Five tips for investing in rental property

Posted by Steve Harmer on Tuesday, April 4th, 2017 at 11:38am.

Local real estate has proven to be an effective long-term wealth creator

By owning rental housing you get the added advantage of earning regular income from your investment.

Could stepping up now and getting into the rental property market be the right choice? If so, how can you help ensure it's a profitable venture?

Understand why you're buying

There are three main reasons people invest in rental property, and a lot depends on whether you're an investor or a speculator. If you're a speculator, timing is everything. When's the best time to invest in a rental property? Catch the market in an upswing and you might make money. But stretch your finances to buy in as the market peaks and you could lose. Do you want to bet on what housing prices will do next? If you guess wrong and want out, you'll find real estate isn't like stocks or bonds which you can sell quickly and easily. It can take time and the right conditions to get a fair price.

On the other hand, being an investor can be a smarter way to benefit from owning real estate. Because you're in it for the long haul, you can stop and do the proper research, find the right property in a prime neighbourhood, and generate income and capital appreciation over time.

RELATED:

10 Tips for investing in a rental propertyFurthermore, if you're considering purchasing a rental property with the intent of  giving to your adult children in the future there are some tax issues to consider. Giving the gift of real estate, while immensely generous, often comes with several disadvantages from a tax perspective.

giving to your adult children in the future there are some tax issues to consider. Giving the gift of real estate, while immensely generous, often comes with several disadvantages from a tax perspective.

Some tax professionals advise people never to give real estate, although that may be a little too harsh, because there are scenarios where giving real estate can be a smart tax move. It all depends on what you want to do with the property, and over what time frame you plan to sell. An experienced tax professional can "run the numbers" on various tax scenarios and advise you on the best strategy for your particular situation.

Are you financially ready to get in…and stay in?

Buying a rental property isn't like shopping for a principal residence. Rental properties with one to four units require a minimum down payment of 20% to qualify for a CMHC insured mortgage. Because rental homes are usually perceived as riskier by lenders, don't be surprised to encounter higher borrowing rates and stricter qualification rules than what you're used to. Don't forget to add the usual expenses related to property purchase like appraisal costs and legal fees.

Before you even get into the market, ensure you have the finances to stay there. What if you incur a major repair bill that you didn't expect? What happens to your budget if interest rates move higher or your strata corporation levies a special assessment? You want to have resources set aside in advance to ride out any bumps so you're not forced out of your investment prematurely, perhaps at a loss. If you eventually sell at a profit, your rental property isn't like your own home. Your capital gains will be taxable like with any other investment.

How Property Taxes Measure Up

If you're looking outside your own municipality for a rental home, don't assume property taxes will be the same as what you're paying now. Some communities add extra fees for services like water, sewer or garbage pickup. These costs of ownership don't always correspond to house values. For example, New Westminster residents paid more in 2012 than homeowners in Burnaby, despite house prices that were nearly 30% lower.

| Area | House Value | Property Taxes / Charges* |

|---|---|---|

| West Vancouver | $1,964,018 | $8,083 |

| Whistler | $1,254,300 | $6,881 |

| Vancouver | $1,368,060 | $6,249 |

| North Vancouver (District) | $990,375 | $5,544 |

| Richmond | $993,118 | $5,033 |

| New Westminster | $660,389 | $4,948 |

| Burnaby | $920,290 | $4,871 |

| Delta | $586,293 | $4,240 |

| Squamish | $468,089 | $3,916 |

| Surrey | $614,771 | $3,893 |

| Abbotsford | $398,228 | $3,888 |

| *taxes and charges on a representative house. Source: Local Government Tax Rates and Assessments 2012, Ministry of Community, Sport and Cultural Development, Province of BC |

||

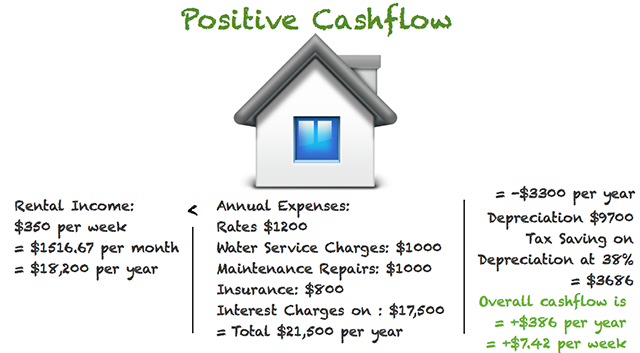

The golden rule: positive cash flow

Once you have an idea of what you can afford to buy, it's time to figure out what income your rental property can produce.

Local market conditions will determine how much rent you can charge. In desirable areas like Metro Vancouver, the potential for regular rent increases gives your income a good chance of keeping up with inflation. In its recent Rental Market Report, CMHC reports that areas like Vancouver, Richmond and the North Shore are seeing vacancy rates as low as 0.7% making our region one of the tightest rental markets in the province.

A key is making sure a rental property pays its own way, rather than relying solely on price appreciation to make the investment work.

For each property you consider, calculate your expected cash flow. Start with the projected annual rental income. Then deduct your expenses including borrowing costs, maintenance, property taxes and home insurance. If you plan to cover utilities as part of the rent, add those too. In the end you're looking for positive cash flow and a sufficient return relative to other investment options.

The good news is expenses you incur in renting out the property are generally deductible against your rental income. And if you have a deficit (your expenses exceed your revenues), you can apply that loss against other income you have to reduce your overall tax bill.

How hands-on do you want to be?

How hands-on do you want to be?

Late rent, rowdy tenants, paperwork. At one time or another, they're all part of a landlord's life. How willing, or able, are you to take these responsibilities on?

Hiring a property manager is an alternative to overseeing the property yourself, but their fees will cut into your profits. Before jumping into rental real estate think about how much your time and “sweat equity” are worth. You want to earn enough to make the extra effort worth your while.

Identifying a profitable rental property

When shopping for a rental home, here's what to focus on to give you the best chance of finding and owning a profitable investment.

First look at economic factors. Is the community you're considering adding people and jobs? A neighbourhood that's on the rise has a better chance of commanding higher rents and seeing property values increase. How is the crime rate? Remember, you're not necessarily looking for the cheapest property. That can mean less rent and indicate the area is on the decline.

First look at economic factors. Is the community you're considering adding people and jobs? A neighbourhood that's on the rise has a better chance of commanding higher rents and seeing property values increase. How is the crime rate? Remember, you're not necessarily looking for the cheapest property. That can mean less rent and indicate the area is on the decline.

Next, take stock of infrastructure that would make the area attractive to renters. Easy access to transit, schools, shopping and recreation will make a difference. Certain neighbourhoods may have unique issues that warrant attention. For example, a university nearby could translate into a high concentration of student renters are in the area. You may have trouble keeping your property occupied year-around.

If you're planning to manage the property yourself, can you get to it easily? How long will it take to drive there during rush hour or in winter snow if the home is out of town?

Even if the physical condition of a property you're evaluating is less than ideal, with a few updates you can enhance a home's appeal and rent potential cost-effectively. Be open to making more significant changes that can payoff in the long run. You'll typically earn more total rental income from a single-family home that's been split into independent living spaces, like a bungalow with a main floor and basement suite rented separately.

To sum up

In many ways putting your money to work in real estate is similar to the investing you're already familiar with. To be successful you need to do research, set an appropriate investment horizon, determine how much risk you're willing to take, and understand the costs involved.

In many ways putting your money to work in real estate is similar to the investing you're already familiar with. To be successful you need to do research, set an appropriate investment horizon, determine how much risk you're willing to take, and understand the costs involved.

View real estate – your rental property and principal residence – as a separate asset class. Ensure you're comfortable with how much of your net worth it represents. Put in place enough resources ahead of time to manage the ups and downs. While investing in a mutual fund requires little attention, owning a rental property can mean hard work. But that effort can pay off smartly.

If you're considering a rental property, preparation and planning are the keys to success. Take advice, lots of advice! Why not call Danielle today and get her take on the Kamloops market in respect to investment and rental property. (250) 319 5896

© https://www.blueshorefinancial.com/ToolsAdvice/Articles/MortgagesHousing/RentalProperty/