Being a first-time home buyer without guidance from qualified professionals is like using the internet to diagnose a serious illness -- it’s not going to end well. That’s the advice Toronto real estate agent and industry expert Karyn Filiatrault gives to millennials looking to enter the housing market.

Being a first-time home buyer without guidance from qualified professionals is like using the internet to diagnose a serious illness -- it’s not going to end well. That’s the advice Toronto real estate agent and industry expert Karyn Filiatrault gives to millennials looking to enter the housing market.

She joined CTV’s Your Morning on Tuesday to warn against some of the biggest mistakes she sees real estate rookies make, even when they are getting help from the pros.

Not getting pre-approved by an experienced mortgage broker

Online calculators can help buyers get a rough idea of how much housing debt they can handle, but Filiatrault recommends using a mortgage broker to find the rate and terms that are best for you.

She adds that younger

…

Finding the perfect home doesn't happen in one day. It takes careful planning and lots of work. Fortunately, there are a number of things you can do to simplify the process.

Finding the perfect home doesn't happen in one day. It takes careful planning and lots of work. Fortunately, there are a number of things you can do to simplify the process. Fear of rising interest rates is causing more Canadians to opt for fixed-rate mortgages over variable-rate alternatives that could save them thousands of dollars in payments, according to a leading expert.

Fear of rising interest rates is causing more Canadians to opt for fixed-rate mortgages over variable-rate alternatives that could save them thousands of dollars in payments, according to a leading expert.

British Columbia's NDP government will introduce tax measures designed to push down the price of housing by targeting vacant homes owned by out-of-province investors.

British Columbia's NDP government will introduce tax measures designed to push down the price of housing by targeting vacant homes owned by out-of-province investors.

Multiple generations living under one roof isn't a new concept, but it is on the rise in North America, especially with millennials. This housing shift comes as a result of many factors, including work challenges and the rising cost of rent in most parts of the country. In fact, millennials are starting their adult lives after the worst financial crisis since the 1930s. This change has been the subject of much speculation and comparison to earlier generations, so personal finance expert Rubina Ahmed-Haq stopped by to help shine some light on why Generation Y is staying put for now.

Multiple generations living under one roof isn't a new concept, but it is on the rise in North America, especially with millennials. This housing shift comes as a result of many factors, including work challenges and the rising cost of rent in most parts of the country. In fact, millennials are starting their adult lives after the worst financial crisis since the 1930s. This change has been the subject of much speculation and comparison to earlier generations, so personal finance expert Rubina Ahmed-Haq stopped by to help shine some light on why Generation Y is staying put for now.

Canada’s federal housing agency says new mortgage rules intended to cool hot markets are “working better than hoped.” However, housing markets remain out of balance with recent price spikes driven by large single family homes at the expense of much needed rental stock, Evan Siddall, CEO of Canada Housing and Mortgage Corp.

Canada’s federal housing agency says new mortgage rules intended to cool hot markets are “working better than hoped.” However, housing markets remain out of balance with recent price spikes driven by large single family homes at the expense of much needed rental stock, Evan Siddall, CEO of Canada Housing and Mortgage Corp.

A new B.C. “dual agency” rule banning real estate agents from working with both the buyer and seller of a property are so complex and onerous it will result in frustrated consumers and a blizzard of useless paperwork when it comes into force March 15, according to real estate agents.

A new B.C. “dual agency” rule banning real estate agents from working with both the buyer and seller of a property are so complex and onerous it will result in frustrated consumers and a blizzard of useless paperwork when it comes into force March 15, according to real estate agents.

Many consumers will soon find their debt loads heavier now that Canada’s central bank and the country’s biggest commercial lenders have raised their benchmark rates by one-quarter percentage point.

Many consumers will soon find their debt loads heavier now that Canada’s central bank and the country’s biggest commercial lenders have raised their benchmark rates by one-quarter percentage point.

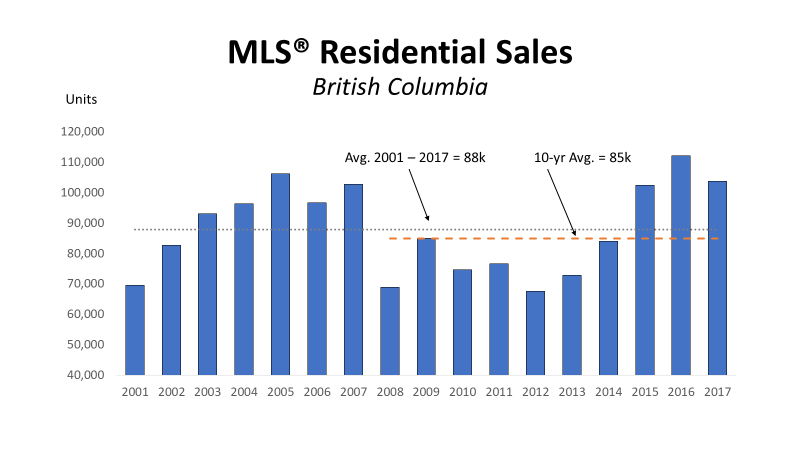

Vancouver, BC – January 12, 2018. The British Columbia Real Estate Association (BCREA) reports that a total of 103,763 residential unit sales were recorded by the Multiple Listing Service® (MLS®) across the province in 2017, a decline of 7.5 per cent from a record 112,211 unit sales in 2016. The average MLS® residential price in BC was $709,579 in 2017, up 2.7 per cent from the previous year. Total sales dollar volume was $73.63 billion, down 5.1 per cent from 2016.

Vancouver, BC – January 12, 2018. The British Columbia Real Estate Association (BCREA) reports that a total of 103,763 residential unit sales were recorded by the Multiple Listing Service® (MLS®) across the province in 2017, a decline of 7.5 per cent from a record 112,211 unit sales in 2016. The average MLS® residential price in BC was $709,579 in 2017, up 2.7 per cent from the previous year. Total sales dollar volume was $73.63 billion, down 5.1 per cent from 2016.

Muir, BCREA Chief Economist. "Above trend migration, both international and interprovincial, also bolstered housing demand, while broader demographic fundamentals added fuel

Muir, BCREA Chief Economist. "Above trend migration, both international and interprovincial, also bolstered housing demand, while broader demographic fundamentals added fuel Missing Granules from the Asphalt

Missing Granules from the Asphalt