What Credit Score do I need When Buying a House?

Posted by Steve Harmer on Monday, July 4th, 2016 at 6:43pm.

General Credit Overview When Purchasing a House in Kamloops

General Credit Overview When Purchasing a House in Kamloops

If you are trying to buy a new home, you have probably heard that your credit score or home buying credit affects this process. However, you may be wondering exactly how it affects your ability to buy a home. Generally, you will need a credit score of 660 to obtain a mortgage. The qualifying credit score used to be as low as 580 points. However, since the mortgage crisis of 2008, banks are becoming more conservative in their lending practices.

Did you know that your credit score affects your interest rate? The lower your credit score, the higher your interest rate will be. This means that if you have a bad credit score, you will end up paying more than somebody with a good credit score. Additionally, you may need to put down a larger down payment than usual. So essentially, having bad credit doesn’t mean that you will not be able to obtain a home loan. What it does mean is that you will have a greater threshold for home buying qualification, which could include a higher interest rate and larger down payment.

Stop right there. Do not throw up your hands in frustration and think that you may not be able to obtain a home mortgage. If you have bad credit, you can still obtain a home mortgage loan. The first step is to get a copy of your credit report, dispute any items on your credit reports, and then work on restoring your credit. This will put you on the road to credit worthiness.

So what's in a credit report?

You may be surprised by the amount of personal financial data in your credit report. It contains information about every loan you've taken out in the last six years — whether you regularly pay on time, how much you owe, what your credit limit is on each account and a list of authorized credit grantors who have accessed your file.

You may be surprised by the amount of personal financial data in your credit report. It contains information about every loan you've taken out in the last six years — whether you regularly pay on time, how much you owe, what your credit limit is on each account and a list of authorized credit grantors who have accessed your file.

Each of the accounts includes a notation that includes a letter and a number. The letter "R" refers to a revolving debt, while the letter "I" stands for an instalment account. The numbers go from 0 (too new to rate) to 9 (bad debt or placed for collection or bankruptcy.) For a revolving account, an R1 rating is the notation to have. That means you pay your bills within 30 days, or "as agreed."

Any company that's thinking of granting you credit or providing you with a service that involves you receiving something before you pay for it (like phone service or a rental apartment) can get a copy of your credit report. Needless to say, they want to see lots of "Paid as agreed" notations in your file. And your credit report has a long history. Credit information (good and bad) remains on file for at least six years.

How to Obtain a Copy of Your Credit Report

You can ask for a free copy of your credit file by mail. There are two national credit bureaus in Canada: Equifax Canada and TransUnion Canada. You should check with both bureaus.

Complete details on how to order credit reports are available online. Basically, you have to send in photocopies of two pieces of identification, along with some basic background information. The reports will come back in two to three weeks. If you can't wait for a free report by mail, you can always get an instant credit report online. TransUnion charges $14.95. Equifax's rate is $15.50.

To get your all-important credit score, you'll have to spend a bit more. Both Equifax and TransUnion offer consumers real-time online access to their credit score (your credit report is also included). Equifax charges $23.95, while TransUnion's fee is $22.90. There is no free service to access your credit score.

You can always try asking the lender you're trying to do business with, but they're not supposed to give credit score information to you.

You can always try asking the lender you're trying to do business with, but they're not supposed to give credit score information to you.

Review Your Credit Report Closely

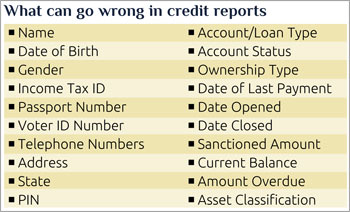

Make sure that you examine your credit report closely to check for any possible discrepancies. If you have not been keeping good fiscal records thus far, you could still check for discrepancies. For example, check all of the addresses on your credit report to make sure that they have that they match your current and previous known addresses. If you do notice any discrepancies in financial amounts on your credit report, highlight them so that you can to dispute them.

What if I find an error in my credit report?

Well, you won't be the first. In millions of files and hundreds of millions of reported entries, there are bound to be mistakes. Some are minor data-entry errors. Others are damaging whoppers. For example, we've heard of instances where negative credit files from one person got posted to the file of someone who had a similar name (the "close enough" school of credit reporting).

Some credit bureau watchers estimate that there are errors in 10 to 33 per cent of credit files. Some of those mistakes can be serious enough to hurt your credit status. That hit to your credit score can result in a denied loan or a higher interest rate. Across Canada, provincial consumer agencies collectively get hundreds of complaints annually about credit bureaus.

If you find something in your file that you dispute, you can write the credit agency in question and tell them you think there's an error. The credit reporting agency usually sends along the form you need when it sends you the credit report. Use it to spell out the details of any information you dispute. The dispute forms are online, too. Be sure to send along any documents that support your version of the matter in dispute. The reporting agency then contacts whoever submitted the information you're disputing. If the file is changed, you will be sent a copy of your new report and any company that's requested your credit file in the previous two months will also be sent the corrected file. If the item is not changed to your satisfaction, you have the right to add a brief statement to your credit file with your side of the story. You can also ask to have your credit file, along with your comment on the disputed entry, sent to any company that has requested your credit report in the previous two months.

If you find something in your file that you dispute, you can write the credit agency in question and tell them you think there's an error. The credit reporting agency usually sends along the form you need when it sends you the credit report. Use it to spell out the details of any information you dispute. The dispute forms are online, too. Be sure to send along any documents that support your version of the matter in dispute. The reporting agency then contacts whoever submitted the information you're disputing. If the file is changed, you will be sent a copy of your new report and any company that's requested your credit file in the previous two months will also be sent the corrected file. If the item is not changed to your satisfaction, you have the right to add a brief statement to your credit file with your side of the story. You can also ask to have your credit file, along with your comment on the disputed entry, sent to any company that has requested your credit report in the previous two months.

You can also file a complaint with your provincial consumer agency.

How to Restore Bad Credit

How to Restore Bad Credit

Since your credit report will be considered during the home buying process, it is in your best interest to start restoring your bad credit. This is true especially if you look at the credit score benchmark of 660 that you will need to obtain a mortgage. If your current credit score falls off of this benchmark, you can use the following tips to repair your credit score.

The Dispute Process

- Contact the credit reporting company in writing. Let them know in detail what information you feel is a discrepancy on your report.

- Ask that the discrepancy be corrected or removed from your credit report.

Tip: Make sure that you send your dispute letter by certified mail so that you can receive a return receipt once the credit reporting company has received the letter. - Once the credit reporting company receives the dispute letter, they must investigate any of the discrepancies within 30 days.

- The information provider as well needs to investigate the dispute. It will then report any pertinent information to the credit reporting company.

- When the information provider finds that the discrepancy is valid, they are obligated to contact the major three credit reporting companies so that they could make adjustments on your credit reports as well.

- Once the investigations are complete, you will receive the results of it in writing from the credit reporting company.

Let’s say that you have discovered and have resolved discrepancies on your credit report. Your credit report will be adjusted in your favor. Resolving discrepancies are one big step towards restoring your good credit. Additionally, you may do the following to restore your credit:

Watch Your Debt-to-Credit Ratio

Try to make sure that your debt-to-credit ratio is 30% or lower. The lower it is, the better it reflects on your credit report. Your credit score is driven by how much revolving credit you have versus how much you are using. Your monthly balances are a factor in your credit score. To help improve your credit score, try to pay down your balances starting with the smallest ones first.

Try to make sure that your debt-to-credit ratio is 30% or lower. The lower it is, the better it reflects on your credit report. Your credit score is driven by how much revolving credit you have versus how much you are using. Your monthly balances are a factor in your credit score. To help improve your credit score, try to pay down your balances starting with the smallest ones first.

CLICK HERE TO TRY OUR FREE ONLINE HOME VALUATION TOOL

CLICK HERE TO TRY OUR FREE ONLINE HOME VALUATION TOOL

Get Rid of Arbitrary Balances

Arbitrary balances are tiny balances that you have spread over several different credit cards. These balances though tiny make a difference to your credit score. Your credit score considers how many balances you have distributed among your various credit cards. Therefore, try to consolidate your spending. For example instead of using two separate cards to charge $20 on each card, try using just one card and charge $40 on it. Where your credit report is concerned, variety (of credit cards,) is not the spice of life.

Keep Good Debt on Your Credit Report

So what is good debt you ask? Could debt ever be good? The answer is, of course. Good debt that shows you as a responsible payer on your credit cards. The longer the history of your good paying record, the better it reflects on your credit score.

Pay Your Bills On Time

Pay Your Bills On Time

In the grand scheme of trying to repair your credit score, do not lose sight of the basics. There is nothing that reflects positively on your credit score as paying your bills on time month after month. It doesn’t get more glamorous than that. On-time credit card payments are the bread and butter of your credit score. Keep it simple and continue to pay your bills as you are trying to repair your credit score.

Pay Collection Payments

If you have any delinquent accounts that have been sent to collections, try to pay them off. Even though it may not remove these delinquent accounts from your credit report, it may still improve your credit score since a late payment is considered better than an unpaid debt.

Check the Age of Negative Information on Your Credit Reports

If you have any negative information on your credit report, it should be removed after seven years. This is law. If you notice that your credit report has negative information on it that is indeed older than the seven-year limit, follow the steps that you did in the dispute process. That is, contact the credit reporting company and request that they remove this old negative information from your credit report.

Overview of Home Buying Qualifications

When you initiate the home buying process, the mortgage lender will check your application using different qualifications before you are approved for a loan. Here is a list of these home buying qualifications:

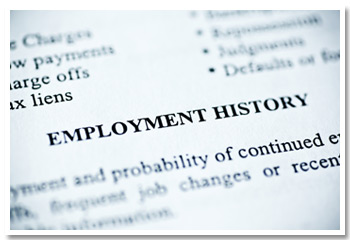

Your Job History

When you are trying to qualify for a mortgage loan, your job history will be an important factor. If you have been working for two years at the same employer, you are considered to have steady employment. If you have received promotions or made moves within your job for more pay, this is seen as positive by the mortgage lender. If you have not worked continuously for the past two years, you can explain the reason to the mortgage lender.

When you are trying to qualify for a mortgage loan, your job history will be an important factor. If you have been working for two years at the same employer, you are considered to have steady employment. If you have received promotions or made moves within your job for more pay, this is seen as positive by the mortgage lender. If you have not worked continuously for the past two years, you can explain the reason to the mortgage lender.

Bill Payment History

The mortgage lender will also consider your bill payment history when considering you for a mortgage loan. More in-depth and more personal than your credit score, this bill payment history will give the mortgage lender an idea of how you will be paying your mortgage payments. The mortgage lender may ask you to list all of your debts and liabilities as well as each monthly payment amount. Moreover, the mortgage lender may ask you to list how many years you have left to pay each of your debts. At this this stage in the qualification process, your mortgage lender may order a credit report as verification for the information that you have personally provided.

The Down Payments and Closing Costs

Another qualification during the home buying process is the amount that you will use to pay for your down payment and closing costs. Different homes at different prices will require down payments. However, a good rule of thumb is that your down payment should be at least 5% of your prospective home’s purchase price. Depending on your location, your closing costs could be pricey.

Your mortgage lender will try to ensure that you have saved the money needed for the down payment and most of your closing costs. For example, if you have these funds stored in the bank, your mortgage lender will verify the amount with your bank. Additionally, the mortgage lender will verify how long these funds have been in your bank account. What the mortgage lender is trying to determine here is ensure that you are not borrowing the money needed for your down payment and closing costs.

Don't forget in B.C. there is a Property Transfer Tax which can add up if the house you are buying is expensive. SEE THE BC GOVERNMENT PAGE ON PTT

Mortgage Monthly Payments

The amount of your monthly payments will vary depending on how much money you will borrow, the repayment period, and the interest rate. If you have a shorter term, your monthly payments will be higher than if you had a longer term. This is why you will find that most home buyers try to repay their mortgage over a long term such as 30 years.

Your Ability to Make Mortgage Payments

Your Ability to Make Mortgage Payments

Besides calculating the term of your mortgage payments, the mortgage lender will use two formula to determine if you have the ability to make your mortgage payment.

- Your monthly housing costs should be no more than 20% of your monthly gross income the mortgage lender will consider other income streams such as payment for overtime work, a second job, retirement, Social Security benefits, disability, and VA payments.

- The mortgage lender will also consider your monthly housing costs with other extended debts such as student loans, car loans, or debt payments. These amounts should not equal more than 36% of your monthly gross income. Depending on your income, you may qualify for a financial assistance program. These financial assistance programs may help you get a bigger mortgage loan than you would normally qualify for under the mortgage lenders assessment.

How Your Credit Qualifications Will Come into Play When You are Purchasing a Home

If you’re trying to buy a new home and already meet the 660 credit score benchmark, you will still need to stay on your toes. You need to ensure that you maintain this credit score throughout the entire home buying process. If you have less than stellar credit, do not feel intimidated by this credit card benchmark or by the home buying processes’ emphasis on your credit report. Just so that you are prepared, here ways that your credit score will have an impact during the home buying process:

Mortgage Interest Rates

Your credit score will determine your mortgage interest rate. If you have good credit, you may find a lower interest rate. The converse is also true. With a challenge credit score, you will find higher interest rates if any mortgage loan is offered to you.

A Large Down Payment

A Large Down Payment

With a challenged credit score, you may need to put down a larger down payment when you are trying to buy a home. A large down payment will reduce the amount of your mortgage each month.

Loan Programs

Your credit score and credit history will affect the types of loan programs that are offered to you during the home buying process. For example, there are several different types of loan programs available. Some of them are backed by the government. Canada has a program aimed at first time buyers that makes the purchase exempt from property transfer tax. SEE HERE

Documents That You Will Need to Provide before Buying a Home

When you make an appointment with the mortgage lender, you will need to furnish personal documents. These documents will vary from lender. While your mortgage lender may contact you with the types of documents to bring, be prepared to furnish the following documents when you meet with your mortgage lender:

Social Security Numbers

Social Security Numbers

You will need to bring the Social Security cards for all of the borrowers on the mortgage loan.

Pay Stubs

You will need to verify the stated income on your application. Plan on bringing paystubs for the past six months

Your Home Address

Bring in a listing of all of your home addresses for the past two years.

Checking and Savings Bank Account Statements

You will need to bring in checking and savings account statements for the past three months.

The Address of Your Bank Branch

Furnish the address of your local bank branch. This is the one that you visit to make deposits and withdrawals and not the address of the bank’s headquarters.

Income Tax Returns

You will need to bring your federal income tax returns for the previous two years. If you are self-employed, you will need to bring in1099 tax returns and balance sheets.

Proof of Rental and Utility Payments

You need to show a good track record and payment history for your rent and utility payments. Plan to bring canceled checks. If you use a credit card, bring your credit card statement with the listings of the rent and utility bill payments on it.

Proof of Additional Income

If you are receiving payments from a rental property, child support, or Social Security, you will need to provide these records into the mortgage lender.

Divorce Settlement Papers

Divorce Settlement Papers

If this applies to you, and your divorce is finalized, bring in your divorce settlement papers to your meeting with the mortgage lender. If you are separated then bring in your separation agreement, Banks will not be too happy about lending you money on a house if your ex-spouse could come after you later for a share of your home.

Your mortgage lender will use the preceding documents to gauge your current debt payments with your income. These documents may seem routine and every day to you, but they are valuable tools for mortgage lenders, who used them to make an adequate assessment of how much home you could really afford.

While you don’t have to provide all of the required documents to the mortgage lender before receiving an estimate, it is in your best interest to furnish as many documents as needed so that the mortgage lender can make an educated decision on your behalf. During this stage, the mortgage lender will not charge any fees, except the one needed to obtain your credit report.

Next Steps

Now that you have a general home buying credit overview, you can make informed decisions about how to proceed in this process. The good news is that if you have bad credit, this does not have to spell the end of your home buying dreams. You could work to repair your credit using the preceding tips in this document. Once you obtain your credit report, it will list your credit score, which will truthfully reflect your home buying credit.

If you need to dispute any items on your credit report, you can do so to ensure that your credit score is accurately reflected on the report. As every credit score point matters, it is to your best advantage to dispute any discrepancies on your credit report. With your credit report in hand you should review your home buying qualifications and find out how much home you could really afford. The mortgage lender and your real estate agent will help you in this determination.

© http://ballennetwork.com/credit-score-need-buying-house/