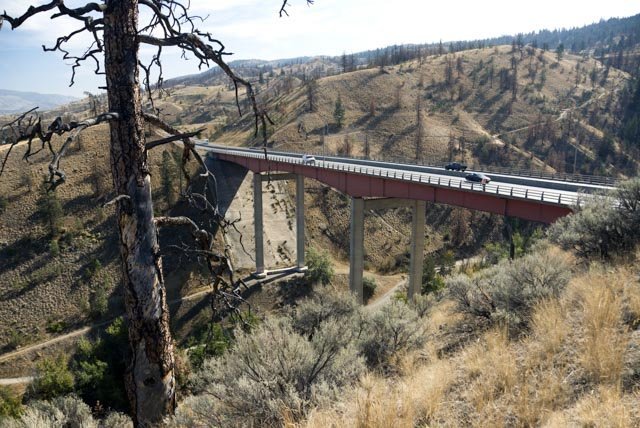

Looking to move to Kamloops? Want to know more about the city?

Looking to move to Kamloops? Want to know more about the city?

Here is an article first published on a lawstudents.ca website highlighting the experience of a couple moving from Calgary to Kamloops.

When we moved to Kamloops from Calgary, I thought for sure that I would miss the hustle and bustle of the big city, along with its zany politics and daily happenings. We lived in Hillhurst (inner city) and took advantage of Calgary's many festivals, farmers' markets, restaurants and night life. While I was sure I would make friends and that law school would provide more than enough entertainment, I expected Kamloops life to be otherwise pretty boring. Probably a fairly natural big city perspective. Those coming from Vancouver had much the same

…

Find the best freebies on your special day

Find the best freebies on your special day

Price drop is due to a lack of supply

Price drop is due to a lack of supply

Finance Minister Mike de Jong repeated in his Tuesday budget speech a by-now-familiar message from Victoria: It’s through increased housing starts that the affordability crisis that has gripped urban centres around the province will be eased.

Finance Minister Mike de Jong repeated in his Tuesday budget speech a by-now-familiar message from Victoria: It’s through increased housing starts that the affordability crisis that has gripped urban centres around the province will be eased.

Finding the right acreage for you will provide years of enjoyment. Make sure that pretty piece of land will support your vision. Read on or click below to jump to the subjects:

Finding the right acreage for you will provide years of enjoyment. Make sure that pretty piece of land will support your vision. Read on or click below to jump to the subjects:

As this year’s tax deadline approaches, recent home sellers should take note of a new rule introduced by Ottawa last year.

As this year’s tax deadline approaches, recent home sellers should take note of a new rule introduced by Ottawa last year.

Most Canadians dream about buying and owning their first home

Most Canadians dream about buying and owning their first home

OTTAWA, ON. – The Canada Mortgage and Housing Corporation is raising the cost of mortgage loan insurance for new home buyers effective March 17th. The Crown Corporation estimates the increases will add about $5 to a monthly mortgage payment for its average home buyer.

OTTAWA, ON. – The Canada Mortgage and Housing Corporation is raising the cost of mortgage loan insurance for new home buyers effective March 17th. The Crown Corporation estimates the increases will add about $5 to a monthly mortgage payment for its average home buyer.

For the

For the