’s newest foodie destination, where a small but mighty contingent of chefs, farmers, winemakers and craft brewers are discovering the potential of this city in the Thompson River Valley.

Perhaps it was inevitable. Kamloops is quietly booming. The population has slowly but steadily been growing (it’s now around 100,000), and the city has attracted a number of diverse new businesses. And yet, it’ s still affordable enough for young families to buy a house and make a life there.

s still affordable enough for young families to buy a house and make a life there.

As Monica Dickinson, the acting CEO of Tourism Kamloops,

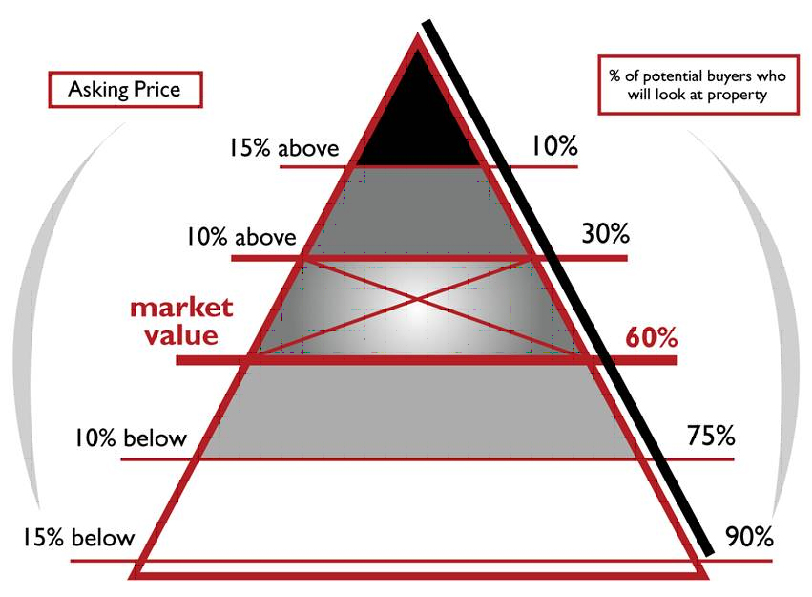

…Info for Sellers: How to sell your home (Pricing)

What is the correct price for your home...

Billy Buyer is looking for a new home. He has been pre-approved for a $360K purchase. He has already expressed his desire to not even look at anything above his affordability level, so we’ve added just a bit of room to the price to allow for negotiating and will only be viewing those homes at or below a $375K limit.

Unfortunately, your house is priced at $410K, which is way above his $375K cap, and which is also about $50K above the market value. Only you and your agent know why you priced it so high, but I do know your home would be PERFECT for Billy, and I also know it’s definitely overpriced. Billy won’t see it, and therefore won’t buy it.

Not pricing a home properly for sale can be the biggest

…October Kamloops Real Estate Sales

Kamloops and District Real Estate statistics for October 2015

In the month of October the Kamloops real estate market slowed down from September As can be seen from the latest news from Kamloops and District Real Estate Association (KADREA) there was a drop in sales in the Kamloops property market, not untypical for this time of year. As can be seen by the following chart there was an overall drop of around 20% of sales over September.

Kamloops And District Real Estate Association

Kamloops Residential Sales by Sub-Area - Monthly - October 2015

Generated on: November 1, 2015

Brocklehurst keeps the highest number of sales as it did in September 2015 even after a 36& decrease. The difference between September 2015 and last months sales

…Vancouver rents rose 4.6% last year, fastest in Canada: CMHC

The city, along with Kelowna and Victoria, has among the lowest rental vacancy rates in Canada

Rent on an average two-bedroom apartment in Vancouver rose almost twice as fast as average for Canadian cities, according to the Canadian Mortgage and Housing Corporation.

The CMHC tracked vacancy rates and the rent being charged on two types of apartments — purpose-built rentals, and condominiums put up for rent — between Oct. 2014 and 2015 for its annual Rental Market Survey.

Purpose-built rentals in Vancouver went up 4.6 per cent — the largest rent increase in all of Canada — so an average two-bedroom would cost $1360 a month, compared to $960 in an average Canadian city.

That steep rise was followed closely by:

- Barrie, Ont. — 4.3 per cent