Here's what you should – and shouldn’t – buy

Here's what you should – and shouldn’t – buy

by Rob Carrick -Personal Finance Columnist - The Globe and Mail

The downside of bank upselling is that customers get talked into buying junk products they don’t need.

According to the bank tellers pouring their hearts out to CBC in a series of recent reports, upselling is rampant because of pressure to meet sales targets. A customer’s best defence is to know which sales pitches are worth listening to, and which to shut down. To help promote more informed banking, the Personal Finance column presents this guide to bank products.

Buy this

- Overdraft protection: Essential for households where money is constantly flying in and out of chequing

accounts to cover automatic payments, mortgages,

accounts to cover automatic payments, mortgages,

The U.S. Federal Reserve raised its key interest rate from 0.75 per cent to 1 per cent today, in a move widely anticipated by economists and investors.

The U.S. Federal Reserve raised its key interest rate from 0.75 per cent to 1 per cent today, in a move widely anticipated by economists and investors.

Some real estate brokerages have ads and billboards that imply that all real estate transactions are as easy as 1-2-3!

Some real estate brokerages have ads and billboards that imply that all real estate transactions are as easy as 1-2-3!

Price drop is due to a lack of supply

Price drop is due to a lack of supply

Finance Minister Mike de Jong repeated in his Tuesday budget speech a by-now-familiar message from Victoria: It’s through increased housing starts that the affordability crisis that has gripped urban centres around the province will be eased.

Finance Minister Mike de Jong repeated in his Tuesday budget speech a by-now-familiar message from Victoria: It’s through increased housing starts that the affordability crisis that has gripped urban centres around the province will be eased.

Finding the right acreage for you will provide years of enjoyment. Make sure that pretty piece of land will support your vision. Read on or click below to jump to the subjects:

Finding the right acreage for you will provide years of enjoyment. Make sure that pretty piece of land will support your vision. Read on or click below to jump to the subjects:

As this year’s tax deadline approaches, recent home sellers should take note of a new rule introduced by Ottawa last year.

As this year’s tax deadline approaches, recent home sellers should take note of a new rule introduced by Ottawa last year.

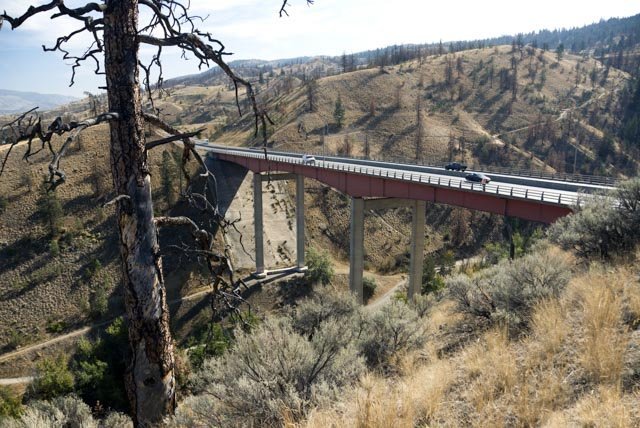

Considering moving to Kamloops BC?

Considering moving to Kamloops BC?

OTTAWA, ON. – The Canada Mortgage and Housing Corporation is raising the cost of mortgage loan insurance for new home buyers effective March 17th. The Crown Corporation estimates the increases will add about $5 to a monthly mortgage payment for its average home buyer.

OTTAWA, ON. – The Canada Mortgage and Housing Corporation is raising the cost of mortgage loan insurance for new home buyers effective March 17th. The Crown Corporation estimates the increases will add about $5 to a monthly mortgage payment for its average home buyer.

For the

For the