For most of us, buying a home is the largest, most complex purchase we’ll ever make.

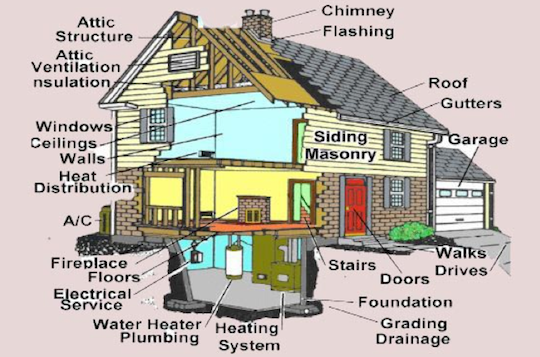

Whole industries and sub-industries have formed to help ease the understandable anxiety we endure before we sign on the dotted line to close a deal: real estate brokerages, real estate lawyers, mortgage brokers, property inspectors. That’s a lot of people doing a lot of things for us, and it’s not always clear what we should expect from each.

Whole industries and sub-industries have formed to help ease the understandable anxiety we endure before we sign on the dotted line to close a deal: real estate brokerages, real estate lawyers, mortgage brokers, property inspectors. That’s a lot of people doing a lot of things for us, and it’s not always clear what we should expect from each.

Home inspectors might be the most interesting of the lot. Home show king Mike Holmes has been dining out on a line for years: “The home inspection industry is like the Wild West — a lot of cowboys but not a lot of sheriffs.”

In order to protect consumers, British Columbia introduced mandatory licensing of home inspectors in

…

Kamloops property for sale blog offers readers many great pieces of advice for first time buyers, investing in real estate and general article on buying or selling your home in Kamloops. Make sure that if you are looking to sell your house in Kamloops or just about to buy real estate then read some of these tips to help you in your real estate decisions. Why not bookmark or favorite the blog pages and pop in for the latest Kamloops market news.

Kamloops property for sale blog offers readers many great pieces of advice for first time buyers, investing in real estate and general article on buying or selling your home in Kamloops. Make sure that if you are looking to sell your house in Kamloops or just about to buy real estate then read some of these tips to help you in your real estate decisions. Why not bookmark or favorite the blog pages and pop in for the latest Kamloops market news. A mortgage is a word that has been in the English language since the late 1300s and comes from the French “mort,” which means “dead,” and “gage,” meaning “pledge.” Therefore, a mortgage, in the real sense of the meaning of the word, means that the security pledged to the mortgagee for the debt will be taken from him if he fails to pay the debt, and will, therefore, be “dead to him upon condition.” on the other hand, the mortgagee fulfills the obligation to pay the debt, the pledge is dead. Either way, something dies.

A mortgage is a word that has been in the English language since the late 1300s and comes from the French “mort,” which means “dead,” and “gage,” meaning “pledge.” Therefore, a mortgage, in the real sense of the meaning of the word, means that the security pledged to the mortgagee for the debt will be taken from him if he fails to pay the debt, and will, therefore, be “dead to him upon condition.” on the other hand, the mortgagee fulfills the obligation to pay the debt, the pledge is dead. Either way, something dies.

There can be profit in dealing with undervalued foreclosure property but there are pitfalls that must be taken into consideration. If your an investor and have the ability to make repairs/updates if needed on a foreclosure then maybe this is something that you should look at.Often houses that end up in foreclosure have a lot of "baggage" with them. Sometimes it can be a house that's not finished and will need more work, permits etc. to finish and some houses are left in a condition that make them unlivable.

There can be profit in dealing with undervalued foreclosure property but there are pitfalls that must be taken into consideration. If your an investor and have the ability to make repairs/updates if needed on a foreclosure then maybe this is something that you should look at.Often houses that end up in foreclosure have a lot of "baggage" with them. Sometimes it can be a house that's not finished and will need more work, permits etc. to finish and some houses are left in a condition that make them unlivable.

Buying or selling a home is probably one of the largest investments you will ever make. That is why it is important to choose the correct REALTOR® that will work to your benefit, to guard your equity and your future.

Buying or selling a home is probably one of the largest investments you will ever make. That is why it is important to choose the correct REALTOR® that will work to your benefit, to guard your equity and your future.

Financial advisers say that while making any contribution to an RRSP or a tax-free savings account (TSFA) is always a good thing, clearing up consumer debt should be the first priority.

Financial advisers say that while making any contribution to an RRSP or a tax-free savings account (TSFA) is always a good thing, clearing up consumer debt should be the first priority.

Some real estate agents won’t even work with you until you’ve been pre-approved for a mortgage. This is an important first step in the home-buying process. You don’t want to start house-hunting and fall for a home you can’t afford.

Some real estate agents won’t even work with you until you’ve been pre-approved for a mortgage. This is an important first step in the home-buying process. You don’t want to start house-hunting and fall for a home you can’t afford.

Fewer homes will sell this year than last and they will sell for less money, the Calgary Real Estate Board predicts in its latest annual outlook, released Wednesday.

Fewer homes will sell this year than last and they will sell for less money, the Calgary Real Estate Board predicts in its latest annual outlook, released Wednesday.

The process of selling a strata property is not the same as selling a house, and it tends to be much more involved when it comes to drawing up the paperwork.

The process of selling a strata property is not the same as selling a house, and it tends to be much more involved when it comes to drawing up the paperwork.

Canadians are investing in home improvement like never before. While most plan to spend reasonable sums, others say they'll go all out: luxurious materials, home theatres, a Jacuzzi on the patio...even $60,000 kitchens are not that unusual! But how much of their investment will be recovered when their house sells?

Canadians are investing in home improvement like never before. While most plan to spend reasonable sums, others say they'll go all out: luxurious materials, home theatres, a Jacuzzi on the patio...even $60,000 kitchens are not that unusual! But how much of their investment will be recovered when their house sells?