Want to buy an acreage? Need more information?

Finding the right acreage for you will provide years of enjoyment. Make sure that pretty piece of land will support your vision. Read on or click below to jump to the subjects:

Finding the right acreage for you will provide years of enjoyment. Make sure that pretty piece of land will support your vision. Read on or click below to jump to the subjects:

- Financing for acreage

- Consider the services

- Maintenance and insurance

- Covenants and Zoning

- Tips

- Develop it yourself

More and more people are leaving the suburbs to live a country life, but buying an acreage is a little different than buying a house in the burbs. Buyers should investigate a number of things on the property, assuring them that the land they purchase is going to support the lifestyle they have envisioned.

On average an acreage will have anywhere from 1 to 20 acres and will be fairly close to a major town or city. People like to live on acreages to experience rural living and to have more room for garages, gardens, and animals. They may also want to get away from the noise and stress of the city and get some peace and quiet. As always use a REALTOR® that has experience of acreages and understands the special items that buying an acreage involves (wells, septic, zoning etc.) in your chosen area. There are lots of thing to consider when moving to the country.

On average an acreage will have anywhere from 1 to 20 acres and will be fairly close to a major town or city. People like to live on acreages to experience rural living and to have more room for garages, gardens, and animals. They may also want to get away from the noise and stress of the city and get some peace and quiet. As always use a REALTOR® that has experience of acreages and understands the special items that buying an acreage involves (wells, septic, zoning etc.) in your chosen area. There are lots of thing to consider when moving to the country.

CLICK HERE TO SEARCH KAMLOOPS ACREAGES

Financing for Acreages

Provided you are not planning to grow crops or raise animals for sale, financing a home in the country is similar to financing an urban home.

Whereas farm loans typically require 25% down payment or more, an acreage under $1 mil. can be bought with as little as 5% down payment under a residential CMHC-insured lending program provided the property meets the residential lending rules:

- The property must have a house in good condition (called 'remaining economic life')

- Lending and your down payment are based, not on the purchase price but, on "residential lending value" which means value of the house, garage and ~10 acres, as determined in a property appraisal, which is a requirement.

- The appraiser is instructed by the mortgage lender to value only the house, one garage and ~10 acres and to give ZERO value to outbuildings (shops, barns, corals, additional garages, or any other buildings like a second house or quonset), and the excess acreage.

- If the purchase price exceeds the residential lending value, you must pay the difference from your own pocket, in addition to your minimum down payment. If it is the same value or less, then only 5% down is possible.

- Example: purchase price agreed to between buyer and seller is $475K for 15 acres with house, garage, guest house, barn and riding arena. Appraiser's report suggests lending value on just 10 acres, house and garage at $460K. Buyer's minimum down payment, is 5% of $460K ($23K) plus $15K difference in purchase price to lending value, so $38K in total.

- Note, acreages in very remote locations may be harder to finance with a smaller down payment, because of effort it takes to sell.

- Acreages in excess of $1mil will need a down payment of at least 20%, more likely 25%.

Lender's don't want your problems to become their problems, so they insist on more paperwork before an approval. You may require:

- Water Potability Certificate no older than 60 days, confirming that the water quality is fit for human consumption. Normally, your* Realtor should take a sample to the regional health board on behalf of the seller for sampling. (*to prevent tampering with the water sample)

- Septic Certificate if the septic system is new only, confirming it complies with provincial or municipal requirements and certify that the soil and water pollution, septic system design and installation are acceptable. For existing septic, the risk is all on you, so get it inspected and check the old permits before you buy.

- Well Drillers Certificate is required for new wells, indicating acceptable flow rate and potability. For existing wells, the Appraiser will note in their appraisal report whether good water flow was maintained.

Consider the services

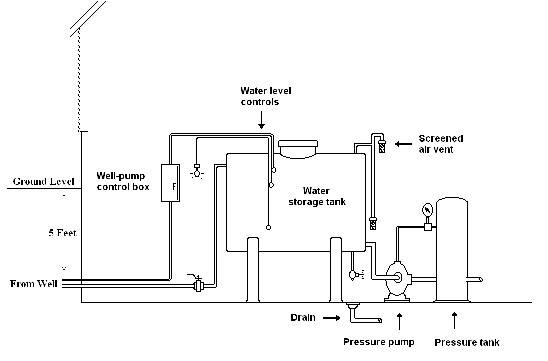

In order to live in house, you need to be able to drink the water and flush the toilet. That's a no-brainer in the city where all the homes are connected to a municipal water and sewer system. In the country, generally you need to take care of these yourself.

In order to live in house, you need to be able to drink the water and flush the toilet. That's a no-brainer in the city where all the homes are connected to a municipal water and sewer system. In the country, generally you need to take care of these yourself.

If you are buying an acreage with the intent of building a home, you will first need to consider services, including garbage collection, Internet connectivity, snow removal, and road maintenance, as well as access to your property. If you get a good buy on the land, you may end up paying more to run electricity, water, and other services to your home. You may be charged by the foot by the utility company to bring services from the nearest lines, which in some cases can be miles away.

It is important to assess the depth of existing wells, the quality of their water, and their condition. Septic systems being installed in bare ground will need to undergo a percolation test to determine the absorption rate of the soil for a drain field or leach field. Existing septic systems should be checked by local health agencies.

Do you have gas on the property? Are there old tanks for heating etc. that would need to be removed.

Maintenance and insurance

The cost of an acreage doesn't end with the purchase. It is important that a buyer plan for expenses on maintenance and improvements, as well as insurance. Fire protection, for example, is an important issue. Insurance rates could be affected depending on the abilities of the fire department that has jurisdiction in your area. Be sure to understand which insurers offer rural property insurance covering the house, outbuildings, ponds, and other features of the property.

Covenants and Zoning

Be aware of the possibility of a protective covenant that governs the use of the land. Under this agreement it is decided what types of animals and  structures are permissible and where they can be located, as well as who maintains the common areas, such as the shared driveways and fences.

structures are permissible and where they can be located, as well as who maintains the common areas, such as the shared driveways and fences.

Zoning may also determine the use of the land. In most cases, a pond can't be created by simply damming up a creek but there may be a covenant that forbids this. Similar to the protective covenant, there may be some mandate as to what types of animals you can have on the land and the location of your driveway. To fully understand the rules in your area, first contact your local zoning authority.

However, with all the great advantages of owning your own land and being away from the hustle and bustle of the city comes more responsibility. Here are 12 tips you need to know before buying an acreage.

1) Where will your drinking water come from?

You could be on a water co-op where a group of communities have set up a water treatment plant and members own shares. If this is the case you must make sure that the water shares are transferred to your name on possession day.

You could be on a water co-op where a group of communities have set up a water treatment plant and members own shares. If this is the case you must make sure that the water shares are transferred to your name on possession day.

You could have a well on the property and if this is the case you must have the water transfer rate tested to ensure you will have at least 5 gallons per minute (GFA) of water flowing for a 1 hour period. This will usually be sufficient for most families but if you need to irrigate the land for grass etc. you may need more. Also get the water tested to make sure it is safe to drink.

You could also have a cistern which is just a big tank that needs to be refilled regularly. Again you need to have an inspection done to see if the tank has any leaks and how often you will have to fill it. You also need to make sure the water is safe to drink as something in the tank could be contaminating the water.

2) Sewer

You will almost certainly have a septic tank and septic field. These need to be inspected prior to finalizing the deal because if there are any problems, it could cost you thousands of dollars. You also need to make sure the system has enough capacity for your family otherwise you will need to pay to have it drained more than once a year. The bank/lender may demand that you drain the tank and make sure the system is working properly.

3) Get a home inspection

This is also recommended for a house in the city, but it is especially important on an acreage. Again try to find someone who understand rural properties and ask your Realtor for advice.

4) Are there any Home Association Fees?

Some acreage communities will have HOA fees to cover maintenance of common areas such as ditches and snow removal.

5) Access to the property

How tough will it be to get to your property in the winter when there may be a lot of snow? Who takes care of snow removal and cutting the grass in common areas? Is there machinery on the property that will let you move snow or cut grass? If you plan on driving into the city for work every day, do a test run during rush hour and see if this is something you really want.

6) Garbage collection

Who does it and how much does it cost?

Who does it and how much does it cost?

7) What are the local bylaws?

Can you build that extra garage or shed? What if you want to have a horse or other animals? This is very important as the bylaws for one area may be different in another.

8) Are you encroaching on the neighbours property?

Find out if all of the existing buildings on the acreage conform to local building bylaws.

9) Are you on a flood plane?

Try and figure out if there might be drainage issues that could cause water to accumulate in the spring or during heavy rains.

10) Are there any oil wells, gas wells, utilities, or other environmental issues on or near the property?

Probably not going to be an issue in Kamloops BC but you may find in provinces like Alberta that this could be an issue for the future. Is there an old oil tank on the property that could cause you expense to move if the lender does not like it?

11) Schools

Find out where your kids will go to school and how will they get there? Is there a bus route close?

12) Take a look at the Title and Real Property report

Make sure you know where the boundaries of the property are so you know exactly how much useable land you are getting by walking on the whole property. Make sure you walk the property line.

Develop it yourself

This strategy will see you adding to the value of raw land by building on it and then selling. When considering this type of purchase, land investor Devenyi uses a rule of thumb: the further away from a major metropolis, the smaller the initial capital investment and the longer the timeline for growth. Of course, the opposite is true: the closer you buy property to a major urban centre, the more costly the land, the faster you can turn the property around for a profit. For Devenyi, closer properties require a five- to 10-year investment, while properties further away can take 20 years or more to achieve maximum value.

The key is finding property that’s undervalued because it’s underdeveloped. REALTORS® can be helpful: they know what’s formally and informally for sale, they can give you comparables for the area, and they can provide insight into potential obstacles, such as access issues. Be sure to inspect the property to determine if there is year-round access by road. This is vital if you plan on financing the purchase, as most lenders won’t touch property that has only seasonal access. “If the land or cottage doesn’t have year-round access we simply cannot finance the purchase, because the risk of not being able to resell can be quite high,” says mortgage specialist McMullen.

If there is year-round access then you’ll want to consider one of two mortgage options: a “completion mortgage” means your builder covers the entire cost until the build is complete and you get funding at the end of the project. The more common option is a “draw mortgage” which provides your builder with financing throughout the build. Keep in mind that both mortgages are only amortized over a 25-year period and that you’re usually limited to a variable rate. “Borrowers with great credit will typically pay prime plus 1.25%. Those with low credit scores will start at prime plus 2%,” says McMullen.

If there is year-round access then you’ll want to consider one of two mortgage options: a “completion mortgage” means your builder covers the entire cost until the build is complete and you get funding at the end of the project. The more common option is a “draw mortgage” which provides your builder with financing throughout the build. Keep in mind that both mortgages are only amortized over a 25-year period and that you’re usually limited to a variable rate. “Borrowers with great credit will typically pay prime plus 1.25%. Those with low credit scores will start at prime plus 2%,” says McMullen.

Once your financing is secure, you’ll want to fork out between $100 and $300 for a basic title search (sometimes known as a sub-search). This will show you who owns the land, when it was bought, any liens or attachments registered against the property (such as mortgages), and any easements placed upon the property.

“You really only need to worry about federal liens,” explains Jeff Oberman (owner of OntarioTaxSales.ca) While all other debts are eventually wiped out once a tax sale is processed, federal liens remain on title until paid off, or the provincial government negotiates a settlement with the feds. Whichever strategy you decide to pursue—be it snapping up farmland with potential, investing in urban infills, or developing underused land yourself—keep in mind that while it can pay off handsomely, it’s not usually a get-rich-quick scheme.