Assuming A Kamloops Mortgage - How does it work and is it for you?

Posted by Steve Harmer on Sunday, August 14th, 2016 at 3:41pm.

An assumable mortgage is, simply put, one that the lender will allow another borrower to take over or “assume” without changing any of the terms of the mortgage.

An assumable mortgage is, simply put, one that the lender will allow another borrower to take over or “assume” without changing any of the terms of the mortgage.

For example, say you purchased a property for $200,000 with a mortgage of $150,000 and $50,000 of your own money. If part way through the mortgage term you decide you’d like to sell the home, you would have the option of essentially selling the mortgage as well. The person who buys the home from you could take over the balance of the mortgage and the associated payments and give you cash for the remainder of the value of the home. So, if your mortgage balance is now $140,000 and the home is now valued at $210,000, a buyer who is assuming the mortgage would need to pay you, the seller, $70,000.

As a BUYER, you need to look at this carefully. In some cases, it will work in your favour, especially if the high ratio insurance premium has already been paid.

The first thing you have to do is to find out the details of the mortgage you could be taking over - what is the amount of the mortgage remaining? What is the interest rate and when is the renewal date (the date the rate ends)? How much time is remaining in the amortization?

You need to make sure that the mortgage amount is enough for your needs and that the rate you are assuming is comparable to (or better than) current rates for the same length of time. You also need to consider the conditions of the mortgage contract - you may find it contains conditions you don't like.

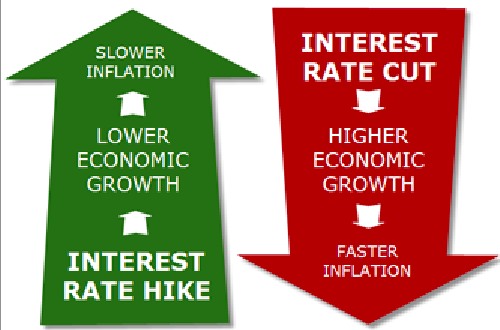

If interest rates have been going up, then assuming a mortgage could be very much in your favour. However, if rates have been stable, or going down, you will probably get a better mortgage by going to your mortgage broker and applying for a new mortgage.

If interest rates have been going up, then assuming a mortgage could be very much in your favour. However, if rates have been stable, or going down, you will probably get a better mortgage by going to your mortgage broker and applying for a new mortgage.

There are several aspects of assumable mortgages that make them attractive to people on both sides of the real estate transaction. If you’re the seller in this equation and you’re willing to have someone assume your mortgage (i.e. you don’t need to port it over to your new property), then you may be able to get a better selling price for your home, and you will have a different pool of potential buyers.

However, there is come caution with assumable mortgages. In cases of default by the new borrower, the lender can come after the original borrower in order to get its money back. This can become a real problem if the new borrower has not taken good care of the home and has negatively impacted its resale value. If the home cannot be sold for enough money to pay back the mortgage, the original borrower could be sued for the shortfall. In short, despite no longer being on title, if you sell your home and allow the buyer to assume your mortgage you could still be pulled back into that debt if the buyer is not able to meet his or her obligations.

All of the major lending institutions insist on the purchaser qualifying for the assumable mortgage, so if you would not normally qualify for a mortgage, you will not qualify to assume a mortgage either.

If you are SELLING your property, and you have a good interest rate, you should first look into using any portablity option offered by your lending institution. Usually you must be purchasing a new home at the same time as selling the old home, and you still need a mortgage.

If you are SELLING your property, and you have a good interest rate, you should first look into using any portablity option offered by your lending institution. Usually you must be purchasing a new home at the same time as selling the old home, and you still need a mortgage.

However, there are two main reasons for letting someone assume your mortgage:

1. If the real estate market is depressed in your area and you have a good interest rate on your mortgage, an assumable mortgage may help you to attract potential purchasers.

2. If someone assumes your mortgage (the whole amount) your lending institution should not charge you any penalty.

If you are selling your property and your lending institution does NOT insist on the buyer qualifying for your mortgage, the most important thing to check is whether you will be released from that mortgage! If not, you could still be liable for the debt even though you have sold the property!

Lenders have the option clauses in mortgage contracts that expressly forbid other borrowers from assuming the mortgage without qualifying, or that specify that the mortgage must be paid out on sale of the property. Since most buyers and sellers don’t want to challenge the banks, this has made mortgage assumptions fairly uncommon. However, if an assumable mortgage is something that you’re interested in, talking to your mortgage broker is a great place to start.

© http://canadian-mortgages.com/index.php?option=com_content&view=article&id=26&Itemid=84