Canadians just aren’t interested in buying homes the way they used to be.

Canadians just aren’t interested in buying homes the way they used to be.

That much is clear from the annual RBC Home Ownership Poll, which was released Monday. It showed that only a quarter of Canadians plan on buying a home in the next two years, down from nearly 30 per cent in 2016. It’s a trend that comes as Canada’s average home price has climbed to almost $520,000, up 3.5 per cent from a year earlier, according to the Canadian Real Estate Association (CREA).

Many Canadians still believe that buying a home is a good investment, but potential buyers are delaying their purchases in the hope that prices will come down, the RBC poll showed.

“For many Canadians, buying a home is a financial and personal milestone – often the biggest investment

…

New mortgage insurance rules introduced by the federal government last fall to cool the housing market have led to a sharp drop in insurance volumes for Canada Mortgage and Housing Corp. as fewer home buyers qualify for mortgage insurance.

New mortgage insurance rules introduced by the federal government last fall to cool the housing market have led to a sharp drop in insurance volumes for Canada Mortgage and Housing Corp. as fewer home buyers qualify for mortgage insurance.

These days, knowing how to sell a house isn't as simple as sticking a "For Sale" sign on your lawn.

These days, knowing how to sell a house isn't as simple as sticking a "For Sale" sign on your lawn.

Canadian Airbnb hosts and the Canada Revenue Agency

Canadian Airbnb hosts and the Canada Revenue Agency

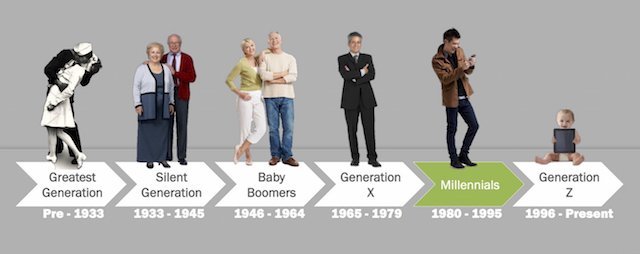

Statistics tell us that those born between 1980 and 2000 are a tough sell – being location-unaffiliated and cash poor means they’ve been written off as a generation of renters. But don’t be fooled: young people are more eager to get on the property ladder than you might think. In fact, Millennials now account for one in three home buyers. That figure is set to explode as we edge into the next decade.

Statistics tell us that those born between 1980 and 2000 are a tough sell – being location-unaffiliated and cash poor means they’ve been written off as a generation of renters. But don’t be fooled: young people are more eager to get on the property ladder than you might think. In fact, Millennials now account for one in three home buyers. That figure is set to explode as we edge into the next decade.

Homeowners often list their homes by themselves in the hope of saving thousands of dollars in commission. But is this actually a saving?

Homeowners often list their homes by themselves in the hope of saving thousands of dollars in commission. But is this actually a saving?

If you’re selling a home, you’ll want the best possible representation.

If you’re selling a home, you’ll want the best possible representation.

Canadian homeowners carried an average of $190,000 in mortgage debt in 2015

Canadian homeowners carried an average of $190,000 in mortgage debt in 2015

Here's what you should – and shouldn’t – buy

Here's what you should – and shouldn’t – buy

accounts to cover automatic payments, mortgages,

accounts to cover automatic payments, mortgages,