What will Kamloops Real Estate do in 2021? Is it time to sell or buy your Kamloops real estate?

What will Kamloops Real Estate do in 2021? Is it time to sell or buy your Kamloops real estate?

Read what the BC Real Estate Association thinks and the stats for 2020

Fourth Quarter – November 2020

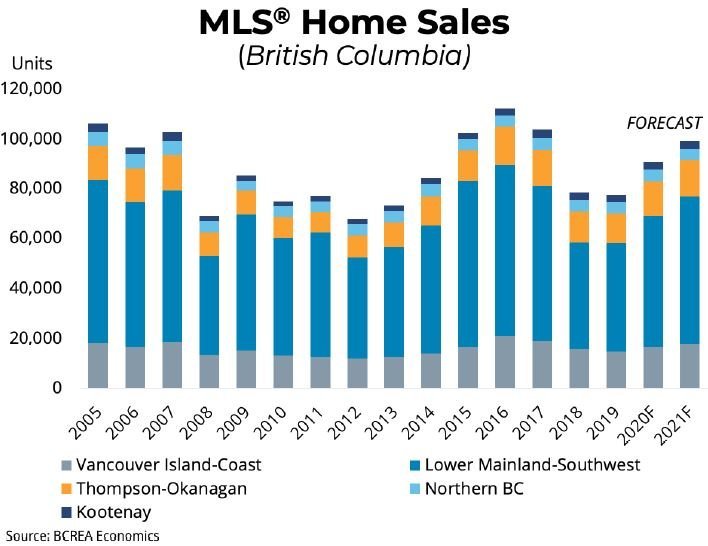

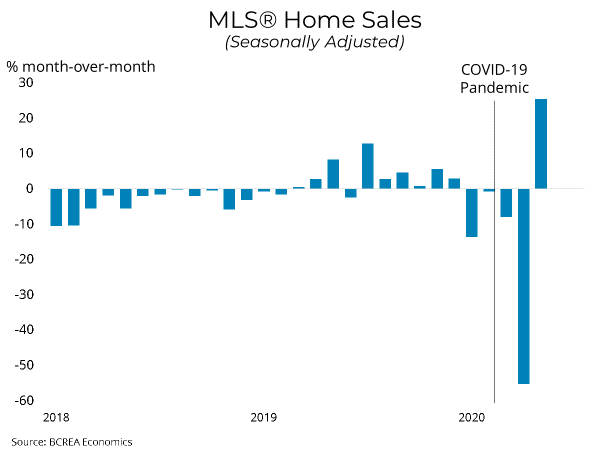

The COVID-19 pandemic and associated recession have impacted housing markets in unexpected and unpredictable ways. Despite what may be the worst recession in BC history, the housing market had a record fall season and prices are rapidly rising as pent-up demand floods into an under-supplied market.

As that pent-up demand from the loss of a spring season fades, sales will likely slow from their current pace, but activity is expected to remain strong as record-low mortgage rates and a recovering economy continue to drive sales.

The average Canadian

The B.C. Real Estate Association's latest housing forecast was released Tuesday and shows that while sales in 2020 did fall to "historic lows" in April, they have since rebounded to pre-pandemic levels and even puts the year on track to outdo 2019 sales.

The B.C. Real Estate Association's latest housing forecast was released Tuesday and shows that while sales in 2020 did fall to "historic lows" in April, they have since rebounded to pre-pandemic levels and even puts the year on track to outdo 2019 sales.

B.C. real estate: home prices forecast to rise 7.7 percent by end of 2020, and 3.7 percent in 2021

B.C. real estate: home prices forecast to rise 7.7 percent by end of 2020, and 3.7 percent in 2021

Radon Precautions for Buyers and Sellers

Radon Precautions for Buyers and Sellers

The global pandemic may have brought the Canadian real estate sector to a near standstill this spring, but over the longer term it appears to have stoked homebuying intentions.

The global pandemic may have brought the Canadian real estate sector to a near standstill this spring, but over the longer term it appears to have stoked homebuying intentions.

The single family home has, unfortunately, become unaffordable for many people.

The single family home has, unfortunately, become unaffordable for many people.

The British Columbia Real Estate Association (BCREA) reports that a total of 4,518 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May 2020, a decline of 45.2 per cent from May 2019.

The British Columbia Real Estate Association (BCREA) reports that a total of 4,518 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May 2020, a decline of 45.2 per cent from May 2019.

Buying and selling manufactured homes

Buying and selling manufactured homes

You may have heard of the incentive programs that the federal government has created to try to entice first time home buyers into the real estate market, but how much do you really understand? Is this something for you?

You may have heard of the incentive programs that the federal government has created to try to entice first time home buyers into the real estate market, but how much do you really understand? Is this something for you?

If you have questions about the coronavirus and how the current situation might impact your finances, you’re not alone.

If you have questions about the coronavirus and how the current situation might impact your finances, you’re not alone.