Canadian homeowners carried an average of $190,000 in mortgage debt in 2015

Canadian homeowners carried an average of $190,000 in mortgage debt in 2015

This according to a Manulife Bank of Canada survey. That’s a lot of money to owe a lender and thousands of dollars in interest to pay over the life of a mortgage.

One way to limit the amount of interest you pay is to pay off your mortgage faster than your agreed upon amortization schedule. Quickly paying down your mortgage will reduce the principal and thus reduce your interest charges. More money for you, less money for your lender.

Fortunately, there are several ways to pay your mortgage off quickly that require almost no effort. Let’s take a look at them below.

Choose Accelerated Mortgage Payments

Accelerated mortgage payments are the oldest trick in the book and

…

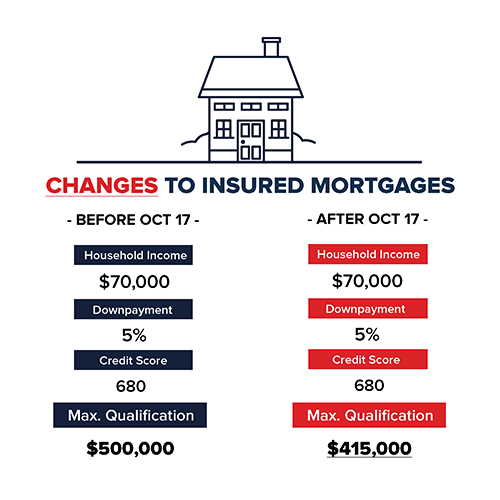

Have the recent government changes effected your home buying choices?

Have the recent government changes effected your home buying choices?

Here's what you should – and shouldn’t – buy

Here's what you should – and shouldn’t – buy

accounts to cover automatic payments, mortgages,

accounts to cover automatic payments, mortgages, Taking current economic and fiscal realities into account, it would be far more sensible to pay the initial 20 per cent down payment for a home purchase in full instead of saving the money for later, according to a veteran industry analyst.

Taking current economic and fiscal realities into account, it would be far more sensible to pay the initial 20 per cent down payment for a home purchase in full instead of saving the money for later, according to a veteran industry analyst. The U.S. Federal Reserve raised its key interest rate from 0.75 per cent to 1 per cent today, in a move widely anticipated by economists and investors.

The U.S. Federal Reserve raised its key interest rate from 0.75 per cent to 1 per cent today, in a move widely anticipated by economists and investors.

Thinking of buying your own place? It’s normal to feel a little overwhelmed.

Thinking of buying your own place? It’s normal to feel a little overwhelmed.

Some real estate brokerages have ads and billboards that imply that all real estate transactions are as easy as 1-2-3!

Some real estate brokerages have ads and billboards that imply that all real estate transactions are as easy as 1-2-3!

Looking to move to Kamloops? Want to know more about the city?

Looking to move to Kamloops? Want to know more about the city?

Becoming a landlord can seem very appealing.

Becoming a landlord can seem very appealing.

There are a number of advantages and disadvantages to buying a property and then renting it out. Talk to an accountant, lawyer, mortgage broker or other financial expert about how it may affect your taxes and financial situation. As always use a great local Realtor to help you make the right decision in locating a property that would work for the purposes of renting out and making sure the zoning is correct.

There are a number of advantages and disadvantages to buying a property and then renting it out. Talk to an accountant, lawyer, mortgage broker or other financial expert about how it may affect your taxes and financial situation. As always use a great local Realtor to help you make the right decision in locating a property that would work for the purposes of renting out and making sure the zoning is correct.