Why Invest in Kamloops Real Estate?

I have lived in Kamloops almost all of my life and I have never seen so much buying demand, so little inventory, and skyrocketing rental rates. I've read countless reports of the hundreds of renters staying in hotels waiting for a home or suite to come on the rental market. My clients who are purchasing investment properties tell me experiences of advertising suites and having people offer to pay them just to view the suite and have a chance at getting it. I'm hoping the madness stops as it simply isn't sustainable nor is it fair to those who cannot afford a down payment in an ever rising housing market, yet it's the perfect storm for investors.

I have lived in Kamloops almost all of my life and I have never seen so much buying demand, so little inventory, and skyrocketing rental rates. I've read countless reports of the hundreds of renters staying in hotels waiting for a home or suite to come on the rental market. My clients who are purchasing investment properties tell me experiences of advertising suites and having people offer to pay them just to view the suite and have a chance at getting it. I'm hoping the madness stops as it simply isn't sustainable nor is it fair to those who cannot afford a down payment in an ever rising housing market, yet it's the perfect storm for investors.

The other attraction for those able to buy a rental home, is that

…

Did you know that two out of three Canadian families own a house? That is one of the highest rates of home ownership in the world. And for good reason . Real estate is a great investment.

Did you know that two out of three Canadian families own a house? That is one of the highest rates of home ownership in the world. And for good reason . Real estate is a great investment. The housing market, like most markets, is cyclical.

The housing market, like most markets, is cyclical.

What will Kamloops Real Estate do in 2021? Is it time to sell or buy your Kamloops real estate?

What will Kamloops Real Estate do in 2021? Is it time to sell or buy your Kamloops real estate?

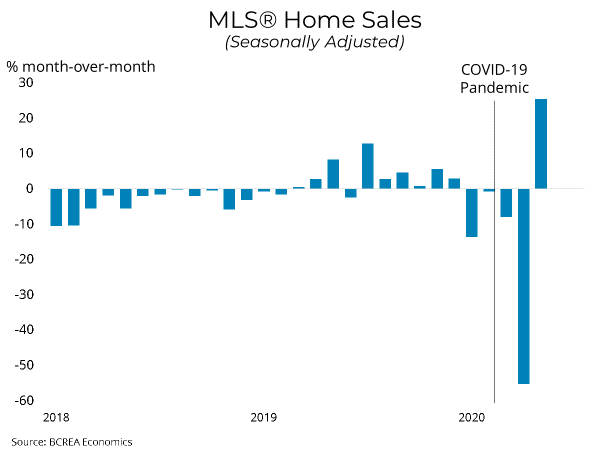

The B.C. Real Estate Association's latest housing forecast was released Tuesday and shows that while sales in 2020 did fall to "historic lows" in April, they have since rebounded to pre-pandemic levels and even puts the year on track to outdo 2019 sales.

The B.C. Real Estate Association's latest housing forecast was released Tuesday and shows that while sales in 2020 did fall to "historic lows" in April, they have since rebounded to pre-pandemic levels and even puts the year on track to outdo 2019 sales.

Things You Should Know Before You Sign an Agreement

Things You Should Know Before You Sign an Agreement

The dollar figure on your provincial property assessment notice should not be taken as your home’s market value

The dollar figure on your provincial property assessment notice should not be taken as your home’s market value

What is a Market Evaluation?

What is a Market Evaluation?

The British Columbia Real Estate Association (BCREA) reports that a total of 4,518 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May 2020, a decline of 45.2 per cent from May 2019.

The British Columbia Real Estate Association (BCREA) reports that a total of 4,518 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in May 2020, a decline of 45.2 per cent from May 2019.

Buying and selling manufactured homes

Buying and selling manufactured homes

Ready to buy a home? Be prepared: With inventory tight and prices rising, this is a tricky time to be entering the market.

Ready to buy a home? Be prepared: With inventory tight and prices rising, this is a tricky time to be entering the market.