Kamloops near the top of B.C. home affordability study

Posted by Steve Harmer on Friday, February 15th, 2019 at 5:34pm.

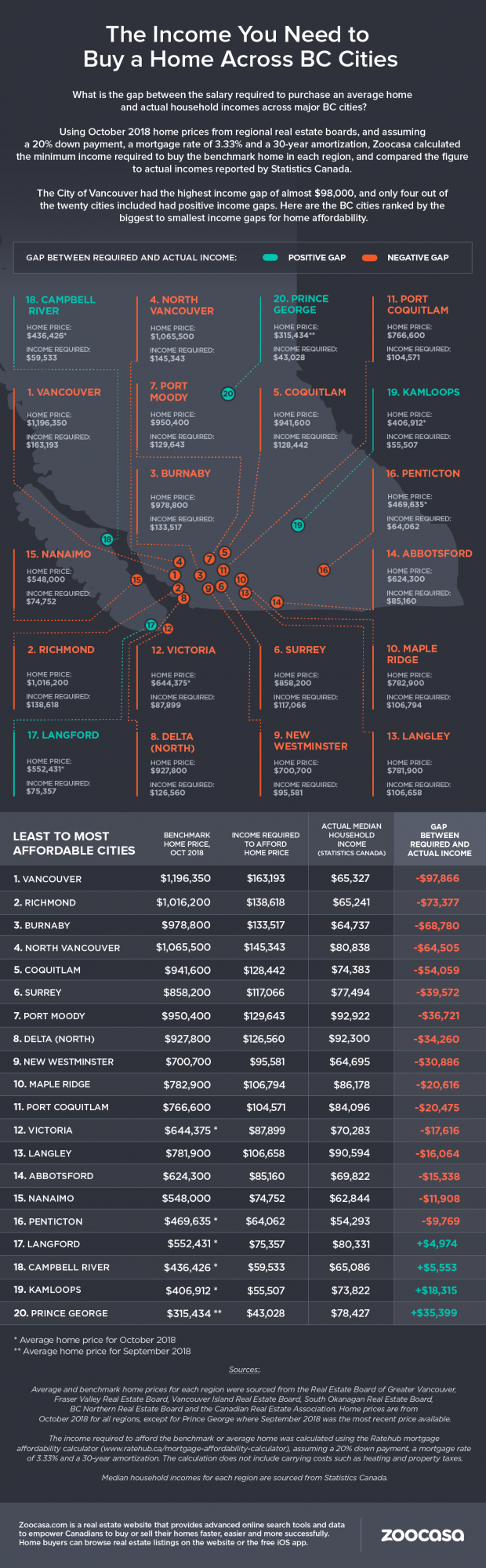

Kamloops is one of only four markets in the province where homes for sale align with local earnings, according to a study of 20 B.C. markets by real-estate search and data website Zoocasa.

Kamloops is one of only four markets in the province where homes for sale align with local earnings, according to a study of 20 B.C. markets by real-estate search and data website Zoocasa.

The findings are based on a summary of October benchmark and average home prices as reported by local real estate boards, the income required to afford the homes and regional median incomes as reported by Statistics Canada.

Kamloops is one of only four markets in the province where homes for sale align with local earnings, according to a study of 20 B.C. markets by real-estate search and data website Zoocasa.

The findings are based on a summary of October benchmark and average home prices as reported by local real estate boards, the income required to afford the homes and regional median incomes as reported by Statistics Canada. (The income required to afford the benchmark or average home was calculated using the Ratehub mortgage affordability calculator, assuming a 20 per cent down payment, a mortgage rate of 3.33 per cent and a 30-year amortization.

The calculation does not include carrying costs such as heating and property taxes.) At the other end of the affordability spectrum, not surprisingly, are communities in the Lower Mainland, beginning with Vancouver.

The benchmark home price in Vancouver in October was $1.2 million, with an income of $163,000 needed to afford a home at that value. With the actual median income in Vancouver at $65,000, that’s a $98,000 gap. Penelope Graham of Zoocasa said steep housing prices are starting to be reflected in the province’s sales activity.

According to the latest numbers from the British Columbia Real Estate Association, sales have plummeted 33.2 per cent from 2017, with the average price budging 1.1 per cent, to $686,000. The total dollar value from sales also fell 34 per cent — representing $2 billion — to $3.8 billion, a contrast to the 30.2 per cent increase recorded last year.

Graham said much of the slowdown has been attributed to the federal mortgage stress test implemented in January, which requires mortgage borrowers to qualify at a rate roughly two per cent higher than their actual contract. “That’s effectively slashed purchasing power among buyers, reducing the type and size of home they would now qualify for,” Graham said.

She said the gap between required and actual income becomes even more acute when the stress test qualification rate (currently 5.34 per cent) is factored into the calculation. Doing so pushes buyers’ income gap in Vancouver into the six-figure range, at $135,169, and reduces the number of truly affordable markets to two: Kamloops and Prince George.

© https://www.kamloopsthisweek.com/news/kamloops-near-the-top-of-b-c-home-affordability-study-1.23496924