The cost of owning a house and starting a family just might be the lost opportunity to get a good head start on saving for retirement.

The cost of owning a house and starting a family just might be the lost opportunity to get a good head start on saving for retirement.

With the March 1 deadline for contributions to registered retirement savings plans just ahead, it’s a good time to look at how to balance life’s biggest financial responsibilities. Home ownership, starting a family and retirement saving – can you do it all?

In cities with reasonably priced housing, you certainly can. But in expensive markets such as Toronto, Vancouver and their satellite cities, only high earners will manage this balance. Something will have to give in the household budgets of everyone else, and it’s probably going to be retirement saving.

There’s more to this than the average $770,745 cost of a

…

Did you know that two out of three Canadian families own a house? That is one of the highest rates of home ownership in the world. And for good reason . Real estate is a great investment.

Did you know that two out of three Canadian families own a house? That is one of the highest rates of home ownership in the world. And for good reason . Real estate is a great investment.

Canada Mortgage and Housing Corporation (CMHC) has defended mortgage stress test rules and warned federal policymakers to hold the line amid calls from industry associations to ease the rules.

Canada Mortgage and Housing Corporation (CMHC) has defended mortgage stress test rules and warned federal policymakers to hold the line amid calls from industry associations to ease the rules.

Vancouver, BC – March 12, 2019.

Vancouver, BC – March 12, 2019.

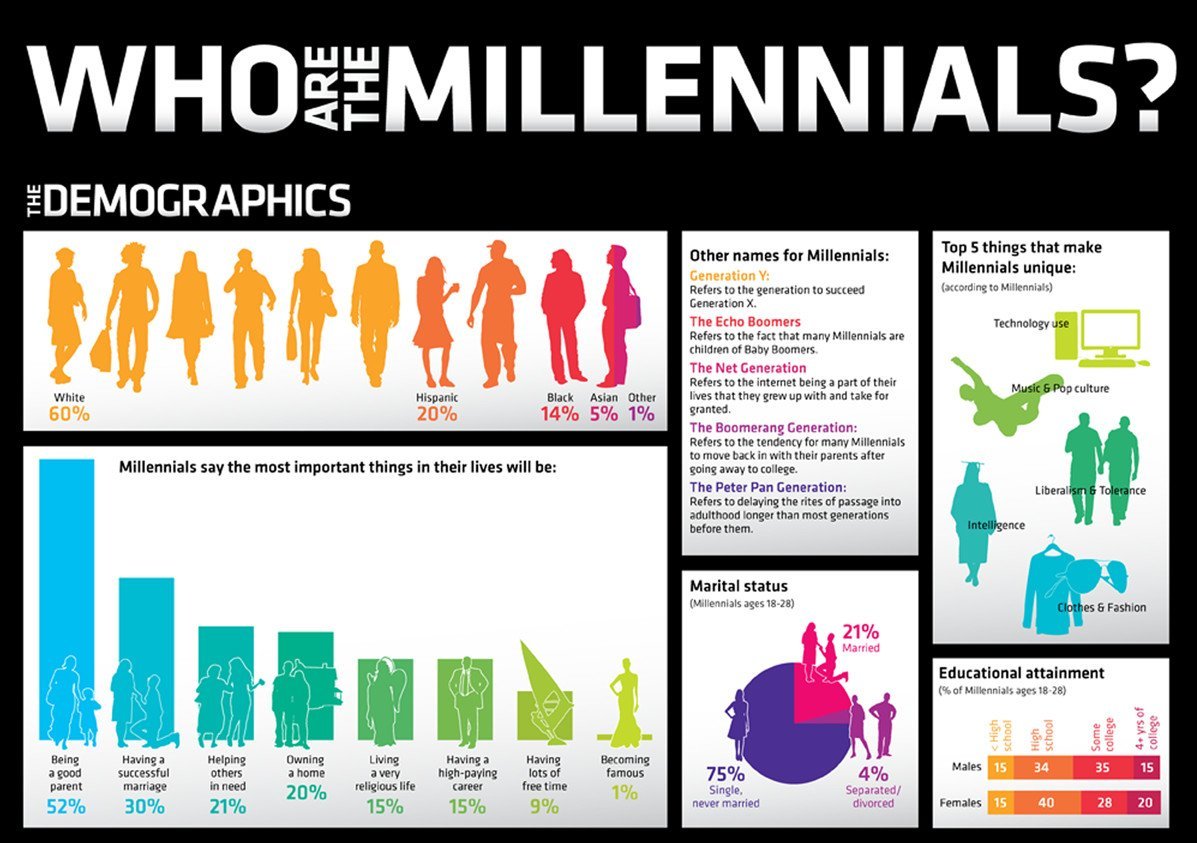

If you are a baby boomer, this might sound familiar: You moved out of your parent’s home as soon as you graduated from high school; you lived in a place you rented – maybe even a ‘room’ in a larger house, where you shared the bathroom with the other tenants; you could put all your belongings in one small bag; and you saved up to buy a car.

If you are a baby boomer, this might sound familiar: You moved out of your parent’s home as soon as you graduated from high school; you lived in a place you rented – maybe even a ‘room’ in a larger house, where you shared the bathroom with the other tenants; you could put all your belongings in one small bag; and you saved up to buy a car.

A house being sold “as is” is a real estate term you should know before you start house hunting.

A house being sold “as is” is a real estate term you should know before you start house hunting.

A special thank you to my past and present clients, friends and family for another great year.

A special thank you to my past and present clients, friends and family for another great year.

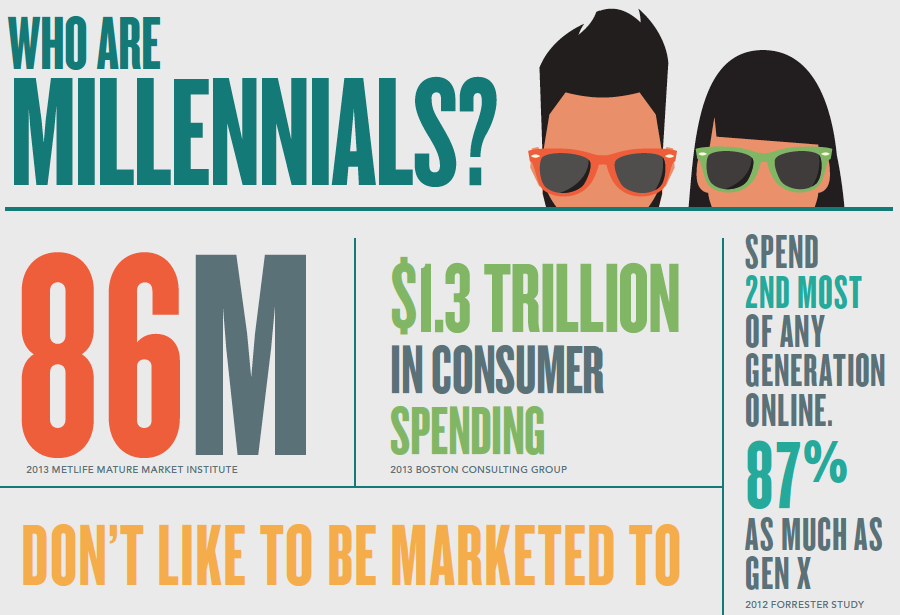

In a nationwide survey of over 9,000 prospective homebuyers carried out on its platform, Point2 Homes found that 66% of the Millennials interested in purchasing a home would like to do so within one year.

In a nationwide survey of over 9,000 prospective homebuyers carried out on its platform, Point2 Homes found that 66% of the Millennials interested in purchasing a home would like to do so within one year.

When buying a home – most of the negotiations occur before the seller and buyer sign the contract.

When buying a home – most of the negotiations occur before the seller and buyer sign the contract.