When selling a house, pricing it correctly is one of the most important steps.

When selling a house, pricing it correctly is one of the most important steps.

If the house is priced too high, it can linger on the market for months without any chance of selling. Even worse, if the price is too low, it will certainly sell, but the seller could be leaving tens of thousands of dollars on the table.

As the homeowner, you play a vital role in preparing your home for the market, determining your asking price, striking the deal, and handing over the role of ownership.

There are two methods that most people use to figure out the price of their home; a comparative market analysis (CMA), and an appraisal. A CMA is prepared by a real estate agent and can come either before or after the agent is hired. An appraisal is done by a licensed appraiser, will cost around $500 and can be used by the seller throughout the selling process.

How do you Get Top Market Value when you Sell?

Determining the best asking price for a home is one of the most challenging and important aspects of selling it. In fact, it’s a balancing act.

On the one hand, you don’t want to set a price so high that it discourages showings and serious offers from qualified, motivated buyers who would otherwise determine your property’s top market value. If the house is priced too high, it can linger on the market for months without any chance of selling.

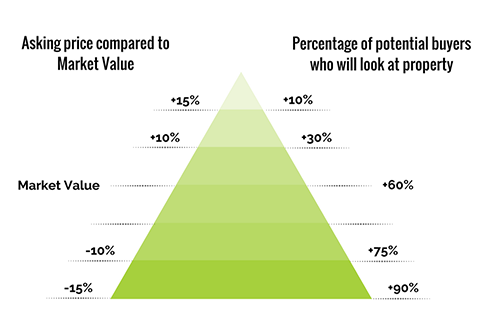

On the other hand, you don’t want to set a price so low that it attracts a lot of interest, but sets the stage for offers and negotiations that will get you less than had you been more aggressive. This balance is depicted in the Pricing Pyramid. If the price is too low, it will certainly sell, but the seller could be leaving tens of thousands of dollars on the table.

To determine your home’s true market value and set expectations for what you’re likely to sell it for, you should:

- Try to be impartial. Unfortunately, the “market” isn’t interested in what you originally paid for your home, or how much you need to sell it for to buy your next home. As well, your home may have features that you value, but which actually reduce its market value by limiting the number of potential buyers who would be interested in buying it.

- Remember why you are selling. Do you want to sell or do you need to sell? Is a faster sale important to you?

- Consider the market itself. Are area home prices trending up, down or levelling off? Is there still a lot of listing inventory with high days-on-market numbers? Doing your own online research here at Kamloops Property For Sale will help keep you informed.

While these considerations will yield an approximate market value, the best way to determine your home’s value will be to get a Comparative Market Analysis from an experienced REALTOR® who lives the market day-in, day-out. We will be happy to provide you with a CMA, so please contact us when you’d like one.

Price Your Home To Sell When Its Market Exposure And Buyer Interest Are Highest

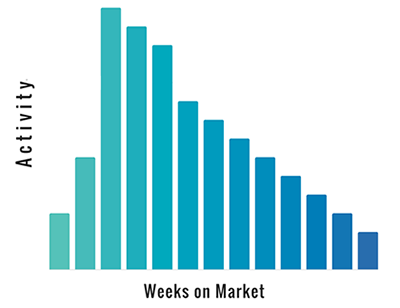

Real estate sales analysis has repeatedly shown that you’re likely to get top market value if you sell when your home has its greatest market exposure, buyer interest and showing activity. With the exception of hot sellers’ markets, this generally occurs about 2-5 weeks after you list your property, as shown in the Activity-To-Time-On-Market diagram.

Real estate sales analysis has repeatedly shown that you’re likely to get top market value if you sell when your home has its greatest market exposure, buyer interest and showing activity. With the exception of hot sellers’ markets, this generally occurs about 2-5 weeks after you list your property, as shown in the Activity-To-Time-On-Market diagram.

So timing is crucial to getting top dollar. Ideally, you need to price it so you get a firm offer during weeks 2-5 of the listing. This, in turn, means that you need to price your home realistically right from the beginning.

One of the problems Realtors® see all the time is that home sellers often spend many hours and thousands of dollars on things like staging, upgrades, photos, and marketing, but don't consider all of the factors when determining the right price. This is a big mistake, as a detailed pricing strategy based on the goals and timelines of the seller is perhaps the most important step in selling a house.

Comparative market Analysis (CMA)

Prepared by a real estate agent, the CMA is subjective and largely unstructured. A CMA for the same house can differ depending on who prepares it. I've seen a detailed CMA with sold data, market trends, and a lengthy pricing strategy, and I've also seen a CMA that was a couple of sentences in an email advising an asking price with no information to back it up. Obviously the more information a seller gets the better, and the more complete and professional a CMA appears, the more accurate it will likely be.

While a CMA can be a useful tool in determining a selling price, it should never be the only method used as there are potential flaws related to inconsistent methodology and structure. In many cases there is an emotional bias tied to a CMA as it is being used as a tool to sign a listing and not a method to figure out the market value of a home. A couple of years ago, I met with a seller who was about to list an old Victorian house in a desirable neighbourhood in Toronto. Before calling me, he interviewed four different agents, who each gave him CMAs, and the selling prices they suggested ranged from $800,000 to $1.2 Million. This seller became disillusioned at the CMA process, and chose a different method of selling his home, feeling that he was not getting the guidance he needed.

Looking for a CMA? CLICK HERE to get us to value your home with no obligation.

Considering there are no repercussions for giving inaccurate advice, and houses are being priced incorrectly every day, here is what you need to know about CMAs when selling your home:

- Ask about how the agent came up with the price.

- Ask to speak to previous sellers who have had a CMA from the same agent.

- Look at multiple sources including the most expert opinion possible. This is where an appraisal comes in.

Licensed Appraisals

An appraisal is done by a licensed appraiser who follows a detailed process in order to come up with an asking price. Appraisers look at comparable sold properties, and the replacement value of a home and its upgrades to determine a market value. There is no one in the industry who knows more about home prices than an expert appraiser. Their reports are unbiased since they are not looking to help sell the property, and it is in their best interest to be as accurate as possible. Unlike with CMAs, there can be repercussions if appraisers are consistently wrong about prices, and they have to demonstrate the reasons why they came up with a given price.

An appraisal is done by a licensed appraiser who follows a detailed process in order to come up with an asking price. Appraisers look at comparable sold properties, and the replacement value of a home and its upgrades to determine a market value. There is no one in the industry who knows more about home prices than an expert appraiser. Their reports are unbiased since they are not looking to help sell the property, and it is in their best interest to be as accurate as possible. Unlike with CMAs, there can be repercussions if appraisers are consistently wrong about prices, and they have to demonstrate the reasons why they came up with a given price.

Appraisals can be used by home sellers in many beneficial ways:

- Transparency is appreciated by buyers: I often have clients print out the appraisal and have it sitting out for buyers to look at during a showing.

- Added seller credibility eliminates many of the unattractive lowball offers.

Instead of spending time and money on staging, upgrades, and marketing, home sellers need to understand where their efforts should begin when putting their home on the market. A poor pricing strategy can make all the renovations and staging in the world go to waste, which is why it is important to use the most professional tools out there, look at multiple opinions, and make the best decisions possible for a successful real estate transaction.

The Dangers Of Overpricing Your Property At The Time You List

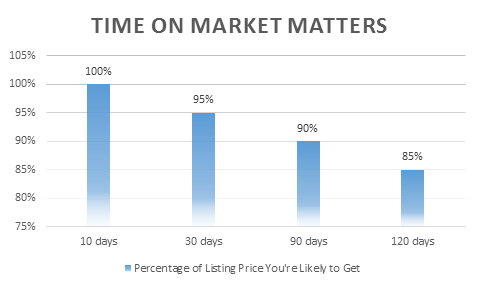

The strategy of overpricing your home when you list (even knowing that you can reduce the price later) might seem to make sense at first glance. However, it seldom works. In fact, sellers who overprice their homes and then reduce the price one or more times often get less than they would’ve if they had priced it realistically from the start. As depicted in the following Sale-Price-To-Time-On-Market diagram, this may mean that you actually get less than market value.

There are many reasons why:

- Fewer buyers – even if they like your home – will view it if they think it’s overpriced.

- Fewer REALTORS® will show your home to their buyers if they know your home is overpriced.

- The right buyers – i.e. those looking to buy a home like yours – may never view it because they’ll confine their search to a lesser price range where yours should be.

- You’ll attract the wrong buyers – i.e. those looking in your price range – who won’t be interested in your home, having viewed others truly worth what you’re asking.

- Your overpriced property will make others look better, so you’ll actually help to sell your competition.

- You’ll get fewer – if any – serious offers because buyers may consider it a waste of time.

- Even if you do get a serious offer, the excessive price can lead to a mortgage rejection for the buyer if the lender has a professional appraisal done on your home. This leads to critical lost time waiting for finance approvals that never go through.

The result?

- Beyond five weeks, your home will increasingly be viewed as a “stale” listing – i.e. one with a history of being rejected by other buyers.

- There will be less market buzz among buyers and REALTORS®, less showings, less offers and less likelihood that you’ll get your asking price.

- When you do eventually reduce the listing price it won’t generate nearly as much interest as if you’d priced it properly from the start.

- As often happens, after repeated price reductions you’ll end up getting less than if you’d priced it properly from the start.

- You’ll have to go through the inconvenience and stress of having your home listed for longer and not selling it.

- Due to not selling your home, you may miss great opportunities to purchase that next home you really want.

These may be hard and unpleasant facts for some potential home sellers. However, these are the facts, and they play themselves out all the time in every real estate market.

Posted by Steve Harmer on

Leave A Comment