Well 2016 is three quarters over, that was fast.

For people who happen to be planning on purchasing a house in the last part of 2016 or early 2017 there is a great deal to look forward to. Why?

MAKE SURE YOU UNDERSTAND THE NEW MORTGAGE RULES FROM OCTOBER 17 2016 HERE

A number of factors this year have dovetailed to make this an ideal time for home buyers to get out there and make a (winning) offer and finally allow them to buy a house in Kamloops. Here are six house-purchasing factors to be grateful for:

Reason No. 1: Interest rates are still at record lows

While they might creep up, it is nevertheless true that interest rates on home loans are at historical lows, you only need to read the news and speak to a lender to confirm this.

While they might creep up, it is nevertheless true that interest rates on home loans are at historical lows, you only need to read the news and speak to a lender to confirm this.

Did you know that two out of three Canadian families own a house? That is one of the highest rates of home ownership in the world. And for good reason . Real estate is a great investment.

Did you know that two out of three Canadian families own a house? That is one of the highest rates of home ownership in the world. And for good reason . Real estate is a great investment. How to Pick a Neighborhood to Live In

How to Pick a Neighborhood to Live In

A first-time home buyer falls in love with a property: afraid to lose out, any & all helpful advice gets thrown out the window, an offer gets put in and accepted.

A first-time home buyer falls in love with a property: afraid to lose out, any & all helpful advice gets thrown out the window, an offer gets put in and accepted.

Millions of immigrants come to Canada and quickly discover that getting established financially isn’t easy

Millions of immigrants come to Canada and quickly discover that getting established financially isn’t easy

The open house is one of the best resources a home buyer can take advantage of

The open house is one of the best resources a home buyer can take advantage of

Many first-time buyers are debating whether they should continue to rent or should they buy. It’s also a consideration for those entering retirement age that are thinking of downsizing out of their home to a condo or apartment. But what makes more sense to rent or to buy? There are some big advantages to rent in certain situations and some even bigger advantages to buy a home.

Many first-time buyers are debating whether they should continue to rent or should they buy. It’s also a consideration for those entering retirement age that are thinking of downsizing out of their home to a condo or apartment. But what makes more sense to rent or to buy? There are some big advantages to rent in certain situations and some even bigger advantages to buy a home.

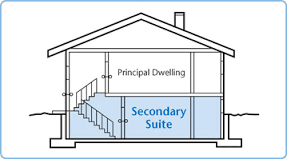

Are you looking to pay off you mortgage sooner? Buying a home with a basement apartment may be your ticket.

Are you looking to pay off you mortgage sooner? Buying a home with a basement apartment may be your ticket.

First off, it’s a good way to subsidize your mortgage in high-priced Toronto and Vancouver housing markets. The rent from your tenants can go directly toward the mortgage, helping you burn your mortgage sooner.

First off, it’s a good way to subsidize your mortgage in high-priced Toronto and Vancouver housing markets. The rent from your tenants can go directly toward the mortgage, helping you burn your mortgage sooner.

Buying a home with a secondary income suite, or with the intention of installing one, can be an effective way to offset steep mortgage costs in some of the hottest Canadian real estate markets.

Buying a home with a secondary income suite, or with the intention of installing one, can be an effective way to offset steep mortgage costs in some of the hottest Canadian real estate markets.

You have many choices when it comes time to get your mortgage.

You have many choices when it comes time to get your mortgage.