Top 10 tips to get your finances organised!

Posted by Steve Harmer on Thursday, September 15th, 2016 at 10:59am.

Whatever you do with your life, and wherever you live, you have to sort out your finances.

Whatever you do with your life, and wherever you live, you have to sort out your finances.

Having enough money to live, to pay bills, to buy treats etc… is fundamental to being independent and being able to live a comfortable life.

Being able to maximise your money (whatever your income), and knowing how to get the most out of every penny is crucial because it frees you up to concentrate on the important things in life.

Leaving money worries behind means knowing that you have things under control. You can free up valuable time and energy so that you can get on with actually living! With all this in mind I have put together a list of my Top 10 tips to get your finances organised – starting today. I hope they will get you started and move you towards a financially savvy life.

1. Create a budget

Begin by determining what your household income and expenses are.

Income – write down all the ways you earn income each month – whether that be salary, investments, rent etc…. – whatever comes in goes here.

Expenses – All the things that you HAVE TO spend money on each month – otherwise known as your fixed outgoings. These can be such things as bills, rent/mortgage, fees, insurance etc….. and I al so include savings here (see tip #2)

so include savings here (see tip #2)

Once you have taken away your expenses from your income then you know what you have left to spend on entertainment / holidays / extras etc…. (this is your disposable income)

If you can understand your position each month you can start to tweak things to match what you want from life and what you need. For instance, you may decide that you need to spend less each month on entertainment as you simply don’t have the funds. Or you may want to start saving more as you have more disposable income than you first thought.

A budget will help you to start to be more in control of what you spend your money on, and be more aware of it.

2. Class savings as fixed outgoings

Just as water, gas, electricity etc.. are fundamental to living, so too is having savings. No-one knows what will happen tomorrow, and what if you lost your job, fell ill etc…. or simply if your car broke down and needed expensive repairs?

It is vitally important to ensure you have savings in case anything unexpected happens.

It is vitally important to ensure you have savings in case anything unexpected happens.

As a rule of thumb try and have 6 months work of your income saved at any one time.

If the main earner in your family got the sack tomorrow then you need to know that you aren’t going to struggle from day one. This will give you breathing space to work out a plan of action and to give you time to find another job.

Savings can of course be used in a variety of ways as well – paying off chunks of your mortgage, paying for a much needed holiday etc…. – without savings you won’t have as much choice in your life.

You can use a large chunk of savings if you leave a corporate job behind and set up your own business. Without this money you wouldn’t have been able to take a time out from earning, and probably would have been stuck in the job you left for a lot longer – and that’s no way to live!

Savings enable you to have a more proactive life.

3. Pay your bills on time

Harris Interactive reports that 23% of adults say they pay bills late (and incur fees) because they lose them

Often, if you pay late then you get billed for late fees – money for nothing for the company, and money simply wasted by you.

Often, if you pay late then you get billed for late fees – money for nothing for the company, and money simply wasted by you.

Luckily there is a quick and easy way to ensure that you never miss a bill deadline again – and that’s with direct debits.

Setting up direct debits will help with this and take away any stresses, and you also sometimes even get discounts for paying in this way.

It doesn’t take long to set these up, and if you keep on top of your money by checking your bank statement each month so that you know the right amounts are being taken, you will be able to easily see how much you need to live your life as well.

4. Avoid bank charges

Spend to your means as much as possible – and avoid the overdraft wherever you can.

Spend to your means as much as possible – and avoid the overdraft wherever you can.

Going into your overdraft every month is a way of life for a lot of people, but can end up costing several tens of pounds, and this really adds up over the years.

Think of it another way – if you always need your overdraft, you still can only spend up to the limit on that as well – so try and recoup a little each month until 0 is your benchmark rather than the overdraft limit – you will save money over time with this way of thinking.

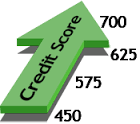

5. Keep a good credit report

Ensuring your finances are in order every step of the way will make it easier for you to get loans, mortgages etc… – and usually with more preferential rates.

This is a simple yet very effective and financially aware way of making savings.

This is a simple yet very effective and financially aware way of making savings.

6. Be prepared

Just as with having savings, being prepared for the worst will help in the long run.

Don’t think that not getting insurance will save you money – you are right that you may never need to make a claim, but what if the worst happens and you do?

If the main earner became very ill and couldn’t work, it would be much less stressful to be able to claim critical illness and be able to carry on leading the lifestyle that you currently are than having to change your lifestyle dramatically as well as coping with the news – and you would also have money there that would help with medical fees and any equipment or changes in your home if they were needed.

Think of what you would do if the worst happened, and make sure you prepare.

Insurance is never a waste of money. Shop round for good deals also – you may be surprised at how little it can cost for peace of mind.

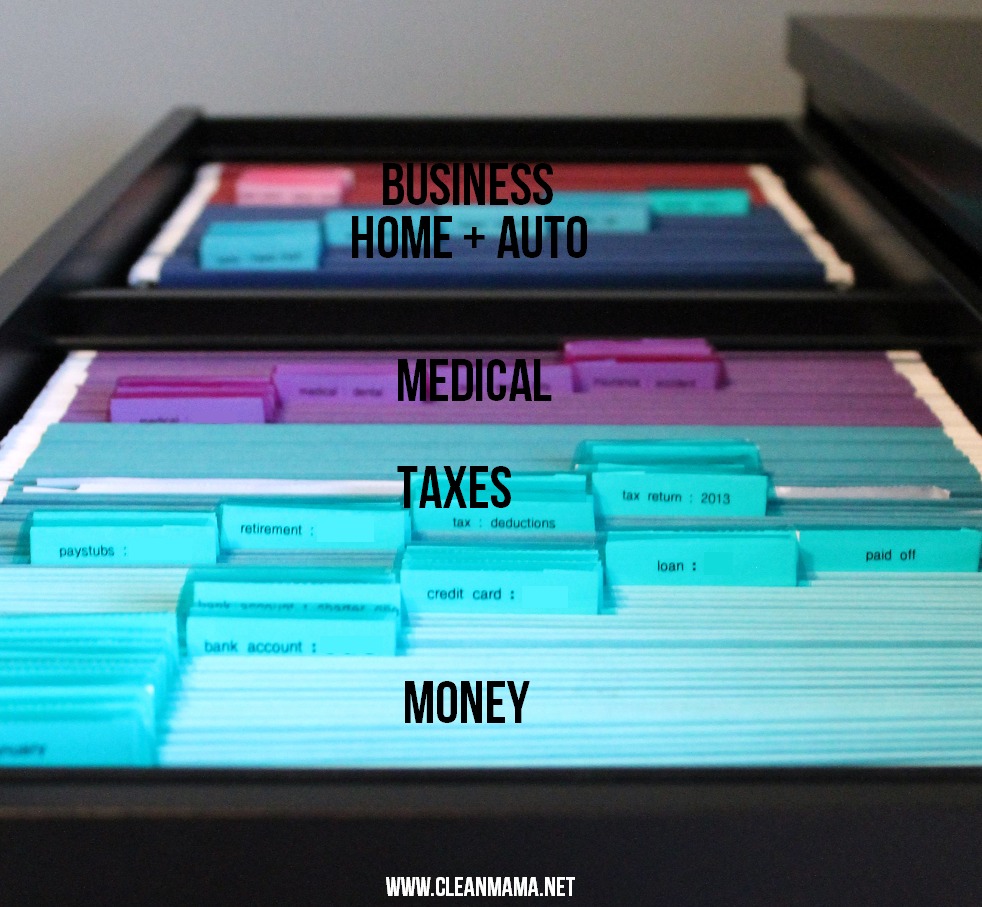

7. Be organised with your paperwork

For self employed people – keep all receipts so taxes are easy to do each year – keep them in a folder on the monthly basis so you can always put your hands on what you need.

For self employed people – keep all receipts so taxes are easy to do each year – keep them in a folder on the monthly basis so you can always put your hands on what you need.

You need to keep 7 years of paperwork when you are self employed – so ensure you have the storage space and that it is secure.

If you don’t work, then getting into the habit of keeping your receipts and checking them off against your account each month is very valuable – especially in the days unfortunately where people can get access to your accounts and start helping themselves – you will be able to spot this early and put a stop to fraud.

8. Use technology

Online banking can help you keep up to date with whats going on and is accessible 24/7.

It also saves on paperwork cluttering your home.

To be environmentally friendly, ask for paperless billing for your accounts with people – just ensure that you check amounts are correct on your bank statement each month (this will save time opening post and space filing).

9. Beware of fraud

9. Beware of fraud

Shred any financial information you are getting rid of – be aware of identity thieves etc…. better to be safe than sorry.

Also make sure that you have all security measures in place if storing financial paperwork at home – don’t keep notes of passwords in the same place as your bank statements for instance, and make sure you download any software requested by the bank if you bank online.

10. Prioritise debt

Are you spending more than you earn? have you built up debt?

Are you spending more than you earn? have you built up debt?

Prioritise debts and pay these off as quickly as you can – as the interest they create will simply grow if you don’t.

Make as many cutbacks as you can now to pay off your debts as quickly as you can. Debt usually has the highest interest rate (just look at your credit card and you may be shocked at what its costing you if not paid back each month).

The key to managing debt is to work out the interest rates and pay off whats costing the most each month, that way you aren’t wasting money on interest when you could actually be paying off the debt.

This works in everything – if you had to get a loan for a car, don’t opt for the one given by the garage, you may find that increasing your mortgage would be the cheapest way to do it (and then pay off this in chunks as quickly as you can).

Also – while going through this process, try and only pay for things with cash – then you can see exactly how much you are spending – and you can then only spend what you have.

© http://www.organisemyhouse.com/top-10-tips-to-get-your-finances-organised/