Divorce and Seperation in Canada - Things you need to know

Posted by Steve Harmer on Monday, October 29th, 2018 at 12:19pm.

Are you thinking about a separation from your spouse? How does that effect real estate?

Are you thinking about a separation from your spouse? How does that effect real estate?

Then you need to know the legal ins and outs when it comes to separation under Canadian law. This article will go over some ideas that many people have about separation so that you will know exactly what your Separation Agreement must include.

Always take professional legal advice

There is much to consider during a divorce, but one of the most basic questions is “Who gets what?” For some couples the division of property can get very messy, while others are able to deal with it quickly and easily. Under Canada’s Constitution, each province and territory is responsible for laws regarding the division and/or equalization of family or marital property, and these laws can vary from one province or territory to another. That said, to help give you a very basic understanding on this topic, below is a general overview of most provincial statutes regarding the division of property during divorce.

Divorce in Canada: General Overview on Property Division

In the eyes of the law a marriage is an equal partnership. So, whether a spouse is responsible for running the household or earning family income, their contribution to the relationship is equally important. When a marriage ends, the partnership is over and property has to be divided. The general rule for this division is:

DIVORCE LAW IN BC - CLICK HERE

“The value of any property that you acquired during your marriage and that you still have when you separate, must be divided equally between spouses. Property that was brought into your marriage is yours to keep, but any increases in the value of this property during the duration of marriage must be shared.”

This theory is applied to most family assets with the exception of some, and one of the most important exceptions being your matrimonial home.

Question: What Is The Matrimonial home?

The Matrimonial home is the place where you and your spouse reside at the time of separation/divorce. Unlike other property, if you owned the matrimonial home on the date of marriage, you do not receive any credit for it when you separate. Also, it doesn’t matter who has their name on the papers for the house, both spouses have an equal right to remain in the matrimonial home. As noted above, this is just a very general overview and laws will vary from one province/territory to another. To get more specific information on laws for your specific area you can visit your provincial government website, or retain a family lawyer. The division of property in a divorce can be quite complicated and the more assets a couple has the more complex the laws can seem. Due to the complex nature of divorce and property laws, we always recommend that couples seek legal advice from a lawyer in their area who specializes in family law. This is the best way to ensure that you are fully educated, and that your rights and property are protected.

The Matrimonial home is the place where you and your spouse reside at the time of separation/divorce. Unlike other property, if you owned the matrimonial home on the date of marriage, you do not receive any credit for it when you separate. Also, it doesn’t matter who has their name on the papers for the house, both spouses have an equal right to remain in the matrimonial home. As noted above, this is just a very general overview and laws will vary from one province/territory to another. To get more specific information on laws for your specific area you can visit your provincial government website, or retain a family lawyer. The division of property in a divorce can be quite complicated and the more assets a couple has the more complex the laws can seem. Due to the complex nature of divorce and property laws, we always recommend that couples seek legal advice from a lawyer in their area who specializes in family law. This is the best way to ensure that you are fully educated, and that your rights and property are protected.

Question: How is family property and family debt divided?

After you separate, the law says that all family property and family debt must be divided equally between you and your spouse, unless you have an agreement that says you'll divide them differently.

Question: What is family property?

Family property is everything either you or your spouse own together or separately on the date you separate. It includes:

- the family home

- RRSPs

- investments

- bank accounts

- insurance policies

- pensions

- an interest in a business

It doesn't matter whose name the property is in.

Question: What isn’t considered to be matrimonial property?

Here are some things that are usually not considered to be matrimonial property and these generally include:

- gifts, inheritances or trusts, unless used for the benefit of the family during the marriage

- an award or settlement of damages, unless used for the benefit of the family during the marriage

- insurance proceeds, unless used for the benefit of the family during the marriage

- reasonable personal effects (personal items like clothing)

- business assets

- property exempted under a marriage contract or separation agreement

- property acquired after separation

If you are unsure whether some of your property will be considered a matrimonial asset, you should speak with a lawyer for advice.

Question: What is 'matrimonial debt'?

Matrimonial debt may also be called family debt. It is debt that was acquired by either spouse or both spouses together during the marriage that was used for ordinary family matters. These may include things like:

- household expenses

- the mortgage on the family home, or

- debt used to finance a family car.

Debts acquired after you separated from your spouse may be considered matrimonial debts if they were used to pay for necessary living expenses or to maintain the house or car, or other assets.

Debts acquired after you separated from your spouse may be considered matrimonial debts if they were used to pay for necessary living expenses or to maintain the house or car, or other assets.

Question: Am I responsible for my spouse's debts that are not matrimonial debts?

As a general rule, both spouses are equally responsible for a debt that is in both of their names. You may also share responsibility for debts that are only in your spouse’s name if the money was used to buy something that benefited you or your family. Examples are heating oil or a family vacation. Usually you are not responsible for your spouse's non-matrimonial debts unless you co-signed or guaranteed them. For example, you would not usually be responsible for debts your spouse acquired to run their business, or debts acquired by your spouse before the marriage.

Debt division can be very complicated, so it is best to talk to a lawyer about your options.

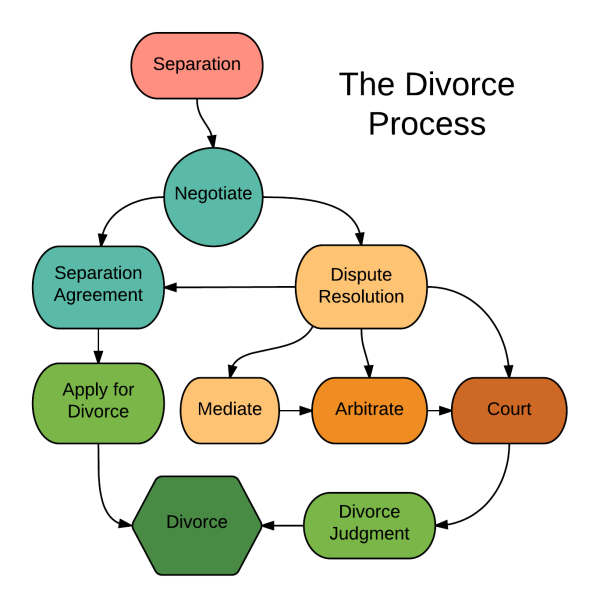

Separation is not divorce

It’s important to note that Canadian law does not provide for a “legal separation” filing. As soon as you move out (or your spouse does) you are considered “living separate and apart.” The only term that “legal separation” refers to is the contract that many couples sign when they separate. Separation does not lead to an automatic time line toward divorce in Canada. You can stay separated indefinitely; some couples wait to file until one of them decides to remarry. However, the separation period has to last for at least one full year before you can file for divorce in Canada, unless you can establish cruelty or adultery as a reason for filing.

You do not have to wait to start applying for your divorce for a full year, but the court system will not grand a final decree of divorce until one full year from separation has passed. If you and your spouse attempt reconciliation, but that attempt fails, your one-year clock does not start over, unless you lived together for a total of 90 days during the separation period, either at one time or combining several attempts. The rationale behind this is that couples should have the chance to work on their marriage without having to start their one-year separation period over if things don’t work out.

Separation does not necessarily mean that the two of you have separate addresses; from a legal standpoint, the two of you have to live lives that are separate. Obviously, one easy way to prove that would be if you live in different places. However, some couples cannot manage that, because of finances, the need to care for children or other reasons. Couples who live at the same address but want to prove separation generally need to have legal representation, as this can be hard to prove.

If you and your spouse sign a contract about the various rights that each of you has about property, debt, child support, alimony, child custody and visitation, and other related issues, this is your separation agreement. Canadian law does not mandate a separation agreement and includes no set forms that this agreement should take. However, these agreements are a good idea, because couples that decide to proceed on the basis of verbal agreements can end up experiencing significant frustration when one partner decides to break the agreement and there is no proof of the agreement’s existence.

A warning for couples who have separated but not divorced.

When couples split up, the last thing they're thinking is, "What happens when I die?"

Breakups are emotionally difficult times, with many decisions to be made. But the ramifications of a split are magnified when the parties do not go through with a divorce. Many people think the mere act of separating will result in legal changes to their wills, estate plans, powers of attorney and beneficiary designations, but that's 100 per cent incorrect, says Jamie Golombek, managing director of tax and estate planning at CIBC Private Wealth Management in Toronto. If married spouses do not execute new wills after separation, then effectively the old wills are still valid. The ex could end up with your property.

While a divorce changes many things, a separation does not. Anyone who is separating should immediately speak to a lawyer. For high-net-worth people, the urgency is even greater. The biggest potential danger is to your estate. "If married spouses do not execute new wills after separation, then effectively the old wills are still valid. The ex could end up with your property," says Mr. Golombek. New documents will immediately make provisions for the division of property, possible support payments and other arrangements in the case of death.

While a divorce changes many things, a separation does not. Anyone who is separating should immediately speak to a lawyer. For high-net-worth people, the urgency is even greater. The biggest potential danger is to your estate. "If married spouses do not execute new wills after separation, then effectively the old wills are still valid. The ex could end up with your property," says Mr. Golombek. New documents will immediately make provisions for the division of property, possible support payments and other arrangements in the case of death.

"Simultaneous to all of this [separation] process, it's very important to update your will, even if this one isn't going to be your final will and you haven't figured out the details of trusts for kids and things like that," says Mr. Golombek. "If it's not your intention to leave your soon-to-be-ex all your property in your will, then it's imperative that you just do a quick updated one in the meantime."

"You also need to change your power of attorney for finances and heath care," says Ms. Van Cauwenberghe. "The worst files I've seen are situations where people have been separated for many years and didn't change their estate plan. For example, someone may have had an insurance policy that they've paid on for years but never changed the beneficiary," she says. "Twenty years later they pass away and the insurance policy is paid to a spouse that they haven't been in touch with for decades. The new spouse could be a common-law one and it would be very difficult for her to have a case."

Separation Agreement - What needs to be in it?

If you’re thinking about a separation agreement, it’s best to have a lawyer draft it for you. Canadian law does not require this; you are allowed to write your own. However, requirements vary by province as to the content of these agreements, so you’ll want to see what rules govern your location. If you put together an agreement that violates the rules in some procedural way, you could end up going to court and seeing a judge fail to enforce it. In general terms, though, here are the things that you need to have in your agreement (although you’ll want to check provincial law and consult a lawyer).

1. Full Legal Name of Each Spouse

2. Separation Date

3. Issues Regarding Children

- With which spouse will they live?

- Which spouse will have custody?

- How will access to the child(ren) take place?

- How much child support will be due each month?

- When will the payment of child support end?

4. Spousal Support / Alimony

- Will alimony be paid? How much, and for how long?

- If one spouse waives support, will that be indefinite?

5. Property Issues

- What property goes to each spouse?

- If you own a house together, will it be sold? Who will maintain it until the point of sale? Who

- will live there in the meantime? How will the proceeds be divvied up?

6. Debts

- Who is responsible for each debt?

- What happens with debts that the spouses incur between separation and divorce?

A separation agreement is a key step in the divorce process. The terms will affect you, your spouse and (when applicable) your children going forward. This will become a binding contract that you must follow, so having a lawyer review it carefully before you sign it is the best practice. Don’t sign it until you have carefully reviewed every term in the agreement.