Assessments, Appraisals, Market Value and Sale Price…Why No One Knows the True Value of a Home

Posted by Steve Harmer on Tuesday, November 29th, 2016 at 9:59am.

Multiple “values” are placed on a home by a number of different parties – so who is right?

Multiple “values” are placed on a home by a number of different parties – so who is right?

Not one is truly accurate because influences on real estate values are almost infinite and “value” is never a static figure. Home owners have opinions of value but often little basis for those opinions. There is rarely consistency between assessments, appraisals, market value and sale price…simply because the real estate market is one of the most complex entities around. It’s beneficial for owners to have an understanding of the different “values” (loosely used for convenience) placed upon their home so that when the “what’s it worth” question is posed, they have some semblance of accuracy.

Several factors affect the value of a house, and a single house may be valued at varying figures. The two assessments of primary concern to buyers and sellers are the market value and the appraised value.

Assessed Value of a Home

The assessed value of a property is a figure local governments use to determine a homeowner’s annual property tax. It is always a percentage of the property’s full market value (FMV), but the percentage varies from province to province. Most provinces calculate assessed value at 80 percent to 90 percent of FMV, and then impose a 1 percent to 2 percent annual property tax on the assessed value. Home assessments are performed by local officials but are not appraisals. A home appraisal determines the likely market value of a home, while assessments are only used to calculate property tax amounts. Owners should keep current on them and know how to challenge the tax assessment of a home if needed.

The assessed value of a property is a figure local governments use to determine a homeowner’s annual property tax. It is always a percentage of the property’s full market value (FMV), but the percentage varies from province to province. Most provinces calculate assessed value at 80 percent to 90 percent of FMV, and then impose a 1 percent to 2 percent annual property tax on the assessed value. Home assessments are performed by local officials but are not appraisals. A home appraisal determines the likely market value of a home, while assessments are only used to calculate property tax amounts. Owners should keep current on them and know how to challenge the tax assessment of a home if needed.

Appraised Value of a Home

An appraisal is the estimated fair market value of a property at a designated point in time, as developed by a licensed or certified appraiser following accepted appraisal principles. Although it’s based on a fair market value, appraised value does not always equal market value; it is an opinion developed by an appraiser based upon comparable closed sales (see below). Appraisers typically consider active and pending homes, but closed sales are the basis of value. Mortgage lenders always require an appraisal because the real estate will be the collateral for the mortgage loan. Appraisals for purchases are written to underwriting standards; these are mandated by the lenders, and appraisers are required to follow them. There are many types of appraisals including general analysis, refinance, estate, retroactive, highest and best use but all follow a similar basic format. It is vital to remember that an appraisal is an opinion developed by that certain appraiser, others may reach different conclusions.

An appraisal is the estimated fair market value of a property at a designated point in time, as developed by a licensed or certified appraiser following accepted appraisal principles. Although it’s based on a fair market value, appraised value does not always equal market value; it is an opinion developed by an appraiser based upon comparable closed sales (see below). Appraisers typically consider active and pending homes, but closed sales are the basis of value. Mortgage lenders always require an appraisal because the real estate will be the collateral for the mortgage loan. Appraisals for purchases are written to underwriting standards; these are mandated by the lenders, and appraisers are required to follow them. There are many types of appraisals including general analysis, refinance, estate, retroactive, highest and best use but all follow a similar basic format. It is vital to remember that an appraisal is an opinion developed by that certain appraiser, others may reach different conclusions.

An appraisal DOES NOT mean your home will sell for the value indicated. It DOES NOT mean your home is “worth” the appraised value. It’s idiotic for an agent or seller to tell a buyer “it appraised at 500K” when it’s languishing at 400K. Mortgage appraisals MUST FOLLOW underwriting standards; buyers, sellers – AND AGENTS – must understand those standards. This should be obvious but it’s not.

Automated Valuation Model (AVM)

This is a service that provides real estate property valuations using mathematical modelling combined with a database. Most AVMs calculate a property’s value at a specific point in time by analyzing values of comparable properties. The problem with AVMs is that simply put, they are automated. They don’t take into account the human element, the present condition of a home, its actual size, views, location, improvements, and more.

CLICK HERE TO TRY OUR FREE ONLINE HOME VALUATION TOOL

CLICK HERE TO TRY OUR FREE ONLINE HOME VALUATION TOOL

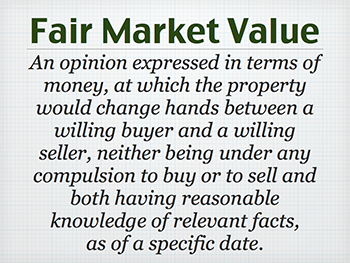

Market Value of a Home

The Uniform Residential Appraisal Report defines market value as the most probable price that a property should bring in a competitive and open market under all conditions requisite to a fair sale, with all parties (buyer and seller) acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby: buyer and seller are typically motivated; both parties are well-informed or well-advised, and each is acting in what he or she considers his or her own best interest; a reasonable time is allowed for exposure in the open market; payment is made in terms of cash in U.S. dollars or in terms of financial arrangements comparable thereto; and the price represents the normal consideration for the property sold, unaffected by special or creative financing or sales concessions granted by anyone associated with the sale.

The Uniform Residential Appraisal Report defines market value as the most probable price that a property should bring in a competitive and open market under all conditions requisite to a fair sale, with all parties (buyer and seller) acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby: buyer and seller are typically motivated; both parties are well-informed or well-advised, and each is acting in what he or she considers his or her own best interest; a reasonable time is allowed for exposure in the open market; payment is made in terms of cash in U.S. dollars or in terms of financial arrangements comparable thereto; and the price represents the normal consideration for the property sold, unaffected by special or creative financing or sales concessions granted by anyone associated with the sale.

Sale Price – Market Price of a Home

The most accurate way to ascertain value is to place a home for sale. Market price is what a willing, ready and financially qualified buyer will pay for a property and what the seller will accept for it. The transaction that takes place determines the market price, which will then influence the market value of future sales. Price is determined by local supply and demand, the property’s condition and what other similar properties have sold for without adding in the value component. The value part is the wild card; what constitutes value to each person is subjective. An inground pool may be highly valued by a seller but dismissed by a buyer. Dropping 100K into a pool may not return anything near that; but there is a value in use for that seller and that pool. A home may appraise at a certain dollar amount but contain specific features that make it especially valuable to a particular buyer or seller. There are variables that may not “show up” in the data but be a priority for a buyer, they may be willing to buy a home for X+ that appraises at X.

The most accurate way to ascertain value is to place a home for sale. Market price is what a willing, ready and financially qualified buyer will pay for a property and what the seller will accept for it. The transaction that takes place determines the market price, which will then influence the market value of future sales. Price is determined by local supply and demand, the property’s condition and what other similar properties have sold for without adding in the value component. The value part is the wild card; what constitutes value to each person is subjective. An inground pool may be highly valued by a seller but dismissed by a buyer. Dropping 100K into a pool may not return anything near that; but there is a value in use for that seller and that pool. A home may appraise at a certain dollar amount but contain specific features that make it especially valuable to a particular buyer or seller. There are variables that may not “show up” in the data but be a priority for a buyer, they may be willing to buy a home for X+ that appraises at X.

Some buyers speak of immediately knowing a home works for them because of a feature(s) that it has. In a situation like this, many are willing to pay a premium price for the added utility of what a particular home offers. For them, the value of the added feature justifies a value that might not be recognized by the data or by an appraisal. Homes with in-law suites that allow for multigenerational living can be more valuable to occupants than the data might suggest. A home mechanic may find more value in a home with a garage workshop than a buyer or appraiser will. An artist who finds a home with fantastic natural lighting may place a very high value on that.

So what is a home worth?

The best answer is that there’s probably a range based on a number of approaches. However, the one definitive answer is that which a buyer is willing to pay in an open market. And truth be told, that varies because Buyer A may pay X but Buyer B coming into town next weekend may have to leave with a home and pay Y. With real estate it’s all “right place, right time”.

© http://hankmillerteam.com/2015/07/assessments-appraisals-avms-market-value-and-sale-price-why-no-one-knows-the-true-value-of-a-home/