Before embarking on an expensive move, consider renovating instead?

Move to a larger, more suitable home in your neighbourhood or stay put and renovate what you have? Finish the basement or build an addition? And most importantly, what would each scenario cost?

Move to a larger, more suitable home in your neighbourhood or stay put and renovate what you have? Finish the basement or build an addition? And most importantly, what would each scenario cost?

There are many Canadian's faced with the choice between moving or improving to increase usable square footage. Back in 2012, Canada Post released numbers indicating that of the 850,000 people who changed addresses, 37% moved to upgrade their home for family reasons. More recently, Altus Group measured the boom in Canadian residential home renovation spending, valuing it at $68 billion in 2014, roughly $20 billion more than what was spent on new builds.

Families grow, possessions multiply,

…

Renting property can be a lucrative way to make money but make sure you know the rules..

Renting property can be a lucrative way to make money but make sure you know the rules..

TORONTO – Homebuyers in Canada now face larger down payment requirements for properties over $500,000. The changes are intended to temper some of Canada’s heated real estate markets. Here are five things to know about the new rules:

TORONTO – Homebuyers in Canada now face larger down payment requirements for properties over $500,000. The changes are intended to temper some of Canada’s heated real estate markets. Here are five things to know about the new rules:

Price, square footage, location: "All that can be trumped by the visceral reaction of seeing a home," says June Cotte, who teaches marketing at Western University's Ivey Business School.

Price, square footage, location: "All that can be trumped by the visceral reaction of seeing a home," says June Cotte, who teaches marketing at Western University's Ivey Business School.

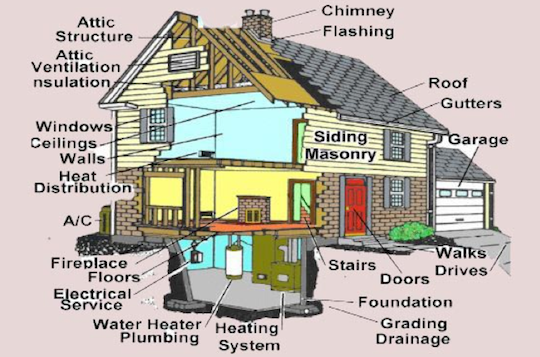

Whole industries and sub-industries have formed to help ease the understandable anxiety we endure before we sign on the dotted line to close a deal: real estate brokerages, real estate lawyers, mortgage brokers, property inspectors. That’s a lot of people doing a lot of things for us, and it’s not always clear what we should expect from each.

Whole industries and sub-industries have formed to help ease the understandable anxiety we endure before we sign on the dotted line to close a deal: real estate brokerages, real estate lawyers, mortgage brokers, property inspectors. That’s a lot of people doing a lot of things for us, and it’s not always clear what we should expect from each.

A mortgage is a word that has been in the English language since the late 1300s and comes from the French “mort,” which means “dead,” and “gage,” meaning “pledge.” Therefore, a mortgage, in the real sense of the meaning of the word, means that the security pledged to the mortgagee for the debt will be taken from him if he fails to pay the debt, and will, therefore, be “dead to him upon condition.” on the other hand, the mortgagee fulfills the obligation to pay the debt, the pledge is dead. Either way, something dies.

A mortgage is a word that has been in the English language since the late 1300s and comes from the French “mort,” which means “dead,” and “gage,” meaning “pledge.” Therefore, a mortgage, in the real sense of the meaning of the word, means that the security pledged to the mortgagee for the debt will be taken from him if he fails to pay the debt, and will, therefore, be “dead to him upon condition.” on the other hand, the mortgagee fulfills the obligation to pay the debt, the pledge is dead. Either way, something dies.

There can be profit in dealing with undervalued foreclosure property but there are pitfalls that must be taken into consideration. If your an investor and have the ability to make repairs/updates if needed on a foreclosure then maybe this is something that you should look at.Often houses that end up in foreclosure have a lot of "baggage" with them. Sometimes it can be a house that's not finished and will need more work, permits etc. to finish and some houses are left in a condition that make them unlivable.

There can be profit in dealing with undervalued foreclosure property but there are pitfalls that must be taken into consideration. If your an investor and have the ability to make repairs/updates if needed on a foreclosure then maybe this is something that you should look at.Often houses that end up in foreclosure have a lot of "baggage" with them. Sometimes it can be a house that's not finished and will need more work, permits etc. to finish and some houses are left in a condition that make them unlivable.

Buying or selling a home is probably one of the largest investments you will ever make. That is why it is important to choose the correct REALTOR® that will work to your benefit, to guard your equity and your future.

Buying or selling a home is probably one of the largest investments you will ever make. That is why it is important to choose the correct REALTOR® that will work to your benefit, to guard your equity and your future.

Financial advisers say that while making any contribution to an RRSP or a tax-free savings account (TSFA) is always a good thing, clearing up consumer debt should be the first priority.

Financial advisers say that while making any contribution to an RRSP or a tax-free savings account (TSFA) is always a good thing, clearing up consumer debt should be the first priority.

Some real estate agents won’t even work with you until you’ve been pre-approved for a mortgage. This is an important first step in the home-buying process. You don’t want to start house-hunting and fall for a home you can’t afford.

Some real estate agents won’t even work with you until you’ve been pre-approved for a mortgage. This is an important first step in the home-buying process. You don’t want to start house-hunting and fall for a home you can’t afford.