The housing market, like most markets, is cyclical.

The housing market, like most markets, is cyclical.

These cycles can be greatly influenced by a number of factors, including interest rates, economic conditions and consumer confidence, which can create a shortage or surplus in housing.

A seller’s market happens when there’s a shortage in housing or more potential buyers than homes. A buyer’s market, on the other hand, occurs when there is a surplus in housing or more homes for sale than buyers. A balanced market happens when there is the same number of homes for sale as there are buyers.

STOP PRESS: January 2021 - It's a sellers market RIGHT NOW

Seller’s market at-a-glance

- More buyers than homes for sale

- Prices tend to be higher because of increased demand

- Homes sell quickly

What will Kamloops Real Estate do in 2021? Is it time to sell or buy your Kamloops real estate?

What will Kamloops Real Estate do in 2021? Is it time to sell or buy your Kamloops real estate?

When it comes to real estate, the ideal time to sell your home often falls in the spring months, or is it?

When it comes to real estate, the ideal time to sell your home often falls in the spring months, or is it?

The B.C. Real Estate Association's latest housing forecast was released Tuesday and shows that while sales in 2020 did fall to "historic lows" in April, they have since rebounded to pre-pandemic levels and even puts the year on track to outdo 2019 sales.

The B.C. Real Estate Association's latest housing forecast was released Tuesday and shows that while sales in 2020 did fall to "historic lows" in April, they have since rebounded to pre-pandemic levels and even puts the year on track to outdo 2019 sales.

Things You Should Know Before You Sign an Agreement

Things You Should Know Before You Sign an Agreement

Expert insights on selling it quickly and for top dollar

Expert insights on selling it quickly and for top dollar

B.C. real estate: home prices forecast to rise 7.7 percent by end of 2020, and 3.7 percent in 2021

B.C. real estate: home prices forecast to rise 7.7 percent by end of 2020, and 3.7 percent in 2021

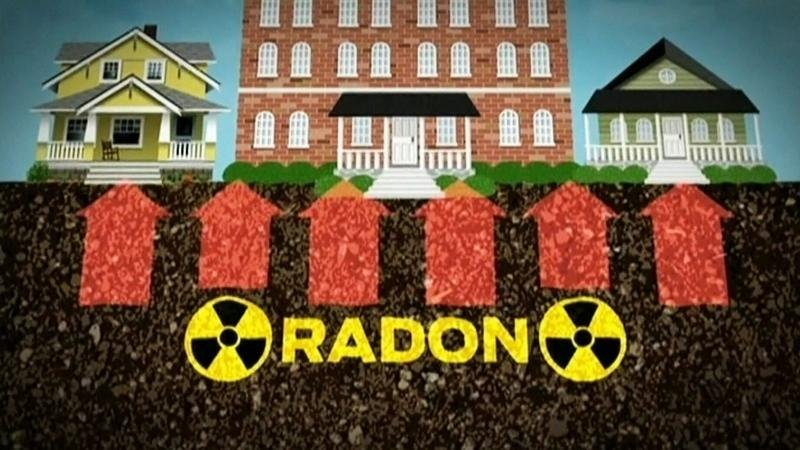

Radon Precautions for Buyers and Sellers

Radon Precautions for Buyers and Sellers

The global pandemic may have brought the Canadian real estate sector to a near standstill this spring, but over the longer term it appears to have stoked homebuying intentions.

The global pandemic may have brought the Canadian real estate sector to a near standstill this spring, but over the longer term it appears to have stoked homebuying intentions.

The stress test rate is about to fall for the second time in three months following cuts by Canada’s Big Six banks to their 5-year fixed posted rates.

The stress test rate is about to fall for the second time in three months following cuts by Canada’s Big Six banks to their 5-year fixed posted rates.