A simple welcome mat and a mailbox bearing your name just won't cut it.

A simple welcome mat and a mailbox bearing your name just won't cut it.

Making your home's entryway both hospitable and a clear statement of who lives inside means starting at the walkway or even the curb, proceeding to the porch, carrying through the front door and continuing all the way into the foyer.

This movement from public toward private space prepares visitors, albeit subconsciously, for who and what to expect inside. So, how do you manage those expectations?

WALKWAY AND PLANTINGS

When planning your front yard, start with the walkway, says Mary-Anne Schmitz of Gardening by Design (gardeningbydesign.ca). Making it wide enough to allow two people to walk side by side (meaning 4½ to six feet) makes visitors feel welcome.

"If you

"If you

Price, square footage, location: "All that can be trumped by the visceral reaction of seeing a home," says June Cotte, who teaches marketing at Western University's Ivey Business School.

Price, square footage, location: "All that can be trumped by the visceral reaction of seeing a home," says June Cotte, who teaches marketing at Western University's Ivey Business School.

The spring housing market, despite the best efforts of weather gods, is budding.

The spring housing market, despite the best efforts of weather gods, is budding.

That’s especially true if you want to save some money or score a return. Here are six surprising options that could score you some major money.

That’s especially true if you want to save some money or score a return. Here are six surprising options that could score you some major money.

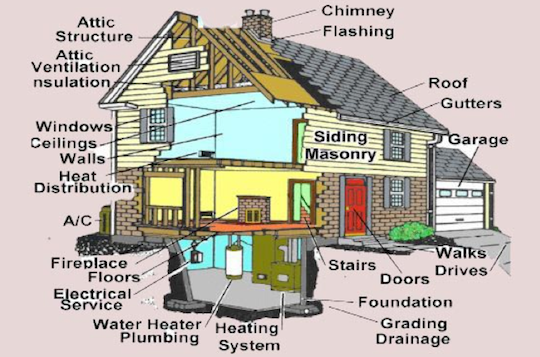

Whole industries and sub-industries have formed to help ease the understandable anxiety we endure before we sign on the dotted line to close a deal: real estate brokerages, real estate lawyers, mortgage brokers, property inspectors. That’s a lot of people doing a lot of things for us, and it’s not always clear what we should expect from each.

Whole industries and sub-industries have formed to help ease the understandable anxiety we endure before we sign on the dotted line to close a deal: real estate brokerages, real estate lawyers, mortgage brokers, property inspectors. That’s a lot of people doing a lot of things for us, and it’s not always clear what we should expect from each.

A mortgage is a word that has been in the English language since the late 1300s and comes from the French “mort,” which means “dead,” and “gage,” meaning “pledge.” Therefore, a mortgage, in the real sense of the meaning of the word, means that the security pledged to the mortgagee for the debt will be taken from him if he fails to pay the debt, and will, therefore, be “dead to him upon condition.” on the other hand, the mortgagee fulfills the obligation to pay the debt, the pledge is dead. Either way, something dies.

A mortgage is a word that has been in the English language since the late 1300s and comes from the French “mort,” which means “dead,” and “gage,” meaning “pledge.” Therefore, a mortgage, in the real sense of the meaning of the word, means that the security pledged to the mortgagee for the debt will be taken from him if he fails to pay the debt, and will, therefore, be “dead to him upon condition.” on the other hand, the mortgagee fulfills the obligation to pay the debt, the pledge is dead. Either way, something dies.

Buying or selling a home is probably one of the largest investments you will ever make. That is why it is important to choose the correct REALTOR® that will work to your benefit, to guard your equity and your future.

Buying or selling a home is probably one of the largest investments you will ever make. That is why it is important to choose the correct REALTOR® that will work to your benefit, to guard your equity and your future.

Financial advisers say that while making any contribution to an RRSP or a tax-free savings account (TSFA) is always a good thing, clearing up consumer debt should be the first priority.

Financial advisers say that while making any contribution to an RRSP or a tax-free savings account (TSFA) is always a good thing, clearing up consumer debt should be the first priority.

Some real estate agents won’t even work with you until you’ve been pre-approved for a mortgage. This is an important first step in the home-buying process. You don’t want to start house-hunting and fall for a home you can’t afford.

Some real estate agents won’t even work with you until you’ve been pre-approved for a mortgage. This is an important first step in the home-buying process. You don’t want to start house-hunting and fall for a home you can’t afford.

The process of selling a strata property is not the same as selling a house, and it tends to be much more involved when it comes to drawing up the paperwork.

The process of selling a strata property is not the same as selling a house, and it tends to be much more involved when it comes to drawing up the paperwork.