Mortgage gap created by the posted rate leaves homebuyers with a decision to make

Posted by Steve Harmer on Thursday, March 23rd, 2017 at 11:36am.

Have the recent government changes effected your home buying choices?

Have the recent government changes effected your home buying choices?

Call it the gap between what you have to pay and what you can afford to pay — it’s going to be considerable when you qualify for your next mortgage. Now the question is what should you do with that money?

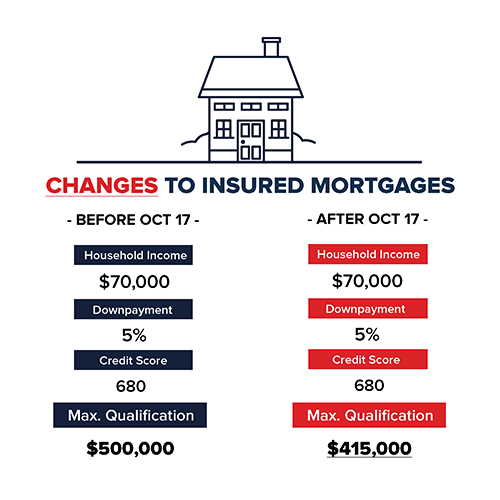

Ottawa tightened mortgage rules in October and the one requirement that has disrupted the lending world is the stipulation that consumers qualify based on the Bank of Canada posted rate for a five-year fixed-rate mortgage.

That rate — it’s based on the most common posted rate of the big six banks for a five-year fixed rate mortgage — has been stuck at 4.64 per cent since the government announced the new measures in October 2016. Qualifying with that rate is a heavy burden and creating a huge gap when it comes time to deciding how much you will actually pay, considering consumers can lock in a rate for as low as 2.28 per cent for five years, according to ratespy.com.

“It is affecting a lot of people here,” said Geoff Willis, managing broker with Vancouver-based Origin Mortgages. “A lot of people look at the interest rate online and think that’s what they’ll qualify on. They go out and buy a new home, they have seven days to firm up a deal, and then they go their bank and find they can’t get financing.” That can mean potentially watching your deal fall apart.

Here’s the math on how on you will have to qualify in today’s market. Considering the Canadian Real Estate Association said the average home in the country sold for $551,400 in February, that means to qualify for a federally backed loan you’ll need to come up with at least $30,140 to get a loan for $521,260. (Government regulations stipulate that you must have five per cent down on the first $500,000 of a home and 10 per cent on any portion above $500,000 up to $1 million.)

The rub on the mortgage qualification is that at 4.64 per cent, that $521,260, based on a 25-year amortization, would mean a monthly payment of $2,925.74 but at 2.28 per cent that monthly payment goes down to $2,278.35. The first figure is the one you must qualify for based on a set ratio for how much of your monthly income can go towards debt and housing costs. The second number is what you actually end up paying — creating a gap and a decision on what to do with that difference.

Janet Boyle, vice-president of real estate secured lending at Scotiabank, doesn’t see a change in that 4.64 per cent rate any time soon. “I think what you might see is some people wait a little longer and try to grow their down payment so they don’t require (mortgage) default insurance,” she says.

Under federal rules anybody with less than a 20 per cent down payment must get mortgage default insurance, the premiums payable by the consumer. Loans with more than 20 per cent but backed by the government and securitized, often called bulk insurance and used by smaller lenders who pay the premiums instead of consumers, must also meet the new guidelines.

The monthly payment becomes key when calculating what is called the gross debt service ratio which mandates that no more than 39 per cent of your average gross monthly income go towards housing costs and that includes mortgage payment, principal and interest, property taxes, heating costs and 50 per cent of condo fees. The total debt service ratio must be under 44 per cent, calculated by taking your monthly gross income and adding car loans or leases, credit card and lines of credit payments and other loans to housing costs.

“It’s a little too early to tell the impact, we’ve had less than a quarter to see it,” said Boyle, about what consumers who do qualify at the higher rate will do with their leftover money once their real rate is considered.

Interestingly enough, Canada Mortgage and Housing Corp. just published a how-to guide book for buying a house with a message that says maybe you shouldn’t borrow as much as your financial institution will allow. CMHC says those ratios should be at most 32 per cent and 39 per cent respectively under its recommended affordability rules.

So what do to with that extra money? One option is to leave the door open for prepayments.

“I wouldn’t say people are keeping their payment at that higher level but what I would say is it does drive a selection of a mortgage package which offers a prepayment opportunity,” says Boyle. It’s a little too early to tell the impact, we’ve had less than a quarter to see it

Most mortgages in Canada have prepayment terms, some that will let you pay a lump sum of up to 20 per cent of your mortgage off annually. Others will let you increase monthly payments — both resulting in your principal being paid off faster with less interest being paid over life of the loan.

“People see that payment cushion but they also see the opportunity to pay off a lump sum,” says Boyle.

“People see that payment cushion but they also see the opportunity to pay off a lump sum,” says Boyle.

Calum Ross, a wealth advisor and author of The Real Estate Retirement Plan: An Investment and Lifestyle Solution for Canadians, says the question of whether you should be using any of that gap money to pay down your mortgage or invest comes down to the age-old question: What is your rate of return?

“If most of those people in a higher tax bracket understood the true opportunity cost of paying their mortgage more quickly they would never do it,” said Ross. “I understand the need to lower your debt and get the stress off your brain. But the fact of the matter is if you’ve got more than enough investment to pay off your debt, you’re not stressed about the mortgage.”

Economist Will Dunning said it’s really only a small minority of Canadians who go for the maximum they qualify for anyway. “Most people won’t be affected by the stress test,” he says, adding his studies have found people start making extra pre-payments as soon as they get a mortgage.

Paul Taylor, chief executive of Mortgage Professionals Canada which represents 11,500 members, believes the 4.64 percentage is really too high to begin with and doesn’t promote a healthy mortgage market.

“It’s to their credit that government has provided us with opportunities to express our concerns to them,” says Taylor, abut recent hearings on mortgage rules. “But we are five to six months into this and we are seeing cracks in local economies (because people can’t buy homes).”

“It’s to their credit that government has provided us with opportunities to express our concerns to them,” says Taylor, abut recent hearings on mortgage rules. “But we are five to six months into this and we are seeing cracks in local economies (because people can’t buy homes).”

Taylor says the whole point of the higher rate was to create a cushion for Canadians in a rising rate environment — something that hasn’t materialized.

“The aim of the stress test is so consumers have excess funds and can purchase consumables like a new fridge and car and help the economy,” said Taylor, referring to statements from government officials. “We all acknowledge Canadians are very good at paying their debt. Our arrears rates are great. There is less concern about default and more concern about people not having any money to spend anywhere else and that could create a consumer recession.”

© http://business.financialpost.com/personal-finance/mortgages-real-estate/mortgage-gap-created-by-the-posted-rate-leaves-homebuyers-with-a-decision-to-make